Ending a business partnership can feel less like a business decision and more like a messy divorce. It’s often packed with stress, uncertainty, and a whole lot of questions. For business owners here in Atascocita, Humble, and northeast Harris County, this process, known legally as the dissolution of a partnership, is far more involved than just locking the doors and walking away. It’s a formal, structured procedure under Texas law meant to fairly untangle every shared asset, debt, and responsibility, and our team is here to help you navigate it with confidence.

Understanding Partnership Dissolution in Texas

For local business owners, knowing the right way to close a partnership is the first step toward a clean break and a secure future. Ending a partnership isn’t an admission of failure. It's simply a business transition, but one that demands careful management to protect everyone’s interests and financial well-being.

Think of it like decommissioning a ship. You can't just abandon it at the dock. There's a formal process to ensure the crew is paid, the cargo is accounted for, and the vessel is officially retired. A partnership dissolution works the same way, following a clear legal path from start to finish. We understand that this process can be emotional, and we are here to provide the steady guidance you need.

The Three Key Stages of Ending a Partnership

The process isn't a single event but a sequence of distinct phases laid out in the Texas Business Organizations Code. Getting these stages wrong can create legal headaches and financial trouble long after you think it’s all over.

Understanding these three distinct phases is crucial for a smooth transition from a functioning business to a formally closed entity.

Key Stages of Ending a Partnership in Texas

| Stage | Description | Primary Goal |

|---|---|---|

| Dissolution | This is the official trigger—the event that starts the clock. It could be a mutual agreement, a partner leaving, or the end of a specific project. | To formally signal the intent to end the partnership and begin the shutdown process. |

| Winding Up | This is the hands-on "clean-up" phase. You'll sell off assets, pay back creditors, notify all relevant parties, and get the books in order. | To methodically settle all business affairs, pay off debts, and determine what, if anything, is left for the partners. |

| Termination | This is the final, official end. After all debts are paid and assets are distributed, the required paperwork is filed, and the partnership legally ceases to exist. | To legally conclude the partnership's existence and remove it from the state's records. |

Each stage builds on the last, and completing them in the right order is non-negotiable under Texas law.

Navigating these steps requires a steady hand. Just like personal relationships, business partnerships can be tested by unexpected pressures. For any business owner in Atascocita or Humble, handling the end of a partnership through proper civil law procedures is the only way to protect your personal finances and professional reputation.

At The Law Office of Bryan Fagan, we see firsthand how a well-managed dissolution can preserve relationships and assets. A proactive, guided approach ensures that every partner's rights are protected according to Texas law, providing a clear and fair path forward for everyone involved.

What Can Kick Off a Partnership Dissolution?

A partnership doesn't just evaporate overnight. Under Texas law, certain events have to happen to officially start the winding-down process. Think of these as "triggers." If you're a business owner in Atascocita, getting a handle on these triggers is one of the smartest things you can do. It helps you plan for the future, protect what you've built, and avoid getting blindsided when the partnership runs its course—whether that's expected or not.

These triggers generally fall into one of three buckets: things spelled out in your partnership agreement, a mutual decision by all partners, or situations where things go wrong and the court has to get involved. Each path leads to a different journey for shutting the business down.

When Your Partnership Agreement Calls the Shots

The best partnerships are built on a rock-solid partnership agreement. This document is essentially the constitution for your business, laying out the rules for everything, including how it ends. A well-written agreement will pinpoint the exact circumstances that automatically trigger dissolution.

Having this in writing brings a ton of clarity and predictability. For instance, a couple of partners in Humble who team up for a real estate flip might put a clause in their agreement stating the partnership dissolves once the house is sold and the profits are split. It's a natural, planned ending.

Common triggers you'll find in an agreement include:

- Hitting a Specific Goal: The partnership was created for one reason—like completing a project—and that mission is now accomplished.

- A Set Expiration Date: The partners agreed from day one that the business would only run for a specific amount of time, say, 5 or 10 years.

- A Partner Leaves: The agreement details what happens when a partner decides to retire or simply walk away.

When Everyone Agrees It's Time to Go

Sometimes, the end comes from a simple conversation. A voluntary dissolution is exactly what it sounds like: all the partners look at each other and mutually agree to close up shop. This is usually the smoothest, most peaceful way to go, since it starts with everyone on the same page.

Picture two buddies who've run a successful auto repair shop in northeast Harris County for decades. They might decide they both want to retire at the same time. Their joint decision to sell the assets and dissolve the partnership is a perfect example of a voluntary dissolution. Even if their original agreement didn't cover this specific scenario, their unanimous consent is all it takes under the Texas Business Organizations Code.

This route gives the partners complete control over the process, allowing them to work together to pay off debts, divide the remaining assets, and move on with their lives.

When Dissolution is Forced: Involuntary Triggers and Court Orders

Then there are the messy endings. Involuntary triggers are the ones nobody wants to deal with. They often stem from serious disagreements, bad behavior, or unexpected events that force a dissolution, even if some partners want to keep the business going.

An involuntary dissolution can be set off by a few different things:

- Partner Misconduct: If one partner commits fraud, steals from the company, or seriously violates their legal duties to the business, the others can go to court to force a dissolution.

- The Business is Failing: The company is bleeding money, and there's no realistic hope of turning things around.

- Death or Incapacity of a Partner: When a partner dies or becomes legally unable to perform their duties, it can trigger dissolution, especially if it's just a two-person operation.

- Partners Are at a Deadlock: The partners simply cannot agree on how to run the business anymore, and it’s grinding to a halt. A judge may decide that dissolving it is the only fair option.

Let's say the co-owners of a popular Atascocita boutique are so at odds over basic strategy that they can't even order new inventory. The business is paralyzed. One of them could ask a court to order an involuntary dissolution to salvage whatever value is left for everyone involved.

Working through these triggers, particularly the involuntary ones, isn't something you should do alone. You need solid legal advice to make sure you're following Texas law to the letter and protecting your personal finances from any lingering business debts.

Your Step-by-Step Guide to Winding Up the Business

Once you and your partners have decided to dissolve the business, the real work begins. This next phase is called "winding up," and it’s the methodical process of closing the company's books, settling its affairs, and liquidating its assets. For business owners in Atascocita and Humble, handling this stage with care isn't just good practice—it's essential for avoiding legal and financial headaches down the road.

Think of it like getting a house ready for sale after the owners decide to move. You can't just toss the keys to the new buyer. You have to clean everything out, pay the final utility bills, and make sure the property is in good order. Winding up is the business equivalent of that—a crucial series of steps for a clean, final closure.

Kicking Off the Winding Up Process

The very first move is to give formal notice to everyone involved. This isn’t just a courtesy; it's a legal requirement that protects all the partners. This notice officially stops the clock on any new business and pivots the partnership’s focus from making money to settling its existing obligations.

This is a critical step because it legally ends each partner's authority to act on behalf of the business for new ventures. From this moment on, every action taken must be for the sole purpose of closing the company's affairs.

Conducting a Final Inventory and Valuation

Before you can pay off debts or divide what’s left, you need a crystal-clear picture of what the business owns and what it's all worth. This means conducting a complete inventory of every partnership asset.

And this goes way beyond just counting desks and computers. A thorough inventory has to include:

- Tangible Assets: All the physical stuff, like real estate, equipment, and product inventory.

- Intangible Assets: The non-physical value-drivers, such as brand reputation (goodwill), customer lists, and any intellectual property like trademarks or patents.

- Financial Assets: This covers cash in the bank, accounts receivable (money owed to you), and any company investments.

After you've cataloged everything, these assets need to be professionally valued to find their fair market price. Getting this right is crucial for ensuring a fair distribution later and can head off a lot of arguments over what something is "really" worth.

Notifying Creditors and Settling Debts

Under Texas law, there’s a clear pecking order: creditors always get paid before partners do. A vital part of dissolving a partnership is formally notifying anyone the business owes money to. This list includes lenders, suppliers, your landlord, and even the Texas Comptroller for any outstanding taxes.

According to the Texas Business Organizations Code, a partnership’s assets must first be used to discharge its liabilities to creditors. If you don't properly notify creditors and settle these debts, the partners can be left personally on the hook for those obligations even after the business is gone.

This process involves pulling together all your invoices, loan agreements, and financial statements to create a master list of liabilities. You then have to pay off these debts using the partnership's assets. If there isn't enough cash to cover everything, partners may need to contribute more funds, depending on their partnership agreement.

The broader economic climate often plays a big role here. In fact, the same pressures that force businesses to dissolve are reflected in larger market trends. Global M&A volumes, for example, dropped 9% in the first half of the year, with projections for fewer than 45,000 total deals—the lowest count in over a decade. This kind of caution is driven by the same high interest rates and geopolitical uncertainty that can push partnerships to liquidate. You can find more insights on these global deal trends on PwC.com.

The following checklist can help you stay organized during this critical phase.

Winding Up Checklist for Texas Partnerships

For business owners in Atascocita and Humble, a clear checklist can turn a complex process into a manageable one. Here are the key tasks to guide you through the winding up process.

| Task | Key Consideration | Legal Importance |

|---|---|---|

| Provide Formal Notice | Notify all partners, employees, and relevant third parties in writing. | Terminates partners' authority to create new business obligations. |

| Inventory All Assets | Account for tangible (property, equipment) and intangible (goodwill, IP) assets. | Establishes the total value available for settling debts and distribution. |

| Appraise Asset Value | Obtain professional, fair market valuations for all significant assets. | Prevents disputes and ensures an equitable distribution process. |

| Compile List of Creditors | Identify all outstanding debts, including loans, supplier invoices, and taxes. | Texas law requires all creditors to be paid before partners receive any assets. |

| Settle All Debts | Use partnership assets to pay off every liability in full. | Protects partners from being held personally liable for business debts later. |

| Distribute Remaining Assets | Divide any leftover assets or cash among partners per the partnership agreement. | Fulfills the final financial obligation to the partners. |

| File Final Tax Returns | Submit final federal and state tax returns to the IRS and Texas Comptroller. | Officially closes the business's tax accounts. |

| File Certificate of Termination | Submit the official termination document with the Texas Secretary of State. | Legally dissolves the partnership's existence as a legal entity. |

Following these steps methodically ensures that nothing falls through the cracks, giving you and your partners a clean break.

Distributing Remaining Assets to Partners

Only after every last creditor is paid can you distribute what’s left among the partners. The rulebook for this distribution should be your partnership agreement.

If your agreement doesn't specify how to handle this, Texas law provides a default plan. Typically, the distribution happens in this order:

- Return of Capital Contributions: Partners get back the money or property they originally put into the business.

- Distribution of Profits: Anything left over is divided among the partners as profit, based on their agreed-upon shares.

As you navigate the complexities of winding up, it's helpful to see it as part of a larger picture. Thinking in terms of strategic business exit planning can give you valuable perspective, ensuring you're not just closing a chapter but doing so in a way that protects your long-term financial goals.

Filing Final Paperwork for Termination

The last step is making the closure official in the eyes of the law. This involves filing the right paperwork to formally terminate the partnership's existence. In Texas, that means filing a Certificate of Termination with the Texas Secretary of State.

You also have to file final federal and state tax returns for the business. This is how you tell the IRS and the Texas Comptroller that the partnership is no longer operating and won’t be filing returns anymore. Once this paperwork is accepted, the partnership legally ceases to exist, and the winding-up process is officially complete. This finalizes the dissolution and lets everyone involved move on.

How to Navigate Asset Division and Liabilities

Let's be frank: dividing up the assets and debts is almost always the toughest, most emotionally charged part of ending a partnership. For business owners here in Atascocita, this is where a straightforward process can quickly get bogged down in disagreements. To protect your own financial health and make sure everyone gets a fair shake, you have to understand how Texas law handles this crucial step.

The law is crystal clear on one thing: creditors get paid first. It's a lot like settling a family estate—before any heirs can inherit, all the outstanding bills must be settled. In the same way, a partnership’s assets must first go toward paying back lenders, suppliers, and anyone else the business owes. Only after every last creditor is paid can the partners start dividing what's left.

The Power of Your Partnership Agreement

Your single best defense against a messy dissolution is a well-thought-out partnership agreement. This document should serve as your roadmap, spelling out exactly how assets and liabilities will be handled when the business ends. It takes the guesswork out of the equation and gives everyone a set of rules to follow when tensions are high.

A solid agreement will typically lay out:

- How assets will be valued, whether by an independent appraiser or another method you all agree on.

- The order of payouts after all the outside debts are cleared.

- Specific steps for dealing with shared property or intangible assets like intellectual property.

If you don’t have an agreement, or if yours doesn't cover dissolution, Texas law steps in with a default set of rules. The problem is, those default rules might not match what you and your partners originally intended. This is why having a custom agreement is always the smarter move.

The Order of Payouts in Texas

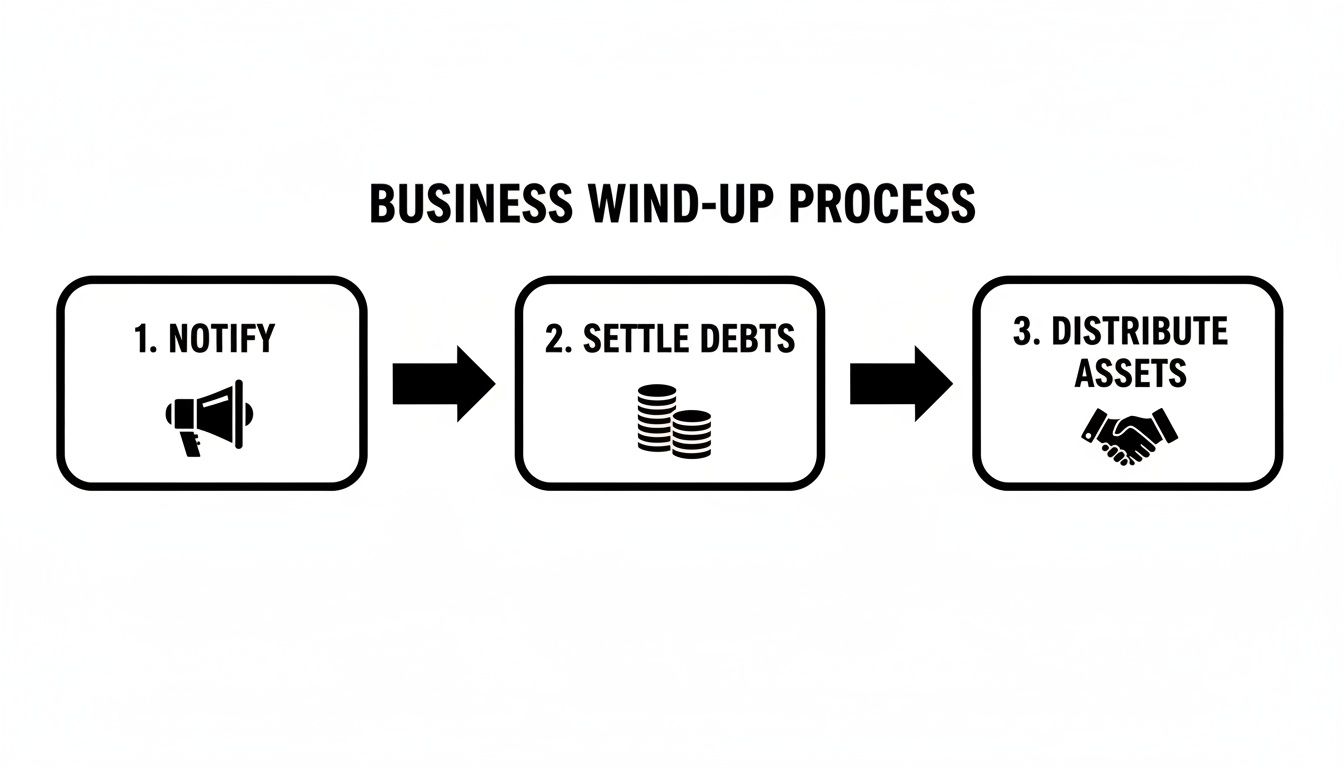

When you're winding up a business, there's a specific legal pecking order for how the money is paid out. This structure is designed to be fair and keep you in compliance with the law. The process really boils down to three core steps.

As you can see, you notify everyone, settle the debts, and only then do you distribute the remaining assets. This sequence is critical because it stops partners from grabbing cash before the business has met its legal obligations.

Here is the legally required priority for distributions:

- Pay Creditors: First, every outside debt and liability must be settled.

- Repay Partner Loans: If a partner loaned personal funds to the business (separate from their initial investment), that loan gets paid back next.

- Return Partner Capital: Each partner then gets back their original capital contribution.

- Distribute Profits: Anything left over is considered profit and is split among the partners according to the percentages in the partnership agreement.

Handling Intangible Assets and Personal Liability

Splitting up physical assets like computers and company vehicles is one thing. But what about the value you can't touch? Intangible assets like goodwill—the value of your business's great reputation in the Humble community—or valuable customer lists can be worth a significant amount of money. These assets need to be professionally appraised to make sure their value is fairly included in the final distribution.

A critical risk for general partners in Texas is personal liability. If the partnership's assets aren't enough to cover what it owes, creditors can come after the partners' personal assets—your home, your car, your savings—to make up the difference. This is why a careful and thorough winding-up process is absolutely vital.

Thinking through a business dissolution requires the same kind of foresight as good estate planning. For example, just as you'd carefully weigh the benefits of a revocable trust to protect your family's assets, you must approach asset division with the same level of care to protect what you've worked so hard to build. To get a better sense of how legal structures can shield your assets, you might find our guide on the pros and cons of a revocable trust helpful.

Untangling assets and liabilities is a complex job with high stakes. Having an experienced local attorney from The Law Office of Bryan Fagan in your corner ensures the process is handled by the book, protecting you from financial pitfalls and allowing you to move on with peace of mind.

Resolving Disputes During the Dissolution Process

Let's be realistic: ending a business partnership rarely goes off without a hitch. Even with the best of intentions, the stress of closing a business you’ve poured your heart and soul into can bring disagreements to the surface. For partners in Atascocita and Humble, what seems like a small difference of opinion can quickly spiral into a major conflict that brings the whole process to a screeching halt.

While these conflicts are a normal part of a business breakup, they have to be handled constructively. Without a solid plan for resolving them, you’re looking at a potentially long, expensive, and very public court battle that can drain your finances and burn professional bridges.

Common Areas of Conflict in a Dissolution

During a dissolution of a partnership, disputes almost always pop up in a few predictable areas where partners’ goals and perspectives collide. Knowing where these friction points are is the first step to navigating them successfully.

Here are some of the most common arguments we see:

- Valuation of Assets: It's amazing how partners can have wildly different opinions on what the business assets are worth. This is especially true for intangible assets like brand goodwill or a client list. One partner might believe the company's reputation in northeast Harris County is its crown jewel, while another might write it off as worthless.

- Breach of Fiduciary Duty: Things get ugly when one partner accuses another of mismanaging money, poaching a business opportunity, or just not acting in the partnership’s best interest during the wind-down. These are heavy accusations that can shatter trust.

- Distribution of Profits or Losses: The final accounting is often a battleground. Arguments can erupt over the numbers themselves, with a partner feeling they aren't getting their fair cut of the remaining profits or are being saddled with an unfair share of the losses.

- Responsibility for Debts: If the business is carrying significant liabilities, figuring out who pays for what can be a major source of conflict. This gets particularly messy if one partner racked up debt without the other’s full knowledge or consent.

Finding Common Ground Through Alternative Dispute Resolution

When you and your partner are at a standstill, it’s easy to think a lawsuit is the only way out. But heading to court is almost always the slowest, most expensive, and most combative way to settle a business dispute. Thankfully, Texas law strongly encourages more constructive options known as Alternative Dispute Resolution (ADR).

ADR offers a private, more collaborative environment to work through your issues. The whole point is to find a mutually agreeable solution, not to have a judge declare a winner and a loser.

At The Law Office of Bryan Fagan, we've seen firsthand that most partnership disputes can be settled long before they ever reach a courtroom. ADR keeps you in control of the outcome, saves you money, and helps preserve a civil relationship for the future.

Practical Paths to a Peaceful Resolution

For business owners in and around Atascocita, two key ADR methods provide a clear path for untangling disagreements and getting the dissolution back on track.

- Negotiation: This is the most straightforward approach. You and your partners, each with your attorneys, sit down to negotiate a settlement. Your lawyer is there to be your advocate, protecting your rights while working toward a compromise that everyone can live with.

- Mediation: If you can’t get there through direct negotiation, mediation is the logical next step. A neutral, third-party mediator guides a structured conversation between everyone involved. The mediator’s job isn't to make decisions for you; it's to help you find common ground and draft an agreement that becomes legally binding.

Choosing ADR over a lawsuit is a strategic move. It puts the power back in your hands, allowing you and your partners to close this chapter of your professional lives with clarity and on your own terms.

How Our Atascocita Lawyers Can Guide You

Ending a business partnership is never just about signing papers. It's a tough, personal process that impacts your finances, your professional reputation, and your future. For business owners here in Atascocita and Humble, trying to handle this alone can be incredibly daunting. But you don't have to. The Law Office of Bryan Fagan is here to offer the steady, experienced hand you need to get through it.

We're not some distant corporate law firm. We're part of this community, and we understand the unique pressures local business owners face. Our approach blends a deep knowledge of Texas partnership law with a real-world understanding of what's at stake for you. Think of us not just as your attorneys, but as your neighbors, committed to protecting what you've worked so hard to build.

Personalized Support Every Step of the Way

No two partnerships are the same, which means there’s no one-size-fits-all solution for dissolving one. Our job is to cut through the confusion and develop a clear, strategic plan that fits your specific circumstances.

Here’s a snapshot of how we can help:

- Deep Dive into Your Partnership Agreement: We'll start by carefully dissecting your original agreement. This is the roadmap that defines everyone's rights and responsibilities, and we’ll make sure the dissolution process honors what was agreed upon.

- Negotiating a Fair Exit: Our attorneys are skilled negotiators who will fight for your best interests. We’ll work to secure fair terms for dividing assets, settling debts, and distributing any final profits.

- Handling the "Winding Up" Details: There's a lot of procedural work involved, from notifying creditors to filing the final documents with the state. We’ll manage every step to ensure you remain fully compliant with the law and avoid future headaches.

- Resolving Disputes Effectively: When disagreements pop up—and they often do—we’ll step in. Our focus is always on resolving conflicts through smart negotiation or mediation to avoid the time, stress, and expense of a full-blown court battle.

Ending a business partnership requires careful attention to detail to protect your personal and financial well-being. Our goal is to handle the legal complexities so you can focus on moving forward with confidence.

Navigating a dissolution of a partnership doesn't have to be a fight. With the right legal team by your side, you can achieve a clean, fair, and final resolution. If you’re ready to find a clear path forward, we invite you to schedule a free, no-obligation consultation at our Atascocita office to discuss your case.

Common Questions We Hear About Partnership Dissolution

When a business partnership is coming to an end, the questions and concerns can feel overwhelming. Here in Atascocita, we’ve walked countless local business owners through this process, and we’ve found that most people have similar worries. Let's tackle some of the most common questions we get about dissolving a partnership in Texas.

What Happens If We Never Signed a Partnership Agreement?

It’s surprisingly common for businesses to start on a handshake and a great idea. If you don't have a formal agreement outlining how to break up, you’re not out of luck, but you are subject to Texas law.

The state’s Business Organizations Code provides a default set of rules for winding things down. The law will dictate how to split assets and pay off debts. The catch? This one-size-fits-all legal template probably won't reflect what you and your partners actually intended, which can lead to some really unfair results. A good attorney is crucial here to make sure your interests are protected, even without that initial contract.

How Long Does It Actually Take to Dissolve a Partnership?

There’s no single answer to this, as the timeline can swing wildly. For a simple partnership in Humble with few assets and partners who are on the same page, you might wrap everything up in just a few months.

On the other hand, if the business is complex—with significant debts, real estate, intellectual property, or partners who can’t agree—the process can drag on for a year or more. Things like getting assets professionally valued, negotiating with creditors, and settling disputes between partners are what really extend the clock. Setting a realistic timeline from the start helps everyone manage their expectations.

Can One Partner Force the Business to Close?

Yes, it’s definitely possible for one partner to initiate the end of the business. If you formed what's called an "at-will" partnership (meaning there was no set end date or specific project to complete), any partner has the right to walk away and start the dissolution process.

Things are a bit different for partnerships created for a specific term or a particular purpose. In those cases, a partner usually needs to get a court order to force a dissolution. This is typically reserved for serious situations, like another partner's misconduct, a complete deadlock on business decisions, or if the business is simply no longer making money.

Am I Still on the Hook for Business Debts After We Close?

This is one of the most important questions, and the answer is a firm yes. You remain personally liable for any debts the partnership took on while you were a partner, even after the business is officially dissolved.

This is exactly why the "winding up" phase is so critical. You have to formally notify all known creditors that the partnership is dissolving. Taking this official step is your best defense—it helps create a clear cutoff for future claims and protects your personal assets from being targeted for old business liabilities down the road.

Navigating the end of a partnership is a delicate process with major financial implications. At The Law Office of Bryan Fagan – Atascocita TX Lawyers, our team is here to provide the steady, experienced guidance local business owners need to reach a fair and orderly resolution. Let us help you find a clear path forward.

Schedule your free consultation today.

Call us at (281) 810-9760 or find us online at https://www.atascocitaattorneys.com.