For many families we talk to in Atascocita and Humble, the biggest draw of a revocable living trust is simple: it lets your estate bypass the public probate process, allowing for a quiet, private transfer of assets. The main trade-off? It takes more work and a greater initial investment to set up and, crucially, to fund it by retitling assets into the trust's name.

Is a Revocable Trust Right for Your Atascocita Family?

When you’re planning for your family's future, the last thing you want is confusion. You’ve probably heard people talk about wills and trusts, but figuring out which one actually protects your legacy can feel like a maze. It's a question we hear a lot from our neighbors here in Atascocita, Humble, and across northeast Harris County: is a revocable living trust the right move for my family?

Think of a revocable living trust as a legal container you create during your lifetime to hold your assets. You're the one who creates it (the grantor), and you're almost always the one managing it (the trustee). This means you keep complete control. You can still sell your house, manage your investments, or spend your money just like you always have.

The "revocable" part is the key to its flexibility—it means you can change your mind, modify the terms, or even dissolve the entire trust if your life takes an unexpected turn.

Its primary job is to create a seamless handover of your assets to your beneficiaries when you pass away, entirely bypassing the often slow and very public probate court process we have here in Harris County. This is the single biggest difference when you compare it to a traditional will, which is specifically designed to go through probate.

Understanding the Core Differences

So, where do a will and a trust really part ways? A will is essentially a set of instructions for a judge, and it does absolutely nothing until after you've passed away. A trust, on the other hand, is a living document. It's active the moment you create and fund it, which means it can offer protection both during your lifetime and after.

A will is an instruction manual for the probate court. A revocable trust is a private plan that allows your family to avoid the courthouse altogether.

This fundamental distinction is at the heart of the revocable trust pros and cons. Let's break down the practical differences for Atascocita residents.

| Feature | Revocable Living Trust | Traditional Will |

|---|---|---|

| Probate | Avoids the public Harris County probate process. | Must go through the public probate process. |

| Privacy | Your asset details and beneficiaries remain private. | Becomes a public court record. |

| Incapacity | Allows your successor trustee to manage assets without court. | May require a court-appointed guardianship. |

| Effective Date | Becomes effective as soon as you create and fund it. | Only takes effect after your death. |

| Initial Cost | Higher upfront cost to create and fund. | Lower upfront cost to draft. |

| Asset Control | You maintain full control as the trustee during your life. | You maintain control of assets in your name. |

Ultimately, choosing between these powerful estate planning tools comes down to what you value most—privacy, efficiency, or protecting your family from unnecessary hurdles. Here at The Law Office of Bryan Fagan, we sit down with Atascocita families every day to help them sort through these exact decisions.

To explore what makes sense for your situation and find out if a trust is the right fit for your family, we invite you to schedule a free consultation at our Atascocita office.

The Core Advantages of a Texas Revocable Trust

When families in Atascocita and Humble think about estate planning, it really boils down to a few simple goals: keeping things private, staying in control, and making life easier for loved ones down the road. A revocable trust, when it’s set up and funded the right way, is a powerful tool for hitting all three of those marks. It offers some serious advantages that you just can't get with a simple will.

The biggest win, and the one that gives our clients the most peace of mind, is the ability to bypass the public probate process. Here in Harris County, a will has to be validated by a court. That process can be slow, surprisingly expensive, and it puts all your family's financial details out there for anyone to see. A revocable trust is a private agreement, so it sidesteps that whole ordeal.

That single benefit means your assets can get to your beneficiaries quickly and quietly, without the delays and public exposure of probate court.

Seamlessly Planning for Incapacity

Life has a way of throwing curveballs. One of the most thoughtful features of a revocable trust is how it protects you if you become incapacitated. If an illness or injury ever leaves you unable to manage your own affairs, the person you named as your successor trustee can step in immediately to handle your finances.

This completely avoids the need for a stressful and often costly court-supervised guardianship. Your chosen trustee can pay your bills, manage your investments, and take care of your property, ensuring your life continues without a hitch and without court intervention. It’s a proactive approach that saves you and your family from a huge legal and emotional headache.

A revocable trust isn't just a plan for what happens after you're gone—it's a vital tool for managing your assets and protecting your well-being while you are still here.

This forward-thinking aspect is a critical point to consider when you're weighing the pros and cons for your own family.

Maintaining Absolute Control and Flexibility

The key is in the name: "revocable." This points to another core advantage—complete flexibility. As the creator (or grantor) and manager (trustee) of your own trust, you keep total control over every asset you put into it. You can sell your Atascocita home, buy a new car, or change your investment strategy whenever you want, just like you do now.

Even better, you can amend the trust anytime your life changes. Welcomed a new grandchild? Ready to name different beneficiaries or pick a new successor trustee? With a revocable trust, making those updates is simple. This ensures your estate plan always reflects what you actually want.

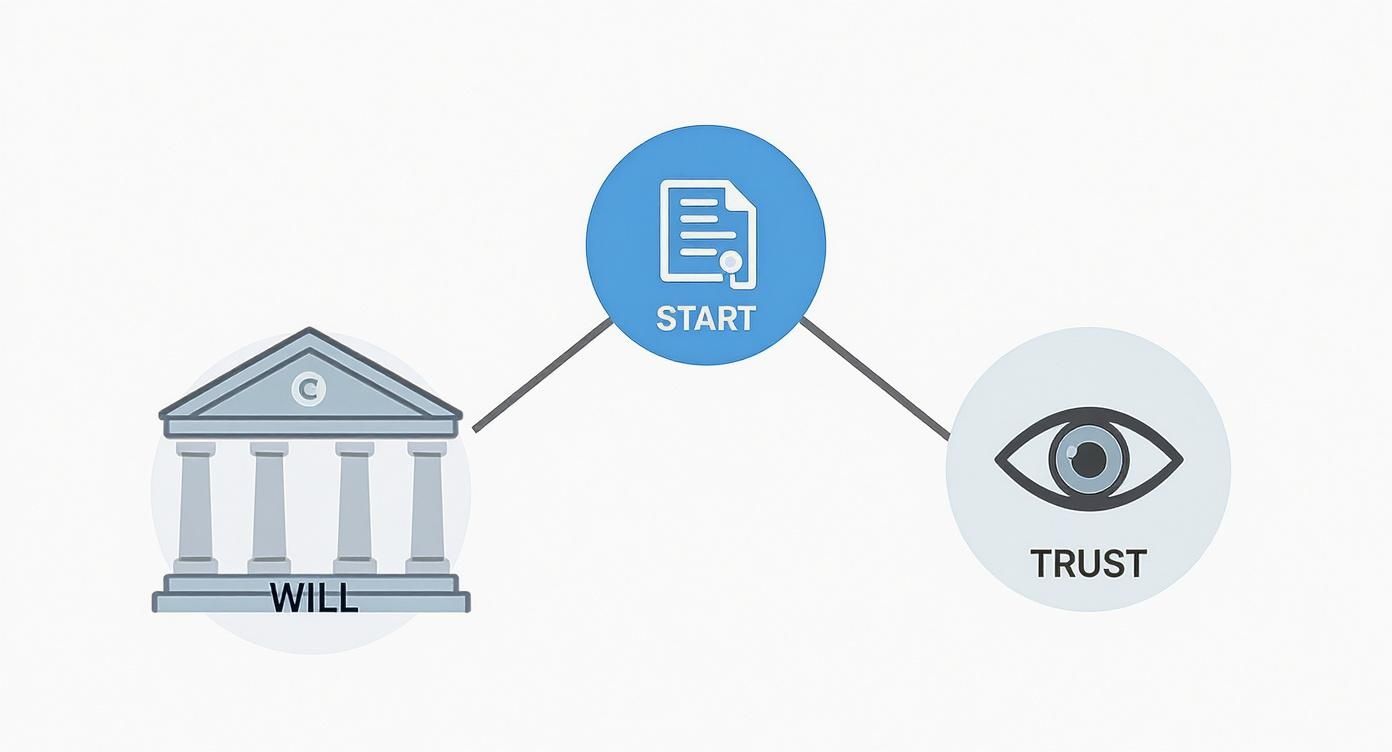

This infographic does a great job of showing the different paths a will and a trust take.

As you can see, a trust is designed for privacy and to avoid the courthouse, while a will is set up to go straight through the public probate system.

To see these differences in a more direct comparison, we've put together a table that breaks it down for Texas residents.

Comparing a Revocable Trust vs a Will in Texas

| Key Consideration | Revocable Trust | Traditional Will |

|---|---|---|

| Probate Process | Avoids probate. Assets are managed and distributed privately by the successor trustee. | Requires probate. Must be filed with and validated by a Texas court before assets can be distributed. |

| Privacy | Private. The terms of the trust and details of your assets remain confidential. | Public Record. The will and inventory of assets become public documents accessible to anyone. |

| Incapacity Planning | Built-in. A successor trustee can immediately manage your finances if you become unable to. | Not included. Requires a separate Durable Power of Attorney; otherwise, a court-ordered guardianship may be necessary. |

| Control During Lifetime | Full control. You can manage, sell, or change assets and the trust terms at any time. | Full control over your assets. You can amend the will at any time. |

| Time to Distribute | Fast. Distribution can begin almost immediately after your passing, according to your terms. | Slow. Can take months, or even years, for the probate process to conclude before beneficiaries receive assets. |

| Upfront Cost & Effort | Higher. More complex and costly to set up and requires funding (transferring assets into the trust). | Lower. Generally simpler and less expensive to draft. |

This table makes it clear that while a will is a foundational document, a revocable trust offers a far more robust and private way to manage your estate's transition.

Privacy and Peace of Mind for Your Beneficiaries

When a will is probated, it’s filed with the county clerk and becomes public information. That means anyone can look up the value of your estate, see who you left things to, and find out exactly what they received. For many families in our community, that kind of public exposure is deeply uncomfortable.

A revocable trust, on the other hand, is a private family document. The details of your estate and your final wishes stay confidential, known only to your trustee and the beneficiaries you chose. This privacy shields your family from nosy neighbors, opportunistic financial advisors, and potential squabbles during an already difficult time.

We saw the real-world value of this privacy and control during the COVID-19 pandemic in 2020. Courts across Texas, including here in Harris County, limited their operations, prioritizing only the most urgent cases. Families relying on probate faced major delays, but those with properly funded trusts saw zero interruption in asset management because no court was involved. It was a stark reminder of the practical power of a trust, especially in a crisis.

By keeping your affairs out of court and out of the public eye, you give your loved ones a profound gift: the space to grieve without the added stress of a public legal battle. To get a better handle on how this works, it’s worth reading more about how to avoid probate in Texas.

Here at The Law Office of Bryan Fagan, we believe in arming our Atascocita neighbors with the knowledge to make smart, confident decisions. If these advantages sound like what you’re looking for, we invite you to schedule a free, no-obligation consultation at our Atascocita office. We’re here to listen to your story and help you build a plan that truly protects what matters most.

Understanding the Limitations of a Revocable Trust

While a revocable trust offers some powerful benefits for Atascocita families, it's just as important to understand what it cannot do. Part of making an informed decision is looking at the whole picture, drawbacks included. A revocable trust isn't a silver bullet for every estate planning goal, and recognizing its limits is the only way to ensure it truly fits your family's needs.

One of the biggest factors to weigh is the upfront commitment. Setting up a trust is definitely more involved than drafting a simple will, requiring more careful thought and a larger initial investment. But honestly, the real work starts after you sign the documents.

This next step is what we call funding the trust, and it's the place where we see many well-intentioned plans fall apart.

The Critical Task of Funding Your Trust

Think of a revocable trust as an empty box; it's only useful once you actually put your assets inside it. "Funding" simply means retitling your assets from your individual name into the name of the trust. This isn't a suggestion—it's an absolute must for the trust to work the way it's supposed to.

For our local families, this process involves a few practical steps:

- Real Estate: You'll need to prepare and file a new deed with the Harris County Clerk's office to formally transfer your Atascocita or Humble home into the trust.

- Bank Accounts: All of your checking, savings, and money market accounts need to be legally retitled in the trust's name.

- Investments: Any non-retirement brokerage accounts have to be formally transferred over as well.

- Business Interests: If you own a local business, that ownership stake may need to be assigned to the trust.

If an asset isn't properly titled in the trust's name, it’s almost guaranteed to get stuck in the public probate process. This defeats one of the main reasons for setting up the trust in the first place. It’s a step that demands real diligence.

A Common Misconception About Asset Protection

It's absolutely crucial for Texas residents to grasp one key limitation: a revocable trust offers no protection from your personal creditors during your lifetime. Because you keep full control over the assets—you can take them back, spend the money, or dissolve the trust whenever you want—the law still sees those assets as yours.

Think of it this way: if you can freely access the money, so can a court or a creditor in a lawsuit. A revocable trust is not a shield against personal liability, medical bills, or other debts.

If protecting your assets from potential lawsuits is a major concern for you, we would need to look at other tools, like certain types of irrevocable trusts. It's a vital distinction to make when you're weighing the revocable trust pros and cons.

Revocable Trusts and Tax Implications

Another frequent misunderstanding is about taxes. A revocable living trust, by itself, does not reduce your estate tax or income tax bill. Because you maintained control over the assets throughout your life, they are still considered part of your taxable estate when you pass away.

While this might sound like a big negative, the reality is that for most families, it's a non-issue. The federal estate tax exemption is currently very high (over $13 million per person), which means the vast majority of estates, including those right here in the Atascocita and Humble areas, won't owe any federal estate tax anyway.

The main job of a revocable trust is not tax reduction; it's about avoiding probate, planning for incapacity, and maintaining privacy. But it's important to be realistic about the costs and limitations. Upfront legal fees are involved, and the trust is only as good as the funding process—a step that, unfortunately, is often overlooked. If you'd like to dig deeper, you can explore the full story on revocable trust limitations.

Understanding these limitations isn't meant to discourage you. It’s about empowering you. Here at The Law Office of Bryan Fagan, our commitment is to provide clear, honest guidance so you can build a plan that truly serves your family.

If you have questions about these limitations or want to discuss whether a revocable trust is the right fit for your unique situation, we are here to help. Schedule a free consultation at our Atascocita office to speak with an attorney dedicated to our community.

When Does a Revocable Trust Make Sense for Your Family?

After sorting through the pros and cons, the question becomes personal: does a revocable trust actually make sense for my family? While every situation has its own unique wrinkles, we see a few common scenarios right here in our Atascocita and Humble communities where a trust becomes an incredibly powerful tool. It’s built to solve specific challenges that a simple will just can't touch.

https://www.youtube.com/embed/Ryw9gK-RF2w

Walking through these situations can help you see past the legal jargon and figure out if a trust is the right move for protecting what you’ve worked so hard to build. Let's dig into a few key examples.

You Own Property in Multiple States

This is a huge one for many Texas families. Maybe you own your primary home here in Atascocita but also have a vacation cabin up in Colorado or inherited a piece of family land over in Louisiana. If those properties are just in your name, your family is staring down the barrel of opening a separate probate case in each and every state where you own real estate. This headache is called ancillary probate, and it's a costly, time-consuming mess.

A revocable trust completely eliminates this problem. When you place all your out-of-state properties into the trust, you sidestep ancillary probate altogether. Your successor trustee can then manage and distribute that property exactly as you wished, without the nightmare of hiring lawyers and navigating court systems in multiple jurisdictions.

You Have a Blended Family

Blended families are the new normal, but they add real complexity to estate planning. A simple will might just say "everything goes to my spouse," which could accidentally disinherit children from a previous marriage. A revocable trust gives you the surgical precision needed to protect everyone you love.

With a trust, you can spell out very specific instructions. For instance, you can set it up to provide for your current spouse for the rest of their life, while ensuring that whatever is left over ultimately passes down to your children from all marriages. That level of control is absolutely critical for keeping the peace and making sure your wishes are followed to the letter.

A trust allows you to create a detailed roadmap for your assets, ensuring each beneficiary is cared for exactly as you intend, which is particularly vital in blended family dynamics.

This kind of thoughtful planning can prevent painful disputes and protect the relationships you cherish most.

You Value Absolute Privacy

If you're not comfortable with your family’s financial business becoming public record down at the Harris County courthouse, a revocable trust is your answer. When a will goes through probate, it’s filed with the court. That means the details of your estate—what you owned, what it was worth, and who you left it to—are open for anyone to see.

A trust, on the other hand, is a private contract. Its terms stay confidential, known only to your trustee and beneficiaries. This privacy is worth its weight in gold for many reasons:

- It protects your family from nosy neighbors or opportunistic people.

- It shields your beneficiaries from getting hit with unsolicited financial "advice" or scams.

- It drastically reduces the chance of public fights among heirs.

For many local business owners and families in Humble or Atascocita, keeping financial matters private is a top priority that a will simply cannot deliver.

You Want to Plan for Your Own Incapacity

As we've touched on, a trust is a living document that works for you while you're still here. If you were to become ill or injured and couldn't manage your own finances, your chosen successor trustee could step in immediately to pay bills and handle your assets. This seamless transition completely avoids a court-supervised guardianship, which is a public, expensive, and often emotionally draining ordeal for your family.

This "living" benefit provides tremendous peace of mind, ensuring that you and your property are cared for by someone you trust, no matter what life throws your way. If any of these situations sound familiar, it's a strong sign that a revocable trust could be the cornerstone of your estate plan.

We're here to help you navigate these important decisions. To discuss your family’s unique needs, we invite you to schedule a free consultation with us at our Atascocita office.

How to Create and Fund Your Revocable Trust

Taking the step to create a revocable living trust is a smart move for protecting your family’s future, but we know the process can feel overwhelming. Our goal is to break it down into clear, manageable steps so you feel confident and in control. Think of a trust as more than just a document; it’s an active plan that requires real thought and action to work correctly.

The whole process starts with a frank discussion about your goals, your assets, and your family situation. From there, we draft the legal paperwork—the trust agreement—which lays out all your instructions. But the most critical phase comes next, and it’s honestly where most do-it-yourself plans fall apart: funding the trust.

The Key Decisions You Will Make

Before a single word of the trust agreement is written, you’ll need to make a few foundational decisions. These choices are the heart of your entire estate plan, and our job is to walk you through each one with practical, experienced advice.

First, we need to identify the key players in your plan:

- Successor Trustee: This is the person or institution you trust to take the reins and manage the trust when you can't, whether due to incapacity or death.

- Beneficiaries: These are the people or organizations who will ultimately receive the assets from your trust.

Choosing your successor trustee is easily one of the most important decisions you'll make. This person absolutely must be trustworthy, organized, and capable of handling financial matters impartially, even when emotions might run high. You could name a family member, like a responsible adult child, or you might opt for a professional trustee like a bank for more complex estates.

A trust is only as effective as the person you choose to manage it. Your successor trustee is the steward of your legacy, responsible for carrying out your wishes with integrity and diligence.

Weighing the pros and cons of naming a family member versus a professional is a deeply personal decision. We can help you think through the potential challenges and benefits of each path. We’ll also help you outline crystal-clear instructions for your beneficiaries, making sure your assets are distributed exactly as you envision. You can learn more about these initial steps in our detailed guide on how to create a trust.

The All-Important Funding Process

Once your trust document is signed and notarized, the real work begins. An unfunded trust is like an empty vault—it can’t protect anything. Funding is the legal process of retitling your assets from your individual name into the name of the trust. This is the crucial step that allows your estate to bypass probate.

For our Atascocita and Humble neighbors, this hands-on process typically involves:

- Real Estate: We'll prepare and file a new deed with the Harris County Clerk to transfer your home's ownership into the trust.

- Bank Accounts: You'll need to work with your local bank to change the title on your checking and savings accounts to the trust’s name.

- Investment Accounts: We coordinate with your financial advisor to retitle any non-retirement brokerage accounts.

- Vehicles: Titles for your cars, trucks, or boats need to be changed through the Texas Department of Motor Vehicles.

- Personal Property: A document called a general assignment is created to transfer tangible personal items like furniture, art, and jewelry into the trust.

This is where having an experienced firm in your corner makes all the difference. We guide you through every single step, ensuring each asset is correctly funded so your trust works exactly as you intended when it's needed most.

If you’re ready to take control of your legacy with a plan that truly protects your family, we’re here to help. Schedule a free consultation at our Atascocita office to discuss creating and funding your revocable trust.

Common Questions About Revocable Trusts

When you start digging into estate planning, a lot of questions pop up. It’s only natural. As we guide families across Atascocita and Humble through their options, we've noticed a few questions come up time and time again. To give you some clarity, we’ve answered the ones we hear most often right here.

Can I Sell My Atascocita Home If It Is in a Revocable Trust?

Yes, absolutely. This is a big worry for many homeowners, but the answer couldn't be simpler. Since you're the one who created the trust (the grantor) and you’re also managing it (the trustee), you never lose control of the assets inside.

You have the complete freedom to sell, buy, or refinance property in the trust just as you would if you held it in your own name. The only real difference is a small detail on the paperwork. When you sign at closing, you'll sign as "Jane Smith, Trustee of the Jane Smith Revocable Trust" instead of just "Jane Smith." That’s it. This flexibility is one of the best parts of using a revocable trust.

Does a Revocable Trust Protect Assets From Medicaid in Texas?

No, it does not. This is an incredibly important point for anyone thinking ahead to long-term care needs. A revocable trust will not protect your assets when it comes to qualifying for Medicaid in Texas.

Because you can cancel the trust and take your assets back at any time, the government views them as fully available resources when calculating your eligibility. If your goal is to plan for long-term care, you’ll likely need a very different kind of tool—a specialized, irrevocable trust, often called a Medicaid Asset Protection Trust. It's vital to have a conversation with an experienced attorney about your specific long-term care goals.

What Happens to My Revocable Trust After I Die?

This is where the real power of a trust comes into play. The moment you pass away, your revocable trust automatically becomes an irrevocable trust. Your chosen successor trustee then steps into your shoes.

Their role is to follow the exact instructions you left in the trust document, managing and distributing the assets according to your wishes. This all happens privately, outside of a courtroom. The successor trustee will handle any final debts and then pass the remaining property to your beneficiaries, completely bypassing the public and often lengthy probate process. To get a sense of just how long that can drag on, you may want to read about how long probate takes in Texas.

Upon your passing, your revocable trust becomes a private roadmap for your successor trustee to follow, ensuring your wishes are carried out efficiently and confidentially, without the need for a judge's permission.

This smooth, seamless transition is one of the most compelling reasons people choose a trust-based estate plan.

Is a Revocable Trust Always Better Than a Will?

Not necessarily. There's no single estate planning tool that's perfect for everyone. The best choice always comes down to your specific assets, your unique family dynamics, and what you hope to achieve.

For a young family in Humble with a straightforward estate, a well-written will might be the most practical and cost-effective solution. But for many others, a revocable trust is simply the better fit.

A trust is often the right move if you:

- Own real estate, like a home in Atascocita.

- Have a blended family or other complex family relationships.

- Want to keep your financial matters completely private.

- Need a clear plan in place in case you become incapacitated.

The only way to know for sure what's right for you is to talk it through. A thoughtful consultation helps you weigh the real-world pros and cons of a revocable trust and make a decision you can feel confident about.

At The Law Office of Bryan Fagan – Atascocita TX Lawyers, we believe in providing our neighbors with clear, compassionate, and practical legal guidance. If you're ready to explore how a revocable trust can protect your family's future, we invite you to schedule a free, no-obligation consultation with our experienced estate planning team.