When you're facing the possibility of a divorce in Texas, the very first thing you need to do is get a crystal-clear picture of your family's finances. It's not the most glamorous task, but it’s the most critical. You have to methodically gather every important document, identify every asset and every debt, and create a complete snapshot of your financial reality before you do anything else.

Your First Financial Steps When Considering Divorce in Texas

The thought of divorce in Atascocita or Humble is overwhelming. It’s a storm of emotion, and the financial unknowns can feel completely paralyzing. You're probably asking yourself a hundred different questions about the future.

Taking organized steps right now isn’t about picking a fight; it’s about building a stable foundation for whatever comes next. This is your roadmap—a straightforward, practical plan to help you navigate the chaos and protect your financial well-being. Getting organized from day one gives you the power and the information you need to make smart, clear-headed decisions for your life in northeast Harris County.

Understanding What's at Stake

Let's be blunt: the financial fallout from a divorce can be massive and can last for years. This is precisely why getting prepared is so non-negotiable.

Families who go into this unprepared can face real economic hardship. The data is sobering. Divorce can crater a family's finances, especially when one spouse is caught off guard. Studies show that women, for example, often see their income drop by as much as 25% to 30% after a divorce. For families with kids, the hit to post-divorce income can be even worse, pushing many single parents toward real financial struggle. You can learn more about the financial trends of divorce from the OECD data.

We share this not to scare you, but to underscore why taking control of your financial information right now is the single most important move you can make for your future.

Initial Financial Preparation Checklist

To get started on the right foot, here is a quick checklist. These are the foundational tasks we advise all our clients in the Atascocita and northeast Harris County area to tackle first. They are designed to bring clarity and give you a sense of control from the very beginning.

| Action Item | Why It's Important for Atascocita Residents | First Step to Take |

|---|---|---|

| Gather Key Documents | This provides the factual proof needed for dividing assets under Texas community property law. | Start by collecting the last three years of tax returns, recent pay stubs, and bank statements. |

| List All Assets | You need a complete inventory of the marital estate that will eventually be divided. | Open a simple spreadsheet and list everything you own, from your Humble home to 401(k) accounts. |

| Identify All Debts | This ensures all liabilities—mortgages, loans, credit cards—are properly accounted for during negotiations. | Pull your credit report from all three bureaus and list every single debt you see. |

| Create a Preliminary Budget | It helps you understand your current spending habits and what you'll realistically need to live on later. | Track every household expense for 30 days. You need to see exactly where the money is going. |

| Schedule a Consultation | This gives you a clear-eyed understanding of your specific legal rights and options in Texas. | Contact a local Atascocita family law attorney for a confidential, no-cost initial meeting. |

Completing these initial steps will do more than just organize your paperwork; it will organize your thoughts. It will also make the entire process smoother, which ultimately saves you time, stress, and money. When you’re prepared, you can work much more effectively with your legal team and advocate for a fair and just outcome.

If you’re thinking about divorce and feel swamped by all the financial questions, you don’t have to figure it out alone. The Law Office of Bryan Fagan – Atascocita TX Lawyers is here to offer the clear guidance and compassionate support you need. Schedule a free, confidential consultation at our Atascocita office today to talk about your situation and learn how we can help protect your financial future.

Building Your Complete Financial Inventory

In a Texas divorce, knowledge isn't just power—it's the foundation for a fair settlement. That knowledge starts with getting a complete and honest picture of your marital finances. This isn’t just about making a list; it’s about systematically gathering every single piece of paper and digital file that tells the financial story of your marriage.

Think of it as building a case for your own future. Every statement you find, every document you copy, and every file you organize gives your attorney the ammunition they need to fight for you. This groundwork ensures that everything—from the family home in Humble to that old retirement account you both contributed to—is properly accounted for under Texas community property law.

Starting Your Document Collection

Your first move should be to locate and copy every important financial document you can get your hands on. Don't stress if you can't find everything right away. The goal here is to create a solid starting file for your legal team. It's often best to do this quietly and store the copies somewhere safe outside your home, like with a trusted friend in the Atascocita community or in a secure cloud drive.

Your initial sweep for documents should focus on the big picture:

- Tax Returns: Grab at least the last three to five years of personal and any business tax returns. These are a goldmine of information, giving a high-level view of income, investments, and potential assets.

- Income Statements: Collect recent pay stubs for both you and your spouse. Also, round up any W-2s, 1099s, or K-1 statements you can find.

- Bank Statements: This is a big one. Print or download at least one full year's worth of statements for every single checking, savings, and money market account, whether it's in your name, their name, or both.

Accurately collecting and analyzing bank statements is absolutely crucial. Using a bank statement converter software can be a huge time-saver, helping to automatically pull and organize financial data from PDF or image files for your inventory.

Digging Deeper into Assets and Debts

Once you have the core income and banking documents, it's time to drill down into a more detailed inventory of everything you own and everything you owe. This part of the process is non-negotiable for ensuring a "just and right" division of your marital estate, as Texas law demands.

This detailed list needs to cover everything:

- Real Estate Paperwork: This means deeds, mortgage statements, property tax records, and any appraisals for your home in Atascocita or other properties.

- Retirement and Investment Accounts: Find the most recent statements for all 401(k)s, IRAs, pensions, brokerage accounts, and any stock option plans.

- Loan and Debt Statements: Gather the paperwork for all debts—car loans, student loans, personal loans, and especially credit card statements for the past 12 months.

- Insurance Policies: Collect info on all life, health, auto, and homeowner's insurance policies. Pay close attention to beneficiaries and any listed cash values.

Walking into your first meeting with an attorney armed with this financial inventory can dramatically streamline the divorce process. It doesn't just save you time and money on legal fees; it helps your lawyer spot discrepancies or potential hidden assets right from the start.

What to Do If You Can't Access Everything

It’s incredibly common, especially here in Harris County, for one spouse to have managed all the finances, leaving the other completely in the dark. If that’s you, please don’t panic. Just gather what you can. Even grabbing mail that comes to the house or logging into online portals you still have access to is a great start.

When you work with The Law Office of Bryan Fagan, we use formal legal tools—a process known as discovery—to legally compel your spouse to provide all the missing documentation. Your early efforts, even if they feel incomplete, give us a powerful head start because we'll know exactly what to ask for.

Building this inventory is your first major step toward taking control of your financial future. If you're feeling overwhelmed or just aren't sure where to begin, schedule a free, no-obligation consultation at our Atascocita office. We’re here to guide you through this with compassion and expertise.

Understanding Community vs. Separate Property in Texas

Of all the stressful questions that come up during a divorce, "How will our stuff be divided?" is usually at the top of the list. Here in Texas, the answer hinges on a crucial distinction: community property versus separate property. For folks in Atascocita and Humble, getting a firm grip on this concept is the first step toward a fair financial outcome.

Texas law operates on what’s called the community property presumption. It’s a powerful starting point. Essentially, the law assumes that almost everything you and your spouse acquired during the marriage belongs to both of you, together. It doesn’t matter whose paycheck bought it or whose name is on the title. If you got it after you said "I do," it's presumed to be part of the marital pot.

What Counts as Community Property?

Think of community property as the entire financial world you built as a married couple. It covers both the good (assets) and the bad (debts). A Harris County court will aim for a "just and right" division, which often looks like a 50/50 split but can be adjusted depending on the circumstances.

So, what falls into this category? More than you might think:

- Income & Wages: Every dollar either of you earned during the marriage is considered community property.

- The Family Home: If you bought your house in Atascocita while married, it's almost certainly community property, even if only one name is on the mortgage.

- Retirement Accounts: The portion of a 401(k), pension, or IRA that was earned and grew during the years you were married is part of the marital estate.

- Vehicles, Furniture & Bank Accounts: The cars you drive, the sofa in the living room, and the money in your savings accounts (even individual ones) are typically community assets.

- Debts: That mortgage, the car loans, and any credit card balances racked up during the marriage are usually community debts that have to be divided, too.

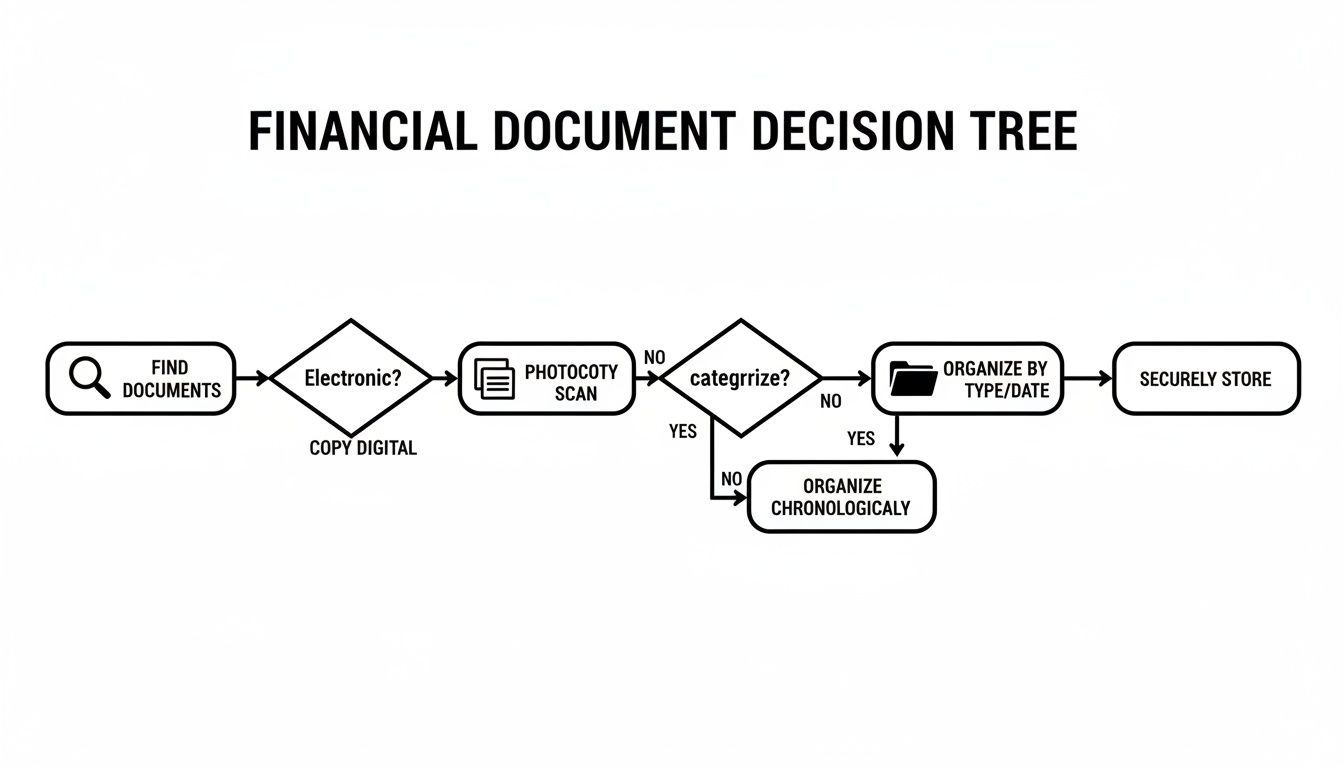

The first step in any divorce is taking a complete inventory of all these things. This flowchart gives you a simple roadmap for finding, copying, and organizing the documents you'll need to get started.

Following a process like this makes sure nothing gets missed and gives you a clear picture of what needs to be divided.

Defining Separate Property

Separate property is the exception to the community property rule. These are assets that belong to one spouse alone and are not on the table for division. But here’s the catch: the burden of proof is on the person claiming something is separate. You have to prove it with "clear and convincing evidence."

Separate property generally falls into three buckets:

- Property owned before the marriage: Anything you had in your name before the wedding day remains yours.

- Gifts received during the marriage: If your aunt gave you (and only you) $10,000 for your birthday, that's your separate property.

- Inheritances received during the marriage: Any money or property you inherited is considered your separate asset.

Proving something is separate property can be incredibly tricky. It requires a clean paper trail—like bank statements showing an inheritance was deposited into its own account and never mixed with joint funds. This is one of those areas where an experienced Atascocita family law attorney can be invaluable.

Let’s say you owned a rental property in Humble before you got married. That property is your separate asset. But what if, over the last 10 years, you used money from a joint checking account to pay the mortgage or put on a new roof? Now, the community estate may have a right to be reimbursed for those contributions. It gets complicated fast. You can explore our detailed guide on community property in Texas for more real-world examples.

Why This Distinction Matters So Much

How your assets and debts are classified will be the single biggest factor in the financial outcome of your divorce. Getting it wrong—like letting a separate inheritance get treated as community property—could literally cost you tens of thousands of dollars or more.

It’s no secret that financial disagreements are a huge driver of divorce. Some studies show that money fights are behind up to 40% of divorces. For Gen X couples, it’s the number one reason at 41%. This just highlights why getting your financial ducks in a row before you file is so important. For anyone in Atascocita and Humble, a solid understanding of Texas property law is your best defense against an unfair financial settlement.

The road through a divorce is tough, but you don't have to figure out these complex financial rules alone. At The Law Office of Bryan Fagan, we focus on helping northeast Harris County families protect what they’ve built and secure their financial future. Schedule a free, confidential consultation at our Atascocita office today to get clear, compassionate answers about your situation.

Crafting a Realistic Post-Divorce Budget

All this financial legwork has one core purpose: making sure you can stand confidently on your own two feet once the divorce is final. This isn't just about splitting up what you have; it's about building a secure, independent future. And the single most powerful tool you have for this is a realistic post-divorce budget.

Creating a budget takes the vague, often scary, feelings about money and turns them into something concrete you can work with. It's an incredibly empowering step, shifting your focus from a shared financial past to your own successful future in the Atascocita area.

From Household Bills to Your Personal Bottom Line

First things first, you need to know exactly where your money is going right now. If you've already been tracking your household's spending, you've got a great head start. The next move is to project what your individual costs will look like.

This step-by-step guidance involves going line by line through your current expenses and making an educated guess about your future needs. Some expenses will get cut in half, some might stay the same, and you’ll definitely have some brand-new ones to add to the list.

- Housing: Will you be staying in the family home in Atascocita, or are you looking for a new apartment over in Humble? Think about rent or a new mortgage, plus your own utilities, property taxes, and homeowner's or renter's insurance.

- Transportation: Don't forget you'll now be solely responsible for a car payment, insurance, gas, and maintenance.

- Healthcare: For many, this is a big one. Health insurance can be a significant new expense, so start researching the cost of an individual plan or continuing coverage through COBRA.

- Child-Related Costs: Go beyond just food and shelter. Factor in everything from school supplies and sports fees to childcare and new clothes.

A detailed budget is far more than just a personal planning tool. It’s a powerful piece of evidence your attorney can use to negotiate a fair division of assets and argue for appropriate spousal or child support.

Securing Your Financial Independence

As you map out your budget, it's time to take practical steps to detangle your financial life from your spouse's. This is absolutely critical for building your own credit and protecting your assets moving forward.

One of the first things you should do is open a new checking and savings account solely in your name at a local bank in Humble or Atascocita. This gives you a secure place for your income and a way to manage your personal expenses without any outside interference. It’s a foundational move toward financial autonomy.

Just as important is establishing your own credit. If you’ve only ever had joint credit cards, apply for a new one using only your social security number. Start small—use it for gas or groceries and pay the balance in full every month. This is the fastest way to build a strong, independent credit history.

How Support Payments Fit Into the Picture in Texas

For many Harris County families, child support and spousal maintenance will be a huge part of the post-divorce budget. Knowing how these are handled in Texas is key to making a realistic plan.

Child Support in Texas isn't arbitrary; it's calculated using a specific formula. This Texas law concept involves the court looking at the non-custodial parent's net monthly income and the number of children to determine the amount, which is intended to cover their basic needs.

Spousal Maintenance (what most people call alimony) is a different story. It’s much less common and more difficult to get in Texas. A judge typically only awards it in specific situations, like after a long-term marriage where one spouse can't earn enough to support themselves.

With over 673,000 divorces in the U.S. in 2022, the need for this kind of solid financial planning is crystal clear. National statistics even show that a woman's income can fall by as much as 25-30% after a divorce, which makes a well-thought-out budget absolutely essential for stability. You can discover more insights about divorce rates and financial impacts to see just how critical this planning phase is.

Budgeting for a whole new life can feel overwhelming, but it’s a necessary step toward gaining peace of mind. If you need help figuring out how support payments might affect your budget or have questions about securing your financial future, we're here to help. Schedule a free consultation at our Atascocita office to get the clear, local guidance you deserve.

Protecting Key Assets Like Retirement Funds and Businesses

For most folks in Harris County, the real wealth isn't sitting in a checking account. It’s tied up in the things you've worked years to build—like a 401(k), a pension, or the family business right here in our community.

Handling these complex assets isn't just another box to check in the divorce process. A single mistake here can have devastating, long-term financial consequences. This is where a sharp strategy and a solid understanding of Texas law become absolutely non-negotiable.

Securing Your Share of Retirement Funds

All those years you spent contributing to a 401(k) or pension plan built up a significant asset. Under Texas law, any portion earned during the marriage is community property. That means you both have a right to it.

But you can't just cash it out. Trying to split a retirement account the wrong way can trigger staggering tax penalties and early withdrawal fees that wipe out a huge chunk of its value.

The only correct way to do this is with a Qualified Domestic Relations Order, better known as a QDRO. A QDRO is a specific type of court order that tells a plan administrator how to divide the funds between spouses without those costly penalties. Getting this document drafted and executed perfectly is one of the most critical steps in any divorce involving retirement savings.

Navigating the Family Business in a Divorce

If a small business in Humble or Atascocita is part of your marital estate, you're dealing with what is likely your most valuable—and most complicated—asset. It's more than just a balance sheet; it's an income stream and often a legacy.

First things first: you need a professional business valuation. This isn't a DIY project. It involves hiring a financial expert, usually a forensic accountant, to determine what the business is truly worth. They dig into everything from cash flow and hard assets to brand reputation and goodwill.

Once you have a solid number, you generally have three paths forward:

- One Spouse Buys Out the Other: This is often the cleanest solution. One person keeps the business and compensates the other for their half, often by trading other assets like the house or a portion of their retirement funds.

- Sell the Business: If a buyout isn't feasible or desired, selling the business and splitting the cash proceeds is a straightforward option.

- Continue as Co-Owners: This is rare and requires an incredibly amicable relationship. Some ex-spouses manage to run a business together post-divorce, but it's a path that requires careful legal structuring.

A business is a living, breathing financial entity. A botched valuation or a poorly structured buyout can sink the company or leave one spouse with a fraction of what they deserve. Protecting this asset is paramount.

We've put together more in-depth information on this topic, and you can learn how to protect assets during divorce in our dedicated guide.

Here's a quick look at how these major assets are typically handled in a Texas divorce.

Handling Key Assets in a Texas Divorce

| Asset Type | Primary Consideration | Key Legal Tool or Process |

|---|---|---|

| Retirement Accounts (401k, Pension) | Avoiding taxes and early withdrawal penalties while dividing the community property portion. | Qualified Domestic Relations Order (QDRO) |

| The Family Home | Deciding whether to sell, have one spouse buy out the other, or arrange for a deferred sale. | Deed of Trust to Secure Assumption or Owelty Lien |

| Small Business | Determining its fair market value and deciding on a buyout, sale, or co-ownership. | Professional Business Valuation and Buy-Sell Agreement |

Understanding these tools and processes is the first step toward a fair and equitable division of your most valuable property.

Updating Beneficiaries and Estate Plans

The financial paperwork doesn't stop once the assets are divided. It's easy to forget, but you absolutely must update all of your estate planning documents to reflect your new life.

Go through every account and policy and change the named beneficiaries. The most common ones to check are:

- Life Insurance Policies

- Retirement Accounts (IRAs, 401(k)s)

- Bank or Investment Accounts with "Payable on Death" (POD) designations

Most importantly, get your will, trusts, and powers of attorney updated immediately. If you don't, your ex-spouse could unintentionally inherit your assets or be left in charge of your medical decisions—a scenario that can cause immense pain for your other loved ones.

If you suspect there are complex or hidden financial assets, like cryptocurrency, that need to be uncovered, you may even need a professional recovery service for valuable assets to get a true accounting.

How an Atascocita Divorce Attorney Can Help

Trying to sort out the finances during a divorce can feel impossible, especially when you're also dealing with the emotional fallout. This is precisely when having a steady, knowledgeable guide in your corner can change everything. A seasoned Atascocita divorce lawyer does so much more than file paperwork—they provide the strategy and legal protection you need to feel secure.

Think of us as your advocate and neighbor. We’ll make sure you understand your rights under Texas community property laws and help you build a clear, accurate financial picture right from the start. To give you some clarity, we've answered a few of the most urgent financial questions we hear from our neighbors here in Humble and Atascocita.

My Spouse Handled All the Finances—How Can I Prepare?

First, take a deep breath. This is an incredibly common situation, and you are far from powerless. Texas law has tools specifically for this scenario. Your attorney can file a formal “request for production,” which legally compels your spouse to turn over every single financial document.

If you have a nagging feeling that assets are being hidden or accounts aren't being fully disclosed, we can bring in a forensic accountant. These are financial detectives who are brilliant at tracing money and uncovering inconsistencies. Your first move is just to gather whatever you can access on your own—bank statements that come in the mail, online logins you still have. We'll handle the rest through the formal discovery process.

How Much Does a Divorce in Harris County Cost?

There's no single price tag on divorce. The cost almost entirely depends on one thing: the level of conflict between you and your spouse. An uncontested divorce, where you both agree on the big issues, will always be the fastest and most affordable route.

Things get more expensive when the case is contested—meaning you disagree on how to divide property, who the kids will live with, or support amounts. These disagreements simply require more time and legal resources to resolve. One of the best ways to keep costs down is to be financially prepared from the outset. Gathering your documents and creating that clear inventory can streamline the process, saving you money in the long run.

The most effective way to manage divorce costs is to be prepared. The more organized you are with your financial information, the more efficiently your attorney can work, saving you both time and money.

When Is the Right Time to Contact an Attorney?

Honestly, the best time to speak with a divorce lawyer is as soon as you start seriously thinking about it. The earlier you get sound legal advice, the better you can protect your financial interests. For instance, just understanding how to choose a divorce attorney who fits your specific needs is a crucial first step you don't want to get wrong.

An initial consultation gives you a strategic roadmap. It doesn't lock you into filing for divorce, but it does arm you with the knowledge to make confident, informed decisions about what comes next. It’s the single best step you can take to regain a sense of control over your future.

Going through a divorce is one of the toughest things you'll ever do, but you don't have to face it alone. At The Law Office of Bryan Fagan – Atascocita TX Lawyers, our team is committed to giving residents of Atascocita, Humble, and northeast Harris County compassionate support and expert legal guidance. We're here to protect your financial future and help you move forward with confidence. To talk about your case and see how we can help, schedule your free, no-obligation consultation today by visiting atascocitaattorneys.com.