Taking care of your family’s future is one of the most important things you’ll ever do, but it's easy to get bogged down by the question: "What will this cost?" When it comes to creating a will in Texas, a straightforward, lawyer-drafted will can start around $400. While more complex estate plans might cost more, this initial investment is a small price to pay for the peace of mind it provides and the potential financial strain and emotional turmoil your family could face without a clear plan.

An Overview of Will Creation Costs in Atascocita

For most families here in Atascocita, Humble, and across northeast Harris County, the thought of estate planning brings up immediate budget concerns. That's completely normal. The good news is that getting a solid will in place is probably more affordable than you think. Understanding your options is the first step toward making a smart choice that protects the people you love.

There's no single price tag for a Texas will. The cost falls along a spectrum, depending on how you choose to create it and how complex your life is—both personally and financially. It’s a bit like buying a suit: you can get one off the rack, or you can have one custom-tailored by a local expert to fit you perfectly. Each approach has its place.

Comparing Your Options

Let's break down the common paths people in our community take to get a clearer picture of the costs.

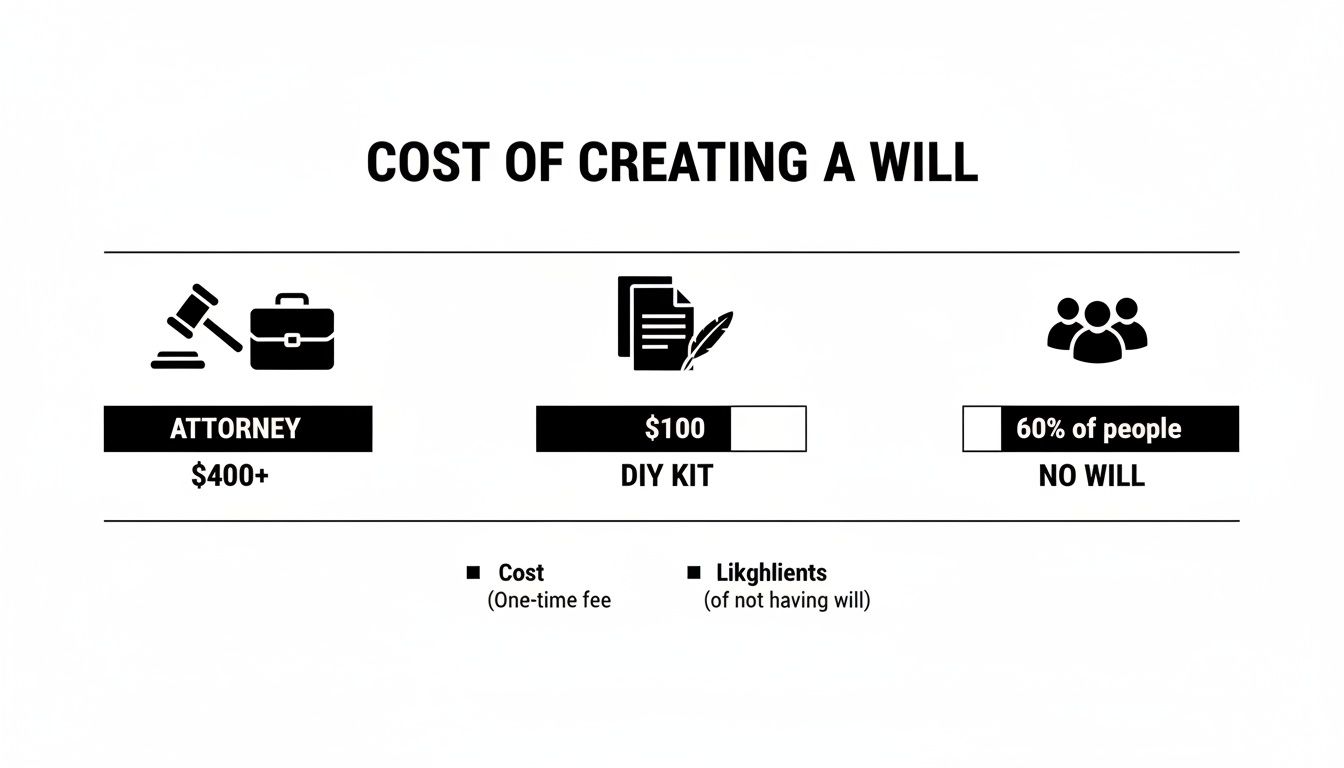

- DIY or Online Will Kits: These are the cheapest routes, often coming in under $100. They can seem like a good fit if your assets are incredibly simple and your family situation is straightforward—think single with no kids and one bank account.

- Online Legal Services: A step up from a basic template, these services range from $100 to $300. They offer more customization but still lack the one-on-one legal advice from a local attorney who understands how to navigate specific Texas laws for your unique circumstances.

- Local Atascocita Attorney: This is the gold standard for a reason. Working with a local lawyer ensures your will is rock-solid under Texas law and truly reflects your wishes. It's the most secure option, especially if you have children, own property in the Atascocita or Humble area, or have specific ideas about who gets what.

The infographic below paints a clear picture of these cost differences and brings a critical statistic to light.

As you can see, while hiring an attorney is the biggest initial investment, the real risk lies in doing nothing at all—a choice far too many people make because they overestimate the cost.

To help you visualize these choices, the table below provides a quick comparison of what you can expect in Harris County.

Estimated Cost of Will Creation Options in Texas

This table provides a quick comparison of the typical costs and key considerations for different methods of creating a will available to residents of Harris County.

| Method | Estimated Cost Range | Best For | Key Consideration |

|---|---|---|---|

| DIY / Online Template | $0 – $100 | Individuals with extremely simple, straightforward assets and no dependents. | High risk of errors or omissions that could invalidate the will. Lacks local legal advice. |

| Online Legal Service | $100 – $300 | People with basic needs who want a step above a generic template. | Still a one-size-fits-all approach; not tailored to complex Texas laws or personal situations. |

| Local Attorney (Simple Will) | $400 – $800 | Most individuals and couples in the Atascocita area, including those with homes and minor children. | Ensures the will is legally valid and reflects your exact wishes. Provides peace of mind. |

| Local Attorney (Complex Plan) | $800 – $1,500+ | Individuals with business assets, blended families, or those needing trusts to protect their legacy. | Comprehensive, personalized planning that addresses unique financial and family dynamics in our community. |

This breakdown shows there’s a viable option for nearly every budget. The key is to match the method to the complexity of your needs.

Putting the Costs in Perspective

Across the country, an attorney-prepared will typically costs between $300 and $1,200. Yet a shocking 60% of Americans don't have one, often because they're worried about the price. What they don't realize is that this upfront cost can save their families thousands of dollars in probate court fees and legal battles later on.

Here in Harris County, a simple will often starts right around $400. For more detailed plans that include things like trusts or guardianship provisions for your kids, you might look at a cost closer to $1,500. While you consider these numbers, it's interesting to note the broader trends in the legal field, including innovations aimed at making legal services more affordable for everyone.

At The Law Office of Bryan Fagan, we believe every Atascocita family deserves the peace of mind that comes from having a solid plan. We’re committed to providing clear, honest guidance on all your options. To get a transparent cost estimate based on your specific needs, we invite you to schedule a free consultation with our compassionate Atascocita estate planning team today.

Key Factors That Influence the Cost of Your Will

When you start researching the cost of creating a will, you'll quickly notice a huge range. Why does one family pay a few hundred dollars while their neighbor’s plan runs into the thousands? The answer is pretty simple: no two families are the same, so no two estate plans should be, either. The final price tag boils down to the unique details of your life.

Think of it like building a house here in the Atascocita area. A standard builder's blueprint comes with a predictable, base price. But the moment you start making it your own—adding a custom home office, a mother-in-law suite, or special features for accessibility—the cost naturally goes up. Your will is the exact same concept. It's the blueprint for your family's future, and its complexity dictates the cost.

Several key factors really drive the final investment. Getting a handle on these will help you figure out what you might need and have a much more productive conversation with a local attorney.

Your Estate's Complexity

The size and type of assets you own play the single biggest role in determining the cost. A straightforward estate is just less complicated—and therefore less expensive—to plan for than one with a lot of moving parts.

Let’s look at a couple of common scenarios for families in our community:

- Simple Assets: If your estate is made up of a primary home in Atascocita, a car, a couple of bank accounts, and maybe a 401(k), your will is likely to land on the lower end of the cost spectrum.

- Complex Assets: The price starts to climb if you have more intricate assets. Do you own a small business over in Humble? Have you invested in rental properties near Lake Houston? What about stock portfolios, out-of-state property, or valuable collections like art or antiques? Each of these requires specific legal language to make sure they're handled exactly the way you want.

The whole point is to account for every asset properly under Texas law. The more you have to account for, the more time and legal expertise it takes to build a solid, secure plan.

Your Unique Family Dynamics

Family is the whole reason we create a will, and every family’s structure is different. This is where a one-size-fits-all online template can really fall flat, because it just can’t navigate the nuances of modern family life.

A will is so much more than a legal document; it's a final expression of love and care for your family. A well-crafted plan foresees potential conflicts and ensures your wishes are honored, giving everyone peace of mind when they need it most.

The cost of your will can be shaped by personal situations like these:

- Minor Children: If you have kids under 18, your will is the place you must name a guardian to care for them if something happens to you and their other parent. This is a massively important decision that needs precise legal wording.

- Blended Families: For families with children from previous marriages, a will is absolutely critical for spelling out who inherits what. This simple step can prevent a world of confusion, disputes, and hurt feelings among your loved ones down the road.

- Special Needs Dependents: If you’re providing for a child or another dependent with special needs, you’ll likely need a special needs trust. This is a powerful legal tool that lets you leave them financial support without knocking them out of eligibility for crucial government benefits. Setting up a trust is a more involved process and will naturally add to the overall cost.

Adding Trusts and Other Protections

Sometimes, a simple will just isn't enough to get the job done. You might need other legal instruments to protect your assets, provide for loved ones in a specific way, or plan for your own potential incapacity.

For instance, you might want to create a trust to manage assets for your children until they're older and more responsible. Or, you could set up a living trust to help your family avoid the time-consuming and public probate process in Harris County courts. Each of these tools adds another layer of protection, which in turn affects the final cost. Learning how to choose the right estate planning attorney can help you find a professional who can walk you through all these options without the confusing jargon.

Here at The Law Office of Bryan Fagan, we always take the time to truly understand your situation. We’ll talk through your assets, your family dynamics, and what you want to achieve, then give you a clear, transparent estimate for a plan that actually works for you.

DIY Wills Versus an Atascocita Estate Planning Attorney

In the age of instant everything, the appeal of a quick and cheap online will is powerful. For many families right here in Atascocita and Humble, a DIY will feels like a smart, budget-friendly move. It seems proactive, and on the surface, it absolutely saves money.

But this is one of those classic situations where the sticker price doesn't tell the whole story. The real value isn't just about what you pay today, but the security and peace of mind you're buying for your family's future.

Think of it this way: choosing between a DIY template and partnering with a local attorney is like the difference between using a generic map app and getting directions from a local who knows every shortcut, pothole, and traffic jam. The map might get you to the right zip code, but the local guide ensures you pull into the exact driveway without any costly detours. An experienced Atascocita attorney does just that, navigating the specific twists and turns of Texas law to make sure your wishes are followed to the letter.

The Hidden Risks of a DIY Will

While the upfront cost of an online will is tempting, it often comes with significant hidden dangers. These one-size-fits-all documents can't possibly account for the unique details of your family, your assets, or the specific requirements of Texas probate law.

A simple mistake—a missing witness signature, the wrong turn of phrase, or a failure to address a particular asset—can have devastating consequences.

Imagine an Atascocita family who used an online form to create their will. They felt they had done the responsible thing, but they were completely unaware of a subtle Texas law regarding the appointment of an independent executor. Because of that one small oversight, their estate was forced into a more expensive, court-supervised probate process. Their loved ones faced months of stress and thousands of dollars in legal fees that were entirely avoidable. That’s the true "cost" of a DIY will.

The Value of Professional Legal Guidance

When you sit down with a local estate planning attorney from The Law Office of Bryan Fagan, you aren't just buying a document; you're investing in personalized advice and legal expertise. We get to know you, your family, and what you want to achieve. We ask the right questions to uncover potential issues you might not have even considered, making sure your will is a rock-solid legal strategy, not just a piece of paper.

This personalized approach delivers benefits you just can't get from a template:

- Compliance with Texas Law: We make certain your will meets every state-specific requirement, from the number of witnesses to the precise legal language needed to make it hold up in a Harris County court.

- Customized Solutions: We help you navigate tricky situations like blended families, providing for a child with special needs, or protecting that small business you've poured your life into.

- Error Prevention: Think of us as your safety net. We catch the potential mistakes that could invalidate your will or create ambiguity that leads to bitter family disputes. Our job is to prevent problems before they ever start.

The truest measure of a will's value isn't its initial price, but its ability to work flawlessly when your family needs it most. Professional guidance transforms your will from a hopeful wish into a legally binding promise.

The numbers really bring this into focus. While costs vary, in the US a lawyer-drafted will typically averages between $500 and $2,000. Here in our own backyard, the Texas Young Lawyers Association reports that attorney-prepared wills average $500 to $1,000.

Now, compare that to a $100 online kit. A 2023 probate court analysis found that a shocking 22% of these DIY wills fail when it matters most. For our neighbors in Harris County who also need to establish guardianships for their children, our firm can integrate that critical planning for under $1,200 total—a reasonable investment for comprehensive protection.

Ultimately, the choice comes down to what you're protecting. If you want genuine peace of mind and the assurance that your family will be cared for without complications, the guidance of a knowledgeable local attorney is priceless.

For more insights on this decision, you can learn more about doing a will on your own in our detailed guide.

Thinking Beyond the Will: What Else Do You Need?

A will is the foundation of any solid estate plan, but for most people, it’s just the starting point. Think of it as the cornerstone of a house—absolutely essential, but it can’t protect you from the elements all by itself. For many families right here in Atascocita and Humble, building a truly protective plan means adding a few other key legal documents to the mix.

These additional tools work hand-in-hand with your will to cover situations a will simply can't. We're talking about managing your finances if you become unable to, or ensuring your healthcare wishes are followed. This isn't about making things more complicated; it's about creating a complete safety net for you and the people you love.

The Other Pieces of the Puzzle

While every situation is different, a few documents almost always come up when we're building a comprehensive estate plan. A good lawyer will help you figure out which of these make sense for your life.

- Trusts (Living Trusts, Special Needs Trusts, etc.): A trust is a powerful tool. It lets you appoint someone (a trustee) to manage assets for the benefit of someone else (a beneficiary). The biggest advantage? A well-structured trust can help your family sidestep the probate process in Harris County, which is often a public, costly, and time-consuming affair.

- Durable Power of Attorney: This is your financial quarterback. It lets you name a trusted person to handle your financial decisions—paying bills, managing investments, and so on—if you ever become incapacitated. Without it, your family might have to go to court just to get the authority to manage your affairs.

- Medical Power of Attorney: Similar to its financial counterpart, this document empowers someone you trust to make healthcare decisions for you if you can't make them for yourself.

- Advance Directive (or Living Will): This is where you spell out your wishes for end-of-life medical care, like your feelings on life support. It’s an incredible gift to your loved ones, freeing them from the agonizing burden of guessing what you would have wanted during a crisis.

These documents aren't just about what happens after you pass away. They protect you and your wishes during your lifetime, too.

The Smart Way to Plan: Bundling Your Documents

Hearing about all these documents might make you think the costs are about to skyrocket, but here's the good news. Just like you get a discount for bundling your home and auto insurance, you can almost always save money by having an attorney prepare your estate planning documents as a complete package.

When you work with a firm like ours, we don't just draft a single document in a vacuum. We sit down with you, look at your entire life situation, and figure out the exact set of tools you need to create a cohesive plan. This streamlined process is far more efficient—and cost-effective—than creating each document one at a time over several years.

An estate plan is a living strategy, not just a single document. By bundling services, you create a synchronized plan where every component works together, often for a lower overall cost than addressing each need in isolation.

Imagine a young family in Humble. They need a will to name guardians for their kids, a trust to hold the children's inheritance until they're old enough to manage it wisely, and powers of attorney for both parents. Tackling all of this at once as a single package will be significantly more affordable than paying separate legal fees for each document down the road. You can learn more about the differences between a living trust vs a will in Texas in our detailed guide.

Ultimately, investing in a complete plan is about so much more than just deciding who gets your property. It's about protecting your independence, securing your family’s future, and bringing clarity and peace of mind to difficult situations. Here at The Law Office of Bryan Fagan, our Atascocita team is ready to help you explore all your options and build a plan that truly fits your life and your budget.

The True Cost of Not Having a Will in Texas

So far, we've talked a lot about the upfront cost of creating a will—what you pay an attorney or an online service. But to really grasp the value of a will, we need to look at the other side of the coin. The real question is: What’s the cost of not having one?

For families here in Atascocita and across Harris County, the answer isn’t just measured in dollars. It’s measured in stress, lost time, and the very real risk that your final wishes get completely ignored.

When someone in Texas dies without a valid will, the legal term is intestate. This means you've effectively surrendered your right to decide who gets your property. Instead of your voice being heard, the State of Texas steps in with a rigid, one-size-fits-all legal formula. The state doesn't know your family dynamics or your true intentions; it just follows the letter of the law, often with heartbreaking results.

When the State Decides Your Family's Future

Texas intestacy laws can lead to scenarios you would never have chosen. Take a blended family in Humble, for example. A husband passes away without a will, assuming his wife will automatically inherit everything. But if he has children from a previous marriage, Texas law says otherwise. His separate property gets split between his surviving spouse and those children.

Suddenly, the family home could be co-owned by his wife and stepchildren—a recipe for a complicated and deeply emotional mess.

Worse yet, without a will, you give up your right to name a guardian for your minor children. If the unthinkable happens, a Harris County judge—a total stranger to you and your kids—is forced to make that life-altering decision. It's a stressful, lengthy process that can leave your children in limbo when they need stability the most.

The most significant cost of not having a will is the loss of control. You're not just leaving behind assets; you're leaving behind a legacy of confusion and potential conflict that your loved ones must navigate during their time of grief.

The Financial Toll of Intestacy

On top of all the emotional hardship, dying without a will almost always costs your family more money than simply creating one in the first place. The probate process becomes far more complicated and expensive. It requires more court oversight, which means higher attorney's fees and administrative costs that eat away at your estate.

Your heirs might even need to post a bond or hire their own lawyers just to prove they are entitled to inherit, causing delays that can drag on for months or even years.

The statistics are staggering. Nationwide data shows that 64% of adults without a will leave their families facing average probate costs of $34,000. That's nine times the national average for drafting a will. Even for smaller estates right here in Texas, the process can easily cost $2,000 to $5,000. A well-drafted will, on the other hand, can often bypass the most expensive parts of probate.

By planning ahead, heirs can save an average of 12 to 18 months in court proceedings. If you're interested in the bigger picture, you can explore more insights from PwC on long-term financial planning.

Protecting Your Loved Ones Is Priceless

When you look at it this way, the few hundred or thousand dollars you invest in an attorney-drafted will is a small price to pay for certainty. It’s a profound act of love that shields your family from unnecessary legal battles, financial strain, and emotional turmoil.

By putting your wishes in writing, you give them the gift of clarity. You allow them to focus on healing, not on fighting in court.

Securing Your Family's Future with a Texas Will

We've spent this guide breaking down the costs of creating a will in Texas, but the real value isn't something you can measure in dollars and cents. It's about the security, clarity, and peace of mind you give to the people you love most.

Putting a will in place is one of the most thoughtful things you can do for your family. It ensures your final wishes are crystal clear and protects your loved ones from a world of unnecessary stress and legal headaches down the road.

For our neighbors right here in Atascocita, Humble, and across northeast Harris County, getting started is much more straightforward than you probably think. It doesn't begin with dense legal jargon—it begins with thinking about your life and the people who matter.

Your Path Forward: A Step-by-Step Guide

A little bit of preparation can make the entire process feel smooth and focused. Here’s how you can get the ball rolling.

- Step 1: Gather Your Information: Before anything else, just make a simple list. Jot down your major assets—your house, bank accounts, retirement funds—and the full, legal names of the people you want to receive them.

- Step 2: Think About Key Roles: Who do you trust to be your executor? This is the person who will be in charge of making sure your will's instructions are followed. And if you have young children, who would be the right guardian to raise them with your values?

- Step 3: Consider Your Legacy: What do you want to leave behind? Your will is your final word, a chance to make sure everything you've worked for supports the people and causes you hold dear.

If you have a more complex situation, like owning a business, your planning will naturally go beyond a basic will. Resources like this guide on Estate Planning for Business Owners offer great insights into planning for business continuity and legacy.

Ultimately, the most important step is getting professional guidance to make sure your wishes are documented in a way that holds up in court. You don’t have to figure this out on your own. At the Law Office of Bryan Fagan, we're here to offer the clear, compassionate, and personal advice you need.

We invite you to schedule a free, no-obligation consultation at our Atascocita office. Let's sit down together, talk through your specific circumstances, and give you the confidence that comes with knowing your family's future is secure.

Your Top Questions About Will Costs Answered

When you start thinking about estate planning, a lot of questions pop up. It’s only natural. For our neighbors here in Atascocita, Humble, and the greater Harris County area, getting straight answers is the first step toward peace of mind. Here are a few of the most common questions we get asked at our office.

How Often Should I Update My Will, and What's the Cost?

Life doesn't stand still, and neither should your will. We generally recommend reviewing your will every 3-5 years. More importantly, you should revisit it immediately after any major life event, like a marriage, divorce, the birth of a child, or a big shift in your finances.

Updating a will is usually much cheaper than starting over. A simple amendment, known as a codicil, might only cost a few hundred dollars. We can sit down with you and figure out whether a quick update or a full rewrite makes more sense for your situation, both legally and financially.

Are Handwritten Wills Actually Legal in Texas?

Yes, they can be. A will written entirely by hand is called a holographic will in Texas law. The key is that it must be 100% in your handwriting—no typed sections, no pre-printed forms. It also doesn't need witnesses.

But here's the catch: these wills are notorious for causing problems. They often get challenged in court over unclear wording or doubts about the person's state of mind when they wrote it. This can drag your family into the very legal mess you were trying to avoid. Having a will professionally drafted sidesteps all that potential drama.

Can I Use My Will to Name a Guardian for My Kids?

Not only can you, but you absolutely should. Your will is the only legal document that lets you name the person you want to raise your minor children if something happens to you. If you don't name a guardian, a Harris County judge has to make that choice for you, and they won't know your wishes.

For parents in our community, this is hands-down one of the most critical reasons to have a solid will in place. It’s your voice, ensuring your kids are cared for by the person you know and trust.

What if I Make a Will in Texas and Then Move to Another State?

For the most part, a will that was legally created in Texas will be honored in other states. The problem is that every state has its own specific rules about probate, what an executor can do, and how property is handled.

It's always a smart move to have an attorney in your new state give your will a once-over. This simple step ensures everything is aligned with local laws and will work the way you planned, saving your family from nasty surprises and legal headaches later on. A little bit of proactive planning can prevent a world of trouble.

Protecting your family’s future is one of the most important things you’ll ever do, and you shouldn’t have to figure it all out on your own. At The Law Office of Bryan Fagan – Atascocita TX Lawyers, our dedicated team is here to offer clear, personal guidance. Let us help you find the peace of mind that comes from having a plan.