When you're lending or borrowing money here in Texas, whether it's in Atascocita or Humble, the choice between a promissory note vs. a loan contract comes down to one crucial question: how much protection do you need? Think of a promissory note as a straightforward IOU, perfect for smaller loans built on trust with friends or family. A loan contract, on the other hand, is a detailed legal agreement that provides serious security for larger, more complex deals.

At The Law Office of Bryan Fagan, we believe in empowering our neighbors with clear, practical knowledge. Understanding these documents helps you protect your finances and your relationships, and we're here to guide you every step of the way.

Understanding the Fundamental Differences

Entering into a financial agreement can feel daunting, but knowing your options is the best way to protect yourself and your family. The document you choose—whether you're helping a family member with a down payment on a house in Eagle Springs or formalizing a business loan for a startup in Humble—carries real weight under Texas law.

A promissory note is essentially a written promise to pay. It’s a clean, simple document where one person (the borrower) commits to paying another person (the lender) back a specific sum of money. It covers the bare essentials: who owes what, how much is owed, and when it needs to be paid. While it is legally binding, it’s designed to be minimalist and straightforward.

Now, a loan contract (often called a loan agreement) is a much more comprehensive and protective document. It doesn't just establish the promise to repay; it lays out the rules for the entire relationship between the lender and the borrower. You'll find detailed clauses covering everything from what happens if payments are late, what the lender can do if the borrower defaults, and any collateral being used to secure the loan.

To put it in perspective, here’s a quick summary of the fundamental differences to help you grasp the core concepts of each document.

Quick Comparison: Promissory Note vs. Loan Contract

| Characteristic | Promissory Note | Loan Contract |

|---|---|---|

| Complexity | Simple, often 1-2 pages, covering basic repayment terms. | Detailed and comprehensive, often multiple pages with extensive clauses. |

| Parties' Obligations | Primarily places obligations on the borrower to repay the debt. | Places binding obligations and rights on both the lender and borrower. |

| Common Use Cases | Personal loans between family/friends, small business loans based on trust. | Mortgages, significant business loans, car loans, and complex financial deals. |

| Legal Recourse | Generally limited to suing for the unpaid balance if the borrower defaults. | Outlines specific remedies for default, such as collateral seizure or late fees. |

Ultimately, picking the right document isn't just a formality. It’s about matching the legal tool to the level of risk and complexity you're dealing with. A promissory note offers simplicity, which is wonderful for low-risk situations. A loan contract delivers true security and peace of mind when the stakes are higher.

When to Use a Simple Promissory Note

Think of a promissory note as a formal IOU—a legally recognized promise to pay someone back. For this promise to be enforceable here in Texas, it needs to be crystal clear on a few key points: the exact amount borrowed (the principal), the interest rate (if any), who the lender and borrower are, and a firm repayment date. The real beauty of a promissory note lies in its approachable simplicity.

This straightforward nature makes them a go-to choice for personal matters throughout the Atascocita community. We often see them used when a family member lends money for a down payment on a home in a neighborhood like Eagle Springs, or when a friend helps another start a small local business near Lake Houston. It’s a way to formalize the debt without the intimidating, multi-page complexity of a full loan contract, making it perfect for low-risk situations built on trust and goodwill.

Ideal Scenarios for a Promissory Note

Promissory notes aren't a one-size-fits-all solution, but they shine in specific contexts where the relationship is solid and the financial stakes aren't sky-high. You might consider using one for:

- Family Loans: Lending money to your son for his first car or helping your sister with a minor home repair in Humble.

- Small Personal Loans: Spotting a trusted friend some cash to cover an unexpected bill or bridge a temporary income gap.

- Simple Business Seed Money: Providing a colleague with initial funds for a startup where the terms are straightforward and based on mutual understanding.

These informal lending situations are incredibly common. Back in 2019, the U.S. Federal Reserve found that about 40% of American adults had borrowed from loved ones, with these personal loans totaling over $500 billion annually—often documented with simple notes. For example, a note might outline a $10,000 principal for a family business venture with a 12-month repayment at 5% interest. Further data shows that 65% of informal loans under $50,000 were recorded with promissory notes, which enjoyed a low default rate of around 8%, largely thanks to the trust involved. You can discover more insights about these lending trends.

Key Takeaway: A promissory note is your best bet for formalizing a loan without overcomplicating a personal relationship. It creates a clean, written record of the debt, which helps avoid misunderstandings and gives you a legal paper trail if things go sideways.

The Inherent Limitations

Of course, the very simplicity of a promissory note is also its biggest weakness. These documents often skip over the detailed "what if" clauses that protect both parties when something goes wrong.

What happens if the borrower misses a payment? Are there specific consequences for a full default? Without these terms explicitly laid out, a lender’s options can be surprisingly limited. The simplicity that makes a note so appealing for a loan between friends in Humble can become a serious headache if that friend suddenly can't—or won't—pay the money back. This is the critical trade-off to weigh when you're deciding between a promissory note and a more robust loan contract.

Understanding the Power of a Loan Contract

When a promissory note's simplicity isn't enough, a formal loan contract steps in to provide serious security and clarity. This document is the gold standard for secure lending, offering far more robust protection for everyone involved. For any significant financial transaction—whether it's a Harris County business owner securing capital or an Atascocita family formalizing a large loan within an estate plan—a loan contract is almost always the right move.

Unlike a basic IOU, a well-drafted loan contract is designed to get ahead of potential conflicts before they ever start. It essentially creates a legal road map for the entire transaction, dramatically reducing the risk of future civil litigation or disputes that can destroy both finances and relationships.

The Critical Components of a Loan Contract

A loan contract goes way beyond a simple promise to pay. It gets into the nuts and bolts of the loan, creating a framework that holds both parties accountable from start to finish. Think of it as the complete rulebook for the loan’s entire lifecycle.

Key elements you’ll find in a loan contract that are often missing from a promissory note include:

- Detailed Repayment Schedules: Instead of just a final due date, a loan contract typically lays out an amortization schedule, which breaks down how much of each payment goes toward principal and interest over the loan's term.

- Specific Default Definitions: The contract spells out exactly what constitutes a default. This could be anything from missing a payment to filing for bankruptcy or violating other terms of the agreement.

- Consequences and Remedies: This is where the contract shows its real strength. It outlines the specific steps a lender can take if the borrower defaults.

- Covenants and Conditions: These are specific promises the borrower makes, like maintaining a certain level of insurance on collateral or agreeing not to take on significant additional debt without the lender's permission.

These detailed provisions are precisely why loan agreements are the backbone of formal lending. Globally, they are used in 85% of commercial lending, and in the U.S., a staggering 95% of residential mortgages rely on these comprehensive documents. A typical mortgage agreement, for example, can easily run 20-50 pages long, detailing everything from the interest rate and 30-year repayment schedule to foreclosure rights, late fees, and guarantor clauses—features almost never found in a simple note. You can discover more about these key differences and how they play out in practice.

Powerful Clauses That Protect Lenders

For anyone in Atascocita or Humble lending a significant amount of money, the protective clauses in a loan contract are indispensable. They give you clear, pre-agreed legal recourse if the borrower doesn't hold up their end of the bargain.

Two of the most powerful provisions are:

- Acceleration Clause: This clause is a game-changer. It states that if the borrower defaults, the lender can demand that the entire remaining loan balance become due and payable immediately. This is a critical tool that allows a lender to act swiftly to recover their funds instead of waiting for more payments to be missed.

- Collateral Rights: If the loan is secured by property, the contract will meticulously detail the lender's right to seize and sell the collateral (like a car or a piece of real estate) to recoup their losses. This provides a tangible path to recovery that a simple promissory note just can't offer.

By defining remedies in advance, a loan contract transforms a potential conflict from a messy, open-ended dispute into a structured legal process. It gives you, the lender, a clear and enforceable plan of action.

This level of detail is exactly why a loan contract is essential for complex transactions. Whether you are structuring a loan within a Texas estate plan to ensure fairness among your heirs or you're a business owner formalizing an investment, this document provides the legal certainty you need. It’s not about expecting things to go wrong; it’s about being responsible enough to plan for every possibility.

Comparing Legal Enforceability in Texas

The real test of any loan document isn’t just what it says, but what you can actually do when a loan goes south. In Texas, both a promissory note and a loan contract are legally binding. However, their power and the paths they provide for legal action are worlds apart. This is often where residents in Atascocita and Humble learn the hard way about the value of a well-drafted agreement.

When a borrower defaults on a simple promissory note, the lender’s main option is pretty straightforward, but it's also limited: sue for the money owed. This involves filing a lawsuit in a Harris County court, getting a judgment, and then going through the often difficult process of collecting on it. The note proves the debt exists, but it doesn't usually grant you any special powers beyond that basic legal route.

A loan contract, on the other hand, is built for exactly this kind of trouble. It anticipates problems and lays out specific, pre-agreed remedies right from the start. This gives the lender a much stronger, clearer, and often faster way to get their money back.

The Critical Role of Collateral and Guarantors

One of the biggest differentiators in enforceability boils down to security. A loan contract is specifically designed to include powerful protections like collateral and guarantors, which completely change the game for the lender.

- Collateral: A loan contract can name a specific asset—a car, a piece of property, or business equipment—that secures the loan. If the borrower defaults, the contract gives the lender the legal right to take possession of that collateral to cover the debt, often avoiding a long, drawn-out court battle. While a promissory note can mention collateral, the nitty-gritty procedures for seizure and sale are almost always found only in a loan contract.

- Guarantors: A loan contract can bring in a guarantor or co-signer. This is a third party who legally agrees to take on the debt if the main borrower can't pay. This provides another source of recovery for the lender, adding a powerful layer of security to the entire deal.

In the world of lending, a promissory note is a promise, but a loan contract is a plan. The plan is what protects you when the promise is broken.

When it comes to enforcement, the devil is truly in the details. The specific clauses within each document determine how—and how effectively—a lender can act in a Texas court.

Here’s a breakdown of how these documents stack up on key legal elements:

Texas Legal Enforceability Promissory Note vs Loan Contract

| Legal Element | Promissory Note | Loan Contract |

|---|---|---|

| Default Clause | Basic acknowledgment of default. Lacks specific, pre-agreed remedies, forcing the lender to rely on standard legal action (suing). | Highly detailed. Spells out exactly what constitutes a default (missed payments, bankruptcy) and triggers immediate, pre-defined consequences. |

| Acceleration Clause | Can be included, but may be challenged if not clearly defined. It's often a standalone, simple statement. | Standard and robust. Clearly allows the lender to demand the entire loan balance immediately upon default, giving significant leverage. |

| Collateral & Seizure | May mention collateral, but lacks the detailed procedures for repossession. Enforcing the claim often still requires a court order. | Contains specific language granting the lender a security interest and outlining the exact steps for repossessing and selling the collateral. |

| Guarantor Liability | Not typically included. A separate guaranty agreement would be needed, creating more paperwork and potential legal complexity. | Fully integrated. The guarantor's obligations are woven directly into the contract, making their liability clear and directly enforceable. |

| Late Fees & Penalties | Can specify late fees, but they must be "reasonable" under Texas law to be enforceable. Ambiguity can lead to disputes. | Clearly defines late fee amounts, penalty interest rates, and other charges. These are pre-agreed, making them much harder to challenge in court. |

| Attorney's Fees | Can include a clause for recovering attorney's fees, but it may be less detailed, potentially limiting the amount recoverable. | Almost always includes a strong "prevailing party" clause, ensuring the lender can recover all reasonable legal costs incurred while enforcing the contract. |

As you can see, the loan contract is a proactive tool. It doesn't just state that money is owed; it creates a clear, legally sound roadmap for what happens if that money isn't paid back.

Understanding Your Legal Options in a Dispute

When a payment is missed, the document you're holding dictates your very next move. With a promissory note, your first steps are likely sending a demand letter and then heading to the courthouse to file a suit.

With a loan contract, you can immediately turn to the default clauses you both agreed on. Does the contract have an acceleration clause? If so, you can demand the full loan balance is due now. Does it outline late fees or penalty interest rates? You can apply them automatically. The contract empowers you to act decisively.

This proactive approach is the core of smart risk management. For anyone facing a potential conflict, having a solid grasp of what constitutes a breach of contract in Texas can give you crucial insight into what to expect.

Ultimately, choosing between these two documents is about assessing your risk. For a small, informal loan to a trusted family member in Kingwood, a simple promissory note might be enough. But for a significant business investment, a major personal loan, or any situation where you can't afford a loss, the superior enforceability and detailed protections of a loan contract are invaluable. It’s an investment in certainty and your own peace of mind.

What Happens When Someone Defaults?

Default is the word no one wants to hear, but it's a reality you have to plan for. Whether you're lending money to a friend in Humble or securing a business loan in Atascocita, what happens next depends entirely on the piece of paper you signed. The fallout from a missed payment looks very different for a promissory note than it does for a loan contract.

With a basic promissory note, a lender’s options are quite limited. If the borrower stops communicating, the main recourse is to file a lawsuit in a Harris County court and hope for a judgment. The note is your proof of the debt, but it doesn't give you any special tools for collection. You're left at the mercy of the legal system, which can be a long and frustrating road.

A well-crafted loan contract, on the other hand, provides a clear playbook for what to do when things go wrong. It’s not about being pessimistic; it's about being prepared and protecting everyone involved from confusion and costly legal battles down the line.

When a Promissory Note is Breached

If a borrower defaults on a promissory note, the lender is often left scrambling. The note confirms that a debt exists, but that’s about it. The path to getting your money back usually looks something like this step-by-step process:

- Send a Demand Letter: This is the first formal step, putting the borrower on notice that you intend to take legal action if they don't pay up.

- File a Lawsuit: If the letter doesn't work, you'll have to sue for breach of contract.

- Get a Judgment: Assuming the court sides with you, you'll be awarded a judgment for the amount owed.

- Try to Collect: Here's the hard part. The judgment doesn't magically put money in your bank account. You now have to pursue legal collection methods like wage garnishment or property liens, which can be expensive and take a lot of time.

A promissory note proves a debt is owed, but it forces the lender to take a long and reactive path to recovery. Without spelling out the consequences for default, you're relying completely on the courts to enforce your rights.

The numbers really tell the story here. A 2022 FDIC analysis of small business loans found that unsecured promissory notes had an 18% default rate. That's double the 9% rate for loans backed by a formal, collateralized agreement. Closer to home, data from Harris County small claims courts between 2023-2025 showed that lawsuits based on promissory notes were only successful 55% of the time, largely because they lacked specific remedies. You can read more key differences between these loan documents to better understand these risks.

The Power of a Loan Contract in a Default

A loan contract changes the game completely. It's a proactive tool that lays out the rules of engagement for a default before any money ever changes hands. If the borrower misses a payment, the contract gives the lender the power to act immediately based on terms everyone already agreed to.

These built-in remedies can include:

- Acceleration Clause: This powerful clause allows the lender to demand the entire remaining loan balance be paid back immediately.

- Penalty Interest Rates: The contract can specify that a higher interest rate kicks in as long as the loan is in default.

- Late Fees: Clearly defined fees for each missed payment.

- Seizing Collateral: If the loan is secured, the lender has a contractual right to take possession of the asset (like a car or equipment) to cover their losses.

This detailed framework is why loan agreements have a much higher recovery rate—82% in U.S. courts. While it's good for any lender to understand how to sue for breach of contract in Texas, having a solid loan contract in the first place can often prevent you from ever needing to go to court.

If you're dealing with a potential default or need to draft an agreement that truly protects your interests, we're here to help. Contact The Law Office of Bryan Fagan – Atascocita TX Lawyers for a free consultation to go over your specific situation.

How to Choose the Right Document for You

Trying to decide between a promissory note and a loan contract can feel a bit overwhelming, but it really just comes down to matching the document to your specific needs. For folks here in Atascocita and Humble, making the right call is as much about protecting relationships as it is about protecting your money.

Your decision should hinge on three key factors: how much money is changing hands, how complex the repayment terms are, and the level of trust between you and the other person. Different situations simply require different levels of legal armor.

Evaluating Your Specific Scenario

Let's get practical. Are you lending a couple of thousand dollars to your sibling for a quick car repair, or are you fronting serious capital for a friend's new business venture over near Lake Houston? The stakes are completely different, and your paperwork should reflect that.

A promissory note is often the perfect tool for straightforward loans built on trust. Think about using one for:

- A small, short-term loan to a family member with a simple payback schedule.

- Helping a trusted friend in Atascocita cover an emergency expense until they get paid.

- Making a personal debt official where the relationship is solid and you have very little concern about default.

On the other hand, a loan contract is the smarter, more responsible choice for bigger or more intricate arrangements. You should almost always use a loan contract when:

- The loan amount is substantial.

- Repayment involves installments stretched out over a long time.

- The money is for a business or involves business assets.

- There's collateral involved, like a vehicle title or property deed.

- The agreement needs to be part of an estate plan to keep things fair for your heirs.

Choosing the right document is an act of foresight. A clear, comprehensive agreement prevents misunderstandings, preserves personal and business relationships, and provides a clear path forward if things don’t go as planned.

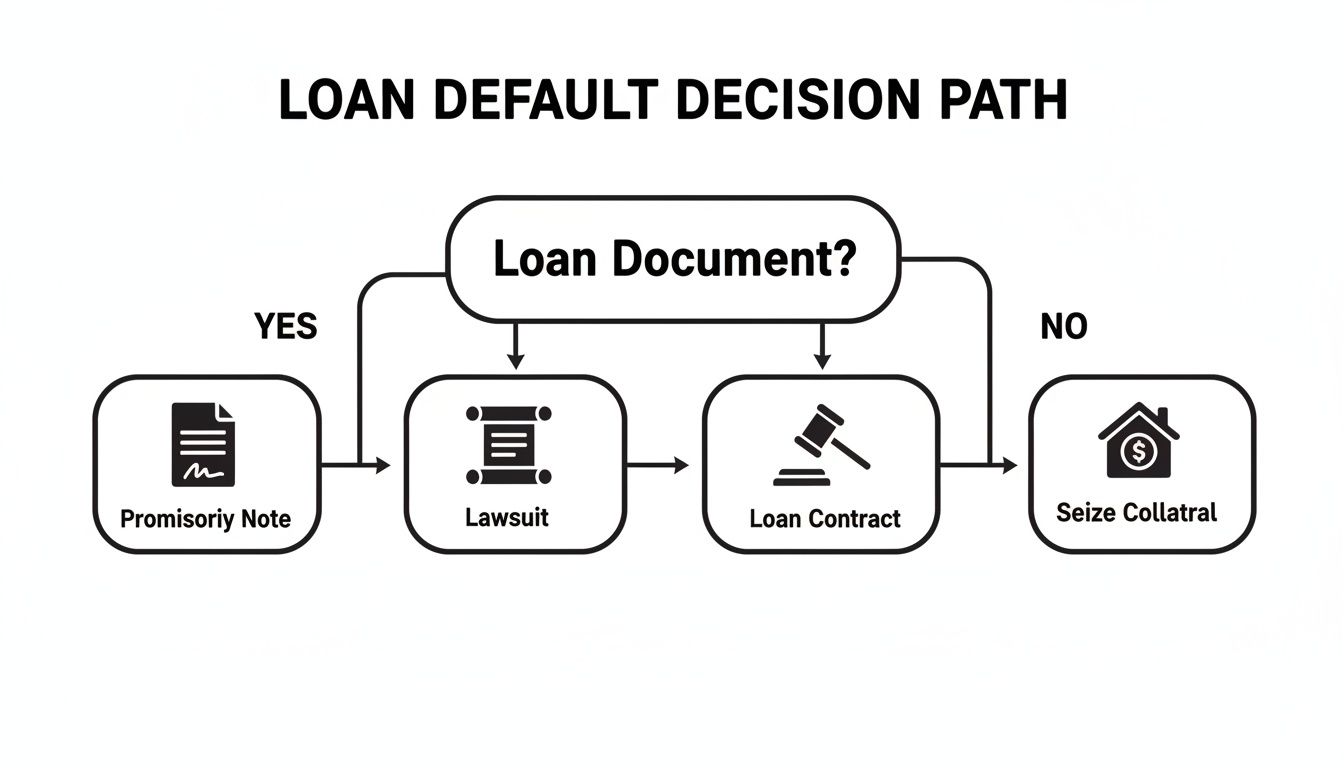

Visualizing the Consequences of Default

The real teeth of these documents show up when a borrower fails to pay. The flowchart below maps out the typical paths a lender might have to take depending on which document is in place.

As you can see, a promissory note usually points toward a lawsuit to get your money back. A well-drafted loan contract, however, can offer a more direct solution, like the right to seize collateral.

When to Seek Legal Guidance

While you might be able to handle a very simple promissory note on your own, any situation involving a significant amount of money or detailed terms really calls for professional legal advice. An attorney can draft a document that's not only ironclad under Texas law but is also perfectly fitted to your unique situation, protecting your financial interests and giving you real peace of mind.

For our neighbors looking at their options, getting a handle on the specifics of Texas civil law is the essential first step to protecting what’s yours.

Here at The Law Office of Bryan Fagan, we know the local dynamics in Atascocita and Humble. We're here to help you put together an agreement that truly protects you, your family, or your business. Give our Atascocita office a call today to schedule a free consultation and make sure your financial future is on solid ground.

Frequently Asked Questions About Texas Loan Agreements

Here in Atascocita and Humble, we get a lot of practical questions from clients trying to figure out the difference between a promissory note and a loan contract. Let's walk through some of the most common ones we hear.

Can I Write My Own Promissory Note?

Absolutely. You can certainly write your own promissory note in Texas, and many people do, especially for smaller loans between family or friends. The key, though, is making sure it’s legally enforceable. It must include the basics: who the lender and borrower are, the exact loan amount, the interest rate (even if it's 0%), and a clear repayment schedule or due date.

The real danger with a DIY note is leaving something important out or using vague language. If a term is unclear, trying to enforce that note in a Harris County court can get complicated and expensive fast. For anything more than a very simple, low-stakes loan, having a local Atascocita attorney draft or review it is a smart move to ensure you're protected.

What Happens If a Loan Is Not Documented at All?

A verbal loan agreement can technically be a valid contract in Texas, but good luck proving it in court. Without a written document, you're left in a "he said, she said" situation, trying to convince a judge that a loan even existed, let alone what its terms were.

An oral agreement is only as strong as the memories and integrity of the parties involved. A written document provides objective proof, protecting both the lender and borrower from misunderstandings and failed recollections down the road.

If you've already lent money without any paperwork, your path to getting it back is tough. You’ll need to pull together any evidence you have—bank statements showing the transfer, text messages discussing the loan, or even witness testimony. This is a scenario where you really need to speak with an attorney to figure out what, if anything, can be done.

How Do Loan Agreements Affect Divorce or Estate Planning?

This is a big one for our community. Texas is a community property state, meaning debts taken on during the marriage can affect both spouses. A well-drafted loan contract can clearly define a debt as either separate or community property, which is incredibly important during a divorce settlement.

The same goes for estate planning. A formal loan document ensures a debt is handled properly after someone passes away—either as an asset of the estate to be collected or a claim to be paid out. It prevents family fights when it's time to settle the estate.

Think about it: an undocumented "loan" to a child can easily be mistaken for a gift, causing major disagreements among heirs during probate. A simple promissory note or a loan contract clears up any doubt and ensures your wishes are followed.

Deciding between a promissory note vs loan contract depends entirely on your situation. To make sure your financial interests are properly protected, let the team at The Law Office of Bryan Fagan – Atascocita TX Lawyers help you sort it out. We’re here to provide clear, practical legal advice for our neighbors in Atascocita, Humble, and across northeast Harris County. We understand your concerns and are here to support you.

Schedule your free consultation today by visiting https://www.atascocitaattorneys.com.