Life is always in motion, and for families in Atascocita, Humble, and across northeast Harris County, that means your estate plan needs to keep up. Updating your will isn't a one-and-done task. For small tweaks, a legal amendment called a codicil might do the trick. But for major life changes, you’ll likely need to draft an entirely new will to ensure your final wishes truly match your current situation and protect the people you love.

At The Law Office of Bryan Fagan, we understand that thinking about your will can feel overwhelming. Our goal is to make the process clear, straightforward, and supportive, providing our community with the legal guidance they need to secure their family's future.

Why You Should Regularly Review Your Will in Atascocita

Life in our community is always changing. An estate plan that seemed perfect five years ago could be a source of serious problems today, creating confusion and conflict for the very people you want to protect.

Think about a local Atascocita couple who drafted their wills a decade ago. Since then, they've welcomed two grandchildren, seen a child go through a divorce, and grown their small Humble business into a valuable asset. Their old will doesn't mention the grandkids, still includes a former son-in-law, and has no plan for business succession. This isn't just a simple mistake; it’s a blueprint for legal battles and family heartache in a Harris County probate court.

This kind of scenario is more common than you'd think, and it’s exactly why your will should be treated as a living document. Keeping it current is one of the most important things you can do for your family, ensuring your legacy is preserved and your wishes are carried out precisely.

Common Life Events That Signal It Is Time for an Update

Certain life events should be an immediate red flag, telling you it’s time to pull out your estate plan for a review. These milestones can completely change your intentions and even impact the legal validity of your existing will under Texas law. If you wait too long, you might accidentally disinherit someone you love or create other unintended headaches for your beneficiaries.

Here are the big triggers that mean it's time for an update:

- Changes in Marital Status: A marriage, divorce, or the death of a spouse carries huge legal weight for your estate under Texas family law.

- Growing Your Family: The birth or adoption of a child or grandchild introduces new loved ones who need to be included and provided for.

- Significant Financial Shifts: Did you receive a large inheritance, sell a major asset like your home in Kingwood, or see your investments grow substantially? These events can alter how you want your assets divided.

- Changes in Key People: If the person you named as your executor, guardian for your minor children, or trustee passes away, moves, or becomes unable to serve, you need to name a replacement.

- Evolving Family Relationships: Sadly, relationships can fray. If you no longer want a particular person to be a beneficiary, your will needs to be formally changed to reflect that.

Your will is a cornerstone of your overall trusts and estates planning, so keeping it up-to-date is vital for it to work with your broader financial goals. By proactively managing these updates, you stay in control and prevent Texas courts from making these critical decisions for you.

Procrastination is the biggest threat to a sound estate plan. An outdated will can cause more family strife and financial loss than having no will at all. Regularly reviewing your documents with a knowledgeable local attorney is the best way to ensure peace of mind for you and security for your family.

The need for this diligence is underscored by a sobering statistic. A recent Caring.com survey found that a staggering 60% of American adults don't have a will, leaving their families completely unprotected. For Atascocita families, this highlights just how critical updating your will is to protecting your legacy.

If any of these life changes sound familiar, it’s time to act. Contact the Law Office of Bryan Fagan today for a free consultation at our Atascocita office. We can help you update your will and secure your family's future.

Choosing Your Path: Codicil vs. A New Will

So, you’ve realized your will is out of date. The next big question is what to do about it. In Texas, you have two primary ways to update an existing will, and the right choice for you really depends on how much your life has changed. We're here to help you understand your options in plain English.

One option is a codicil. The simplest way to think of a codicil is as a legal P.S. to your will—a separate document that adds, removes, or modifies a specific part of the original.

The other route is to tear up the old will (figuratively, of course) and draft a brand new one. This might sound like a lot of work, but for anything more than a minor tweak, it’s often the cleanest and safest way to go.

When a Codicil Makes Sense

A codicil is the perfect tool for small, simple adjustments. It’s an efficient and cost-effective way to change one or two things without disturbing the rest of the document.

Let's say you originally named your brother, who lived nearby in Eagle Springs, as your executor. But he just retired and moved to Florida. A simple codicil lets you swap in a new, local executor without rewriting your entire estate plan.

Here are a few other common scenarios where a codicil works well:

- Adding a small cash gift for a new grandchild.

- Updating the last name of a beneficiary who recently got married.

- Changing a specific item you’ve left to someone—maybe you sold the boat you promised your nephew and want to give him your classic car instead.

The key here is simplicity. If the change is minor and doesn't create ripple effects throughout the rest of the will, a codicil is a great solution.

The Case for Starting Fresh with a New Will

While codicils are handy, they can create a real mess when used for major life changes. Think of your will as the blueprint for your house. A codicil is great for changing a light fixture, but if you’re adding a second story, you need a whole new set of plans.

A new will is almost always the right call after a major life event. Things like a divorce, a new marriage, or the birth of a child fundamentally change your family’s landscape. Trying to "patch" your old will with a codicil in these situations can create contradictions that a probate judge will have to sort out later.

Tacking multiple codicils onto an old will is a recipe for disaster. It forces a Harris County probate court to piece together your wishes from a confusing stack of documents, practically inviting a costly and stressful will contest between your loved ones. We've seen this happen, and it's heartbreaking for families.

Starting fresh is also the best approach when you’re making significant changes to how your assets are divided. For instance, if you decide to set up a trust for a child with special needs or completely rebalance the percentages each heir receives, those are complex moves that demand a clean slate.

A new will automatically revokes all previous wills and codicils, leaving just one clear, undisputed document that spells out your final wishes. For anyone thinking about more complex planning, understanding the difference between a will and a trust is a great next step. You can explore the pros and cons of revocable trusts in our detailed guide.

Making the Right Choice for Your Family

Choosing between a codicil and a new will isn't just a legal formality; it's about giving your family clarity when they need it most. The goal is to make the process as simple and painless for them as possible.

Here’s a quick step-by-step guide to help you decide.

Deciding Between a Codicil or a New Will

| Type of Change Needed | Best Option: Codicil | Best Option: New Will |

|---|---|---|

| Minor Change (e.g., naming a new executor) | ✓ – Simple and efficient | X – Usually overkill |

| Major Family Event (e.g., divorce, new child) | X – Creates ambiguity | ✓ – The only safe choice |

| Significant Asset Change (e.g., new business) | X – Can be confusing | ✓ – Best for complex shifts |

| Multiple Small Changes | X – Prone to legal challenges | ✓ – Consolidates everything clearly |

When in doubt, drafting a new will is almost always the safer bet. It ensures your instructions are coherent and dramatically reduces the risk of confusion or legal fights down the road.

If your life has changed, your will needs to change with it. The Law Office of Bryan Fagan is here to help you make the right choice for your family. Schedule a free consultation at our Atascocita office to talk about your unique situation.

The Formal Process for Updating Your Texas Will

Once you’ve decided your will needs an update—whether it’s a minor tweak handled by a codicil or a major rewrite requiring a new will—you must follow the formal legal process. We can't stress this enough. In Texas, the law is incredibly specific about how a will must be signed and witnessed to be valid. Trying to shortcut these steps, even with the best intentions, can unfortunately make the document legally worthless. That leaves your family right back in the difficult spot you were trying to help them avoid.

It all starts with clarity. Before you even pick up a pen, you need to be crystal clear about the changes you're making. Pull out your existing estate planning documents and make a detailed list of what you're adding, removing, or changing. If you're new to this, getting a handle on the basics is essential. This guide on how to write a will is a great resource for understanding the foundational document you're working with.

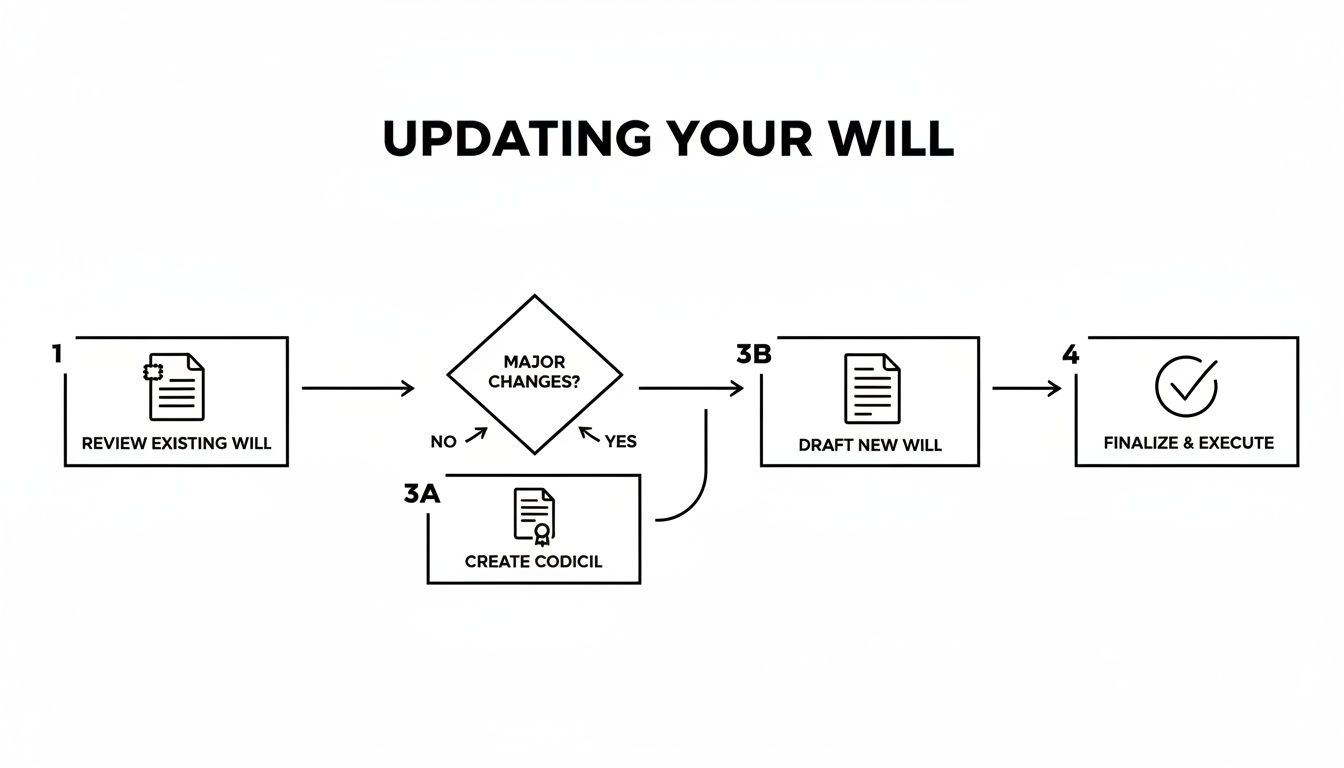

The flowchart below breaks down the two main paths for updating your will. It’s a great visual for figuring out if a small adjustment is enough or if it’s time for a complete overhaul.

As you can see, a codicil is fine for small things, but major life events almost always mean you're better off drafting a brand-new will to keep things clean and prevent any potential conflicts down the road.

The Signing Ceremony: Your Legal Requirements

Texas law doesn't view signing a will as a casual affair. It's a formal ceremony with strict rules. These aren't just suggestions—they are mandatory requirements that ensure your will can stand up to legal challenges in probate court.

The most important part of this ceremony is having two credible witnesses. Here’s what the Texas Estates Code requires for them:

- They must be at least 14 years old.

- They cannot be a beneficiary in your will. This is absolutely critical to avoid any hint of a conflict of interest.

- They must be physically in the room and watch you sign the document.

- They must then sign the will in your presence.

Think of it as a three-way verification. You watch them sign, and they watch you sign. This protocol confirms that you, the testator (the person making the will), signed it willingly and were of sound mind. We often tell our clients in Atascocita and Humble that asking a trusted, neutral neighbor or friend to be a witness is a much safer bet than involving a family member who stands to inherit.

The Power of a Self-Proving Affidavit

This is one of the smartest things you can do for your family. While a will is still valid without it, adding a self-proving affidavit can be a game-changer. This is simply a separate statement that you and your witnesses sign in front of a notary public.

What does it do? It's essentially pre-validated testimony, confirming that all the legal steps of the signing ceremony were followed correctly.

A self-proving affidavit is like a probate court fast-pass for your will. It means your executor won't have to hunt down the original witnesses—who might have moved away or even passed on years later—to testify that they saw you sign it. This one small step can save your loved ones a tremendous amount of time, money, and stress.

Imagine an Atascocita couple creating a new will to set up a trust for their child with special needs. By including a self-proving affidavit, they ensure their plan can be executed immediately without getting bogged down in court delays. It’s a simple, proactive measure that provides incredible peace of mind.

Why Following Formalities Matters

Cutting corners here can have serious financial and emotional consequences for your family. The Federal Reserve reports that 1.5 million probate cases are filed in the U.S. each year, and a staggering 55% of them involve wills that are more than five years old. These outdated documents often lead to 20-30% higher administration costs because of all the ambiguities and arguments they cause.

Following the formal process isn't about jumping through legal hoops for the sake of it. It's about protecting your family and ensuring your final wishes are honored exactly as you intended. At The Law Office of Bryan Fagan, we walk our clients through every single step, making sure every detail is handled with precision. If you're ready to update your will, schedule a free consultation with us, and let's get it done right.

Common Mistakes to Avoid When Changing Your Will

When you decide it's time to change your will, you're doing it for the right reasons. You want to protect the people you care about and make sure your final wishes are crystal clear. But even a small misstep in the process can unravel all that careful planning, creating a nightmare for your family right here in northeast Harris County.

Over the years at our Atascocita office, we've seen firsthand how simple errors can spark confusion, family feuds, and expensive court battles. Just knowing what these common pitfalls are is half the battle in making sure your updated will is rock-solid.

The Dangers of DIY Updates

One of the most common and costly mistakes we encounter is the "do-it-yourself" edit. It seems so simple, right? Just grab a pen, cross out an old name, and write in a new one. Maybe you want to add a little note in the margin to leave your vintage watch to your nephew.

Here’s the hard truth: under Texas law, those handwritten changes are completely invalid. A will is a formal legal document. Any changes you make have to follow the exact same strict formalities as when you first signed it. A probate judge in Harris County will simply ignore the name you crossed out or the new beneficiary you scribbled in. Your wishes won't be honored, leading to the exact situation you were trying to fix.

Forgetting About Beneficiary Designations

It's so easy to focus on the will and forget about the assets that pass completely outside of it. Many of us have accounts with beneficiary designations that act as a direct pipeline for your assets, bypassing the will entirely. These often include:

- Life Insurance Policies: The payout goes straight to the person named on the policy, no matter what your will says.

- Retirement Accounts: Your 401(k), IRA, or pension funds are transferred directly to the designated beneficiary.

- Bank Accounts: Payable-on-death (POD) or transfer-on-death (TOD) accounts are designed to go automatically to the person you named.

These designations always trump your will. It's a critical point. If your will leaves everything to your children after a divorce, but your ex-spouse is still listed on that life insurance policy from 15 years ago, they will get the money. Period. Every single time you review your will, you absolutely must review these designations, too.

Using Ambiguous or Unclear Language

The specific words you choose for your will have enormous power. Vague instructions or fuzzy language are an open invitation for arguments. And when family members start arguing over what you really meant, things can get ugly fast.

We once worked with a family torn apart by a single ambiguous phrase in their father's will. He left his "personal effects" to his children to divide "as they see fit." One child thought this included a valuable art collection, while another believed it only meant household furniture. The resulting legal battle cost the estate tens of thousands of dollars and permanently damaged family relationships—all of which could have been avoided with clearer language.

Your will needs to be precise. Don't just say "my car"; specify "my 2022 Ford F-150." Instead of leaving a general sum for a grandchild's education, it might be better to create a trust with very specific instructions for the trustee. Clarity is your best weapon against future conflict. The money you might think you're saving with a DIY approach can be dwarfed by the legal fees needed to clean up the mess later. To see more about these risks, you can learn about the challenges of doing a will on your own in our comprehensive article.

Steering clear of these common mistakes is the key to protecting your legacy and your family. If you're having any doubts about the right way to update your will, the team at The Law Office of Bryan Fagan is here to provide clear, straightforward guidance. Schedule a free, no-obligation consultation at our Atascocita office to get the peace of mind that comes from knowing your wishes are secure.

After the Update: Storing and Communicating Your Wishes

You’ve done the hard work of updating your will to reflect your current wishes and protect your family. But signing on the dotted line isn't the end of the road. A will is only as good as its accessibility; if your executor can't find it or your family doesn't understand your intentions, all that careful planning can be for nothing.

This final stage—safeguarding the document and communicating with your family—is just as crucial as drafting it in the first place. Safeguarding your original signed will is absolutely paramount. While you should certainly make copies, the Harris County probate court will require the original wet-ink signature document to move forward. If that original is lost, your estate could get tangled in a more complex and expensive legal process, adding a layer of stress your family just doesn’t need.

Smart Storage Solutions for Your Will

So, where should you keep this all-important document? You need a spot that’s both secure from damage and accessible to your executor when the time comes.

For our Atascocita and Humble clients, we recommend these step-by-step solutions:

- A Fireproof Safe at Home: This is often the most practical choice. It protects the will from fire or water damage, and your executor—who you should entrust with the combination—can retrieve it immediately.

- With Your Attorney: Our firm, The Law Office of Bryan Fagan, offers to store original documents for our clients. This ensures it's kept in a secure, professional environment, safe from being misplaced or accidentally destroyed.

One common choice that we often advise against is a bank safe deposit box. It seems like the pinnacle of security, but under Texas law, it can create a real headache. After your passing, your executor might need a court order just to open the box, causing frustrating delays right when they need to take action.

The Importance of Open Communication

We know talking about your will can be uncomfortable, but a straightforward conversation today can prevent a world of confusion and hurt feelings down the line. This isn't about airing all your financial laundry. It's about empowering the key people in your life with the information they need to carry out your wishes smoothly.

A recent Gallup poll showed that while 78% of U.S. adults over 65 know they need to update their estate plans, only 32% have actually talked about them in the last five years. It’s a huge gap. For professionals in our growing Atascocita community, being proactive with both the plan and the communication is key to managing your legacy. You can even explore economic and demographic data insights to better understand the changing landscape of estate planning.

Who to Talk to and What to Say

The most important conversation you'll have is with the person you've named as your executor. They don't need to know every detail, but they absolutely need to know:

- Where to find the original will and other key documents (deeds, insurance policies, etc.).

- The names and contact information for your attorney and financial advisor.

- A general overview of your wishes, especially if you’ve made any decisions that might come as a surprise, like an uneven split between your children or a large gift to charity.

Explaining the why behind your decisions can be a powerful tool for preventing conflict. A simple explanation, like, "I've left a bit more to your sister because she has greater financial needs," can go a long way toward preserving family harmony.

Taking these final steps ensures your thoughtful planning results in a smooth, peaceful process for the people you love. If you have any questions about where to store your will or how to start these important conversations, The Law Office of Bryan Fagan is here to guide you. Schedule a free consultation at our Atascocita office today.

Your Questions on Updating a Texas Will Answered

When you start thinking about how to update your will, a lot of specific questions pop up. It's completely normal. Here in our Atascocita office, we help our neighbors from Humble and all over northeast Harris County get clear, straightforward answers so they can feel confident about their decisions. Let's walk through some of the most common questions we hear every day.

How Much Does It Cost To Update a Will in the Atascocita Area?

This is usually the first thing on everyone's mind, and the honest answer is that it really depends on what you need to change. The cost is tied directly to the legal work needed to make sure your wishes are locked in tight and can stand up to any challenges down the road.

A simple change, like swapping out an executor who moved away, can often be handled with a codicil for a few hundred dollars. But if you’re looking at a major life change—say, you need to draft an entirely new will that sets up a trust for a new grandchild—that's going to be a more involved process.

Think of the cost not as an expense, but as an investment in your family's peace of mind. What you spend now on a proper update is a tiny fraction of the potential legal bills, family fights, and heartache that a messy, outdated will can cause.

At The Law Office of Bryan Fagan, we're big on transparency. We offer a free consultation where we can sit down, look at your current will, listen to what you want to achieve, and give you a clear, upfront cost. No surprises.

Does My Texas Divorce Automatically Change My Will?

Yes, but only in one specific way, and it’s a temporary fix at best. Under the Texas Estates Code, when your divorce is final, any part of your will that gives property to your ex-spouse or names them as your executor is automatically voided. The law basically acts as if your ex-spouse passed away before you did.

Here’s the problem: that’s all it does. While the gift to your ex is gone, the law does not pick a new executor for you or decide who gets that share of your property instead. This leaves a huge hole in your estate plan. A judge and the courts will end up making decisions that you should have made yourself. The only real solution is to create a new will after your divorce to make sure your estate is handled exactly the way you want it now.

Can I Just Write on My Current Will To Make Changes?

Please, don't do this. It's one of the biggest and most common mistakes we see, and it will invalidate your wishes. Texas law is incredibly strict on this: a court will completely ignore any handwritten notes, crossed-out names, or initials you add to a will after it’s been signed and witnessed.

Once your will is properly executed, think of it as set in stone. The only two legal ways to change it are:

- A Codicil: This is a separate, formal legal document that amends your original will. It has to be signed with the exact same formalities—in front of two credible witnesses—as the will itself.

- A New Will: This is a brand-new document that starts from scratch and clearly states that it revokes all previous wills you've made.

Trying to take a shortcut by marking up your old will is a surefire way to have your intentions ignored.

Should I Update My Will If I Moved to Texas From Another State?

Yes, absolutely. This is something you should put at the top of your to-do list. While Texas might recognize a will that was valid in the state you came from, that document was drafted under a completely different set of rules. The biggest difference is that Texas is a community property state, which dramatically changes how marital assets are handled after a death.

An out-of-state will that doesn't account for our community property laws could cause some serious unintended headaches for your spouse and kids. Getting a Texas attorney to review your old will and update it to align with our state laws is a critical step. You can learn more about how our dedicated team can help by exploring our local estate planning attorney services. It’s the best way to ensure your plan works the way it’s supposed to here in Harris County.

The world of estate planning can feel overwhelming, but you don’t have to figure it all out on your own. At The Law Office of Bryan Fagan – Atascocita TX Lawyers, our commitment is to give our neighbors the clear guidance and compassionate support they need. If you're ready to update your will and protect your family's future, we're here to help. Contact us today at https://www.atascocitaattorneys.com to schedule a free, no-pressure consultation with our experienced team and take that first step toward real peace of mind.