When a business partnership comes to an end, it can feel just as personal and complicated as a divorce. For entrepreneurs in Atascocita and Humble, understanding the formal process of a dissolution of partnerships is the single most important step you can take to protect your financial future and move on. It’s all about legally ending the partnership, wrapping up the business operations, and settling the books on all assets and debts.

Understanding the End of a Business Partnership in Atascocita

It’s never easy to close the book on a business relationship you’ve poured your heart and soul into. Whether the decision is mutual or born from conflict, the path forward requires a careful walk through Texas law to make sure everyone's interests are protected. The legal term "dissolution" marks the official beginning of the end, but it doesn't mean the business just disappears overnight.

Instead, dissolution kicks off a structured process for untangling the company’s affairs in an orderly and fair way. Think of it less like a sudden crash and more like a controlled landing. The partnership technically continues to exist, but only for the specific purpose of closing things down correctly.

The Three Core Stages of Dissolution

The entire journey can be broken down into three fundamental stages. Each phase has a distinct purpose, guiding you from the initial decision to dissolve all the way to the final termination of the business itself. Managing these stages properly is absolutely essential to avoid expensive legal battles and achieve a clean break.

Before we dive deeper, let’s look at a high-level overview of what this process entails for a local business.

The Three Core Stages of Partnership Dissolution

| Stage | What It Means for Your Business | Primary Goal |

|---|---|---|

| 1. Dissolution | The official decision to end the partnership is made and documented. The business stops taking on new work. | To formally trigger the end of the partnership and halt new business activities. |

| 2. Winding Up | This is the "housekeeping" phase. Debts are paid, assets are sold, and accounts are settled between partners. | To liquidate assets, satisfy all creditor claims, and prepare for final distribution. |

| 3. Termination | The partnership is officially and legally over. The entity ceases to exist. | To file final paperwork with the state and legally close the business entity for good. |

Walking through these steps methodically is the key to minimizing disputes and protecting your investment.

The unfortunate reality for many local business owners is that this process can be filled with conflict. In Texas, state records show thousands of business dissolutions occur each year. Partnerships make up a significant portion of these, with a large number of cases stemming from partner disagreements.

For small businesses in our communities like Atascocita and northeast Harris County, this trend hits close to home. Many partnerships dissolve within five years due to disputes over profits or management, often leading to litigation that can feel as intense as the property division in a divorce.

Navigating a partnership dissolution is about more than just paperwork; it’s about protecting the value you've built and ensuring a fair outcome for your future. A clear legal strategy is your best tool for achieving peace of mind during this transition.

At The Law Office of Bryan Fagan, we see firsthand what’s at stake for business owners in our community. We’re here to provide the compassionate, knowledgeable support you need. To understand your rights and options, schedule a free, no-obligation consultation at our Atascocita office today.

Legal Reasons for Dissolving a Partnership in Texas

In Texas, a business partnership doesn't just evaporate when someone decides to walk away. Just like any formal relationship, its ending has to be based on solid legal ground. For business owners in communities like Atascocita and Humble, knowing these reasons is the first step toward a predictable and orderly dissolution of partnerships.

Your partnership is governed by a specific set of rules—the ones you laid out in your partnership agreement and the ones defined by the Texas Business Organizations Code. A dissolution can only happen when one of the conditions in that rulebook is met. This framework isn't there to make things difficult; it’s there to protect everyone involved, ensuring the process is fair and preventing one partner from leaving the others to clean up a mess.

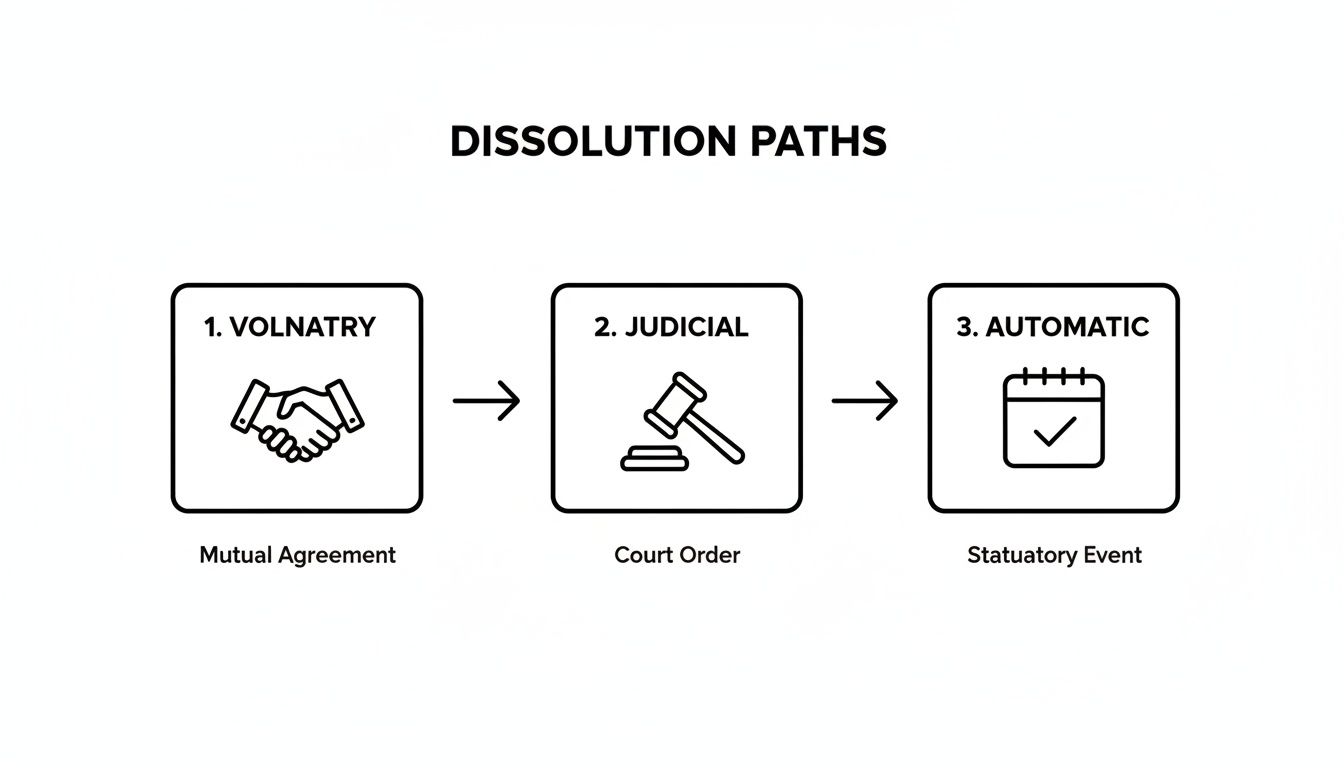

Generally, the path to ending a partnership follows one of three routes: by mutual agreement, by a court order, or by an automatic trigger.

Voluntary Dissolution By Agreement

The cleanest and most common way to end a partnership is through voluntary dissolution. This is exactly what it sounds like: all the partners agree it’s time to close up shop. Ideally, the "how" and "when" of this process are already spelled out in a solid partnership agreement you created when the business first started.

A well-drafted agreement acts as your roadmap. It typically outlines specific events that would trigger a dissolution, such as:

- Hitting a specific goal: Let's say your Humble-based partnership was formed just to develop a single property on West Lake Houston Parkway. Once that property is sold, the partnership's purpose is fulfilled, and it can dissolve.

- Reaching a set date: The agreement might state that the partnership will automatically dissolve after a certain amount of time, like five years.

- Mutual consent: Most agreements include a straightforward clause allowing partners to dissolve the business at any time, as long as everyone agrees in writing.

This voluntary route is always the best-case scenario. It keeps control in your hands, minimizes legal fees, and helps preserve professional relationships that might be valuable down the road.

Judicial Dissolution When Partners Cannot Agree

Unfortunately, not all business breakups are friendly. When partners are deadlocked and can't agree to dissolve, or when one partner’s behavior is actively harming the business, a judicial dissolution might be the only option. This is a formal court process where one or more partners petition a Texas court to legally order the partnership to end.

Under the Texas Business Organizations Code, a court won't step in for minor disagreements. It will only intervene if there are serious, substantial grounds, making this a last resort for when a partnership has become completely broken.

A Harris County judge might grant a judicial dissolution if one of these situations arises:

- Partner Misconduct: A partner has acted in a way that negatively impacts the business, such as committing fraud or a serious breach of trust.

- Willful Breach of Agreement: One partner repeatedly and deliberately ignores the terms of the partnership agreement, making it impossible for the others to carry on the business with them.

- Impracticability: The business environment has changed so dramatically that it's no longer reasonably practical to continue operating under the original terms of the agreement.

- Incapacity: A partner becomes mentally or physically unable to fulfill their duties.

Going to court is a serious legal step. It requires presenting compelling evidence and is a situation where having an experienced Atascocita business lawyer is absolutely critical.

Automatic Dissolution Events

Finally, some events can trigger a dissolution automatically by law, with no vote or court order needed. These are often unforeseen circumstances that legally terminate the partnership structure itself. Common examples include the death of a partner or the business's purpose suddenly becoming illegal. For instance, if a new local ordinance in Humble or Atascocita makes your primary business activity unlawful, the partnership may automatically dissolve.

Knowing these legal grounds is the foundation for protecting your interests. If you're facing the end of a partnership, The Law Office of Bryan Fagan is here to help you navigate your options. Contact our Atascocita office for a free consultation to discuss the specifics of your situation and map out the best path forward.

The Winding Up Process: A Practical Checklist

Once you've decided to dissolve your partnership, the real work begins. In Texas, this next stage is legally known as "winding up." It's the methodical process of shutting down the business's day-to-day operations for good. For business owners here in Atascocita, this part can feel like a tidal wave of tasks, but breaking it down with a clear plan makes it manageable.

Think of it like packing up your house before a big move. You can't just walk out the door and leave everything behind. You have to sort through your belongings, pay the final utility bills, and make sure nothing important gets lost in the shuffle. Winding up is the business equivalent—a critical legal duty that, if rushed, can lead to personal liability and legal nightmares down the road.

Starting the Shutdown: A Step-by-Step Guide

To help our neighbors in the Atascocita and Humble communities, we've put together a practical, step-by-step guide. Let's use a hypothetical local landscaping partnership in Humble as an example to illustrate how to tackle the winding up process.

Provide Formal Notice to All Parties: Communication is step one. The partners must officially notify everyone with a stake in the business. This isn't just a courtesy; it's a legal requirement. You need to inform all other partners, your employees, suppliers, your landlord, and especially any creditors. For our Humble landscaping company, this means calling their mulch supplier, notifying the bank that holds their truck loan, and letting regular clients know they won’t be taking on new service contracts.

Cease All New Business Activities: The moment dissolution is triggered, you must stop bringing in new business. The partnership's only legal purpose now is to wind up existing affairs. Our landscaping partners would have to stop bidding on new lawn care contracts for homes in Fall Creek or Atascocita Shores. Their focus shifts entirely to finishing the jobs they're already committed to.

This diagram shows the different legal paths that lead a business to this crucial winding up stage.

As you can see, whether the split is friendly, court-ordered, or triggered by an event, the winding up process is the mandatory next step to legally close the business.

Finalizing Operations and Settling Accounts

After halting all new operations, the focus pivots to settling the company's financial life. This requires a transparent and diligent accounting of everything the partnership owns and owes.

Complete All Existing Projects and Contracts: You are legally obligated to finish the work you've already started. Our Humble landscapers must complete that patio installation they began for a client last week. Simply walking away could trigger a breach of contract lawsuit, which would throw a wrench into the entire dissolution process. You can learn more about how a solid partnership agreement can prevent these kinds of problems by reading our guide on dissolution of partnership agreements.

Collect All Accounts Receivable: It's time to get paid. Start sending out final invoices and follow up on any outstanding payments owed to the partnership. The cash you collect from these final jobs is critical—it becomes part of the asset pool used to pay off the company's debts.

A partnership isn't officially terminated the moment you decide to dissolve it. The business legally continues to exist until the winding up of its affairs is fully completed. Rushing this process or skipping steps can expose partners to significant personal financial risk.

Failing to follow these steps can be incredibly costly. For Atascocita small business owners, the numbers are a stark warning. When there's no proper buy-sell agreement in place, a staggering number of dissolutions can end up in court, with legal costs spiraling, much like a contentious divorce.

The winding up process is detailed and demands careful attention to both legal and financial duties. If you are facing a partnership dissolution and need guidance, The Law Office of Bryan Fagan is here to help. Contact our Atascocita office for a free consultation to ensure your interests are protected every step of the way.

How Assets and Liabilities Are Divided

Once the decision to dissolve is final and the business has stopped operating, you arrive at what is often the most contentious part of a dissolution of partnerships: settling the finances. This is the stage where simmering disagreements can boil over, turning what should be a methodical process into a bitter dispute. For any business owner in Atascocita or Humble, knowing how Texas law dictates the division of assets and liabilities is absolutely essential to protect your own financial well-being.

This process is far from a free-for-all where partners simply take what they feel they're owed. The Texas Business Organizations Code lays out a very specific "order of priority" for how money must be paid out. This legal framework ensures the business satisfies its obligations to outsiders before the partners themselves get anything back. It’s best to think of it like a waterfall—the money flows from the top, and each level must be completely filled before any cash spills down to the next.

The Legal Order of Payments

This legally mandated sequence is designed to be fair, preventing chaos and protecting both creditors and the partners. The partnership’s assets must first be used to pay off all its debts. Only after every outside party has been paid in full can the partners start looking at their own financial stake in the business.

Here’s a clear, step-by-step breakdown of who gets paid and in what order:

- Outside Creditors: The number one priority is paying back anyone the business owes money to, not including the partners. This covers suppliers, banks, landlords, and any other third-party vendor.

- Partner Creditors: Next in line are any partners who personally loaned money to the business. This is separate from their initial capital investment and is treated as a formal debt that must be repaid.

- Return of Capital Contributions: Once all debts are cleared, the partners are entitled to get back their initial capital contributions—the money or property they put in to get the business off the ground.

- Distribution of Profits: Finally, if there’s anything left after all the above obligations are met, it’s considered profit and is split among the partners as laid out in the partnership agreement.

Priority of Payments When Liquidating a Partnership

To make it even clearer, this table lays out the pecking order for payments. Understanding who gets paid first is critical for a smooth and lawful dissolution.

| Payment Priority | Recipient | Common Example |

|---|---|---|

| 1st | Outside Creditors | Paying off a supplier invoice or a bank loan. |

| 2nd | Partner Loans | Reimbursing a partner who loaned the business cash for payroll. |

| 3rd | Partner Capital | Returning the initial $25,000 each partner invested. |

| 4th | Partner Profits | Splitting the remaining funds according to the agreed-upon ratio. |

Following this order isn't just a suggestion; it's a legal requirement designed to ensure a fair and orderly wind-down.

A Real-World Atascocita Example

Let's imagine a small retail shop in an Atascocita shopping center is closing its doors. The two partners start by liquidating the assets—selling off inventory, fixtures, and their point-of-sale system. This generates $100,000 in cash.

Before either partner gets a single dollar, they must follow the legal priority:

- First, they pay the $30,000 they owe to their main clothing supplier and the outstanding $10,000 on their business line of credit.

- Next, they repay one of the partners who had personally loaned the business $5,000 last month to make payroll.

- With all debts paid, $55,000 is left. Each partner originally put in $20,000, so they each get that capital contribution back, for a total of $40,000.

- This leaves a final profit of $15,000. Their agreement calls for a 50/50 split, so each partner walks away with $7,500.

One of the biggest points of conflict during a dissolution is the valuation of assets. Disagreements over what inventory, equipment, or even the business's brand is worth can stall the entire process and lead to costly disputes.

But what if the boutique’s debts totaled $110,000, but they only generated $100,000 from selling the assets? In a general partnership, the partners would be personally on the hook for that $10,000 shortfall. This is exactly why navigating the financial settlement with an expert is so critical—your personal assets could be at risk.

Untangling a partnership's finances is a minefield of potential conflicts and legal risks. At The Law Office of Bryan Fagan, we know the pressures local business owners are under. If you're facing a dissolution and need to ensure the outcome is fair and legally sound, contact our Atascocita office for a free consultation today.

Preventing Common Disputes Before They Start

An ounce of prevention is worth a pound of cure, especially when a business partnership is on the line. The most bitter and expensive conflicts that explode during a business breakup could have been sidestepped with smart planning at the very beginning.

Putting in the work to create solid legal groundwork from day one is like an insurance policy for your business. For business owners here in our Harris County communities, the single best defense is a detailed, thorough partnership agreement. Think of it as the ultimate rulebook for your business—a clear, mutually agreed-upon map for handling disagreements and, if it comes to it, the end of the partnership.

Addressing Breach of Fiduciary Duty

One of the most destructive conflicts is a breach of fiduciary duty. This is when a partner puts their own interests ahead of the business, like secretly launching a competing venture or snagging business opportunities for themselves. Picture a thriving Humble-based IT services firm where one partner starts quietly poaching the company's best clients for their own side business.

This kind of betrayal doesn't just drain profits; it shatters trust and almost always leads to a messy legal fight. A well-crafted partnership agreement can stop this before it starts by including:

- A Non-Compete Clause: This lays out clear boundaries, restricting partners from starting or joining a competing business while they are part of the partnership and for a set period after they leave.

- Conflict of Interest Policies: These rules are simple: partners must disclose any potential conflicts. This keeps everything transparent and ensures all business dealings are out in the open.

- Clear Consequences: The agreement should state exactly what happens if someone breaks these rules, such as forfeiting their share of the business or paying financial damages. Knowing the specifics of a breach of contract in Texas is crucial here, as these clauses need to be airtight to be enforceable.

Avoiding Financial Disagreements

Arguments over the final numbers are another major flashpoint. When it's time to close the books for good, it's common for partners to clash over the value of assets, the accuracy of the financial records, or how to calculate profits and losses during the winding-up phase.

A well-structured partnership agreement anticipates these financial friction points and establishes clear procedures before emotions are running high, ensuring a fair and orderly process for everyone involved.

For instance, a partnership agreement for a restaurant in Atascocita should spell out precisely how the business will be valued if it dissolves. Will you use a pre-set formula, or will you bring in a neutral third-party appraiser? It should also mandate clear record-keeping standards and give every partner the right to audit the books, which goes a long way in building trust and minimizing suspicion.

Creating a Clear Buyout Process

What happens when one partner wants out, but the others want to keep the business running? Without a plan, this scenario often leads to a deadlock, forcing a total liquidation that nobody really wanted. This is where a buy-sell provision in your agreement becomes invaluable. It pre-determines:

- Triggering Events: It defines what situations can trigger a buyout, like retirement, disability, death, or simply a partner's decision to exit.

- Valuation Method: It outlines how the departing partner's share will be priced.

- Payment Terms: It specifies how the buyout will be paid—in a single lump sum or through installments over an agreed-upon timeline.

Taking these proactive steps can prevent the vast majority of dissolution fights from ever ending up in court. Here at The Law Office of Bryan Fagan, we specialize in helping local entrepreneurs build strong foundations. Schedule a free consultation at our Atascocita office to talk about how a solid partnership agreement can protect your vision and your investment.

Why You Need an Atascocita Lawyer on Your Side

Trying to wind down a business partnership by yourself is a huge risk. It might feel like you're saving money by going the DIY route, but the legal red tape and potential for conflict can quickly spiral into an expensive, exhausting fight. This is where having a local attorney who knows our community isn't just a good idea—it's essential for protecting your financial future.

The entire process of a dissolution of partnerships is tightly regulated by Texas law. From notifying creditors the right way to accurately valuing and selling off assets, every single step is loaded with paperwork and unforgiving deadlines. One wrong move could leave you personally on the hook for business debts or stuck with an unfair settlement that threatens everything you've built.

Protecting Your Interests in Our Community

Here at The Law Office of Bryan Fagan, we're not just lawyers; we're your neighbors in the Atascocita and Humble area. We understand the specific pressures local business owners face because we're part of this community, too. Our job is to be your staunchest advocate and make sure your rights are defended from start to finish.

We take on the critical tasks that can mean the difference between a clean break and a financial disaster, like:

- Ensuring Legal Compliance: We'll make sure every move you make lines up perfectly with the Texas Business Organizations Code, shielding you from potential lawsuits down the road.

- Negotiating Fair Terms: When you and your partners can't see eye-to-eye on what assets are worth or who owes what, we step in to negotiate firmly on your behalf for a fair deal.

- Protecting Personal Assets: We work tirelessly to draw a clear line between the business's liabilities and your personal finances, protecting your home and family's assets from business creditors.

Our aim is to carry the legal weight so you can start focusing on what's next. As your dedicated Atascocita business lawyer, we provide the steady, experienced hand you need to navigate this stressful time and turn it into a manageable transition.

The end of a partnership is a critical financial crossroad. Having an experienced attorney to guide you isn't just about interpreting the law; it's about having a strategic partner who is solely dedicated to protecting your best interests and securing your future.

Closing a business chapter is tough, but you absolutely do not have to go through it alone. The team at The Law Office of Bryan Fagan is here to offer the support and straightforward advice you deserve.

Schedule a free, no-obligation consultation at our Atascocita office today. Let's talk about how we can help you move forward with confidence and peace of mind.

Answering Your Top Questions About Ending a Partnership

When a business partnership is coming to an end, it's natural to have a lot of questions and feel a bit of uncertainty. Let's tackle some of the most common concerns we hear from our clients in Atascocita and Humble as they face the process of dissolution of partnerships.

What Happens If My Partner Refuses to End the Business?

It’s a tough spot to be in, but you aren't stuck. If you've hit a wall and your partner simply won't agree to dissolve the business, Texas law provides a path forward through "judicial dissolution." This means you can petition a Harris County court and ask a judge to order the partnership to end.

Courts don't take this step lightly, though. You'll typically need to show a serious problem, like a partner's misconduct, a major breach of your partnership agreement, or proof that it's just not practical to keep the business running. This is where having a skilled Atascocita attorney becomes essential; they can build a strong case to protect your interests in court.

Am I Personally on the Hook for the Partnership's Debts?

For most general partnerships, the answer is, unfortunately, yes. This is one of the biggest risks partners face. The "winding up" phase is designed to pay off all business debts using the partnership's assets first.

But what if the business assets aren't enough to cover everything? That's when creditors can potentially look to your personal assets to cover the remaining balance. A lawyer's guidance is crucial to manage this process correctly, ensuring business liabilities are settled properly and your personal finances are shielded from unfair claims.

The line between business debt and personal liability can become blurred without careful legal management. Ensuring every step of the winding up process follows Texas law is your best defense against personal financial exposure.

Can Just One Partner Leave Without Shutting Everything Down?

Absolutely. This happens all the time and is usually handled with a "buyout." In a buyout, the partners who are staying purchase the departing partner's ownership stake in the company.

The best-case scenario is having a buy-sell provision already baked into your original partnership agreement. Think of it as a prenuptial agreement for your business—it lays out the exact rules for how to value a partner's share and the terms for buying them out. Having this in place ahead of time can prevent a massive headache and let the business continue its operations smoothly.

Trying to figure all this out on your own can be overwhelming, but you don't have to. The team at Law Office of Bryan Fagan – Atascocita TX Lawyers is here to offer clear, straightforward legal advice to our neighbors in Harris County. To talk about your specific situation and get a handle on your options, please schedule a free, no-obligation consultation at our Atascocita office. You can find more information about how we can help at https://www.atascocitaattorneys.com.