When a business partnership in Atascocita decides to close its doors, the dissolution of a partnership agreement is the formal event that gets the ball rolling. For our neighbors in Atascocita, Humble, and across northeast Harris County, understanding this process is crucial. It’s not the end of the road, but rather the first official step in a structured legal process to wind down the company.

What Partnership Dissolution Means for Your Atascocita Business

For any business owner in Atascocita or Humble, ending a partnership can be as emotionally charged and complicated as a divorce. You’ve poured countless hours and resources into building something together, and now it’s time to part ways. It's easy to feel a sense of loss or even failure, and we understand that.

However, the best way to look at it is as a necessary transition. It’s a formal, legal process designed to protect everyone's interests and provide a clear path forward for you and your family.

Think of it like deciding to decommission a ship. The moment the captain announces the final voyage, the ship hasn't vanished—but its mission has changed. From that point on, every action is about bringing it back to port, paying the crew, and unloading the cargo before it's officially retired. The decision to dissolve is that announcement. Under the Texas Business Organizations Code (BOC), this distinction is crucial for local businesses.

The Difference Between Dissolution and Termination

Business partners often toss around the words "dissolution" and "termination" as if they mean the same thing. They don't. In the eyes of Texas law, they are two very different stages of closing a business, and getting them right is fundamental to a clean break.

- Dissolution: This is the triggering event. It’s the formal point in time when the partners agree to stop doing business together. This could be due to a partner leaving, a specific goal being met, or any other reason outlined in your partnership agreement. Once dissolved, the business can't take on new projects; its only job is to wrap things up.

- Termination: This is the final outcome. It's the official end of the line, which happens only after every single debt is settled, all assets are distributed, and the last legal document is filed with the state. At termination, the partnership legally ceases to exist.

Right after dissolution, the partnership enters a critical phase known as “winding up.” This is where the real work happens: paying off creditors, liquidating assets, and squaring accounts between the partners. Being meticulous here is non-negotiable—it’s what stands between you and potential lawsuits down the road.

At The Law Office of Bryan Fagan in Atascocita, we know that ending a business relationship is a major life event. Our focus is to bring clarity and steady guidance to local business owners like you, making sure the process is handled professionally and that your financial interests are protected every step of the way.

To make these concepts even clearer, let's look at a side-by-side comparison.

Dissolution vs Termination Key Differences

Understanding the distinction between these two terms is the first step toward a smooth and compliant business closing in Texas.

| Aspect | Dissolution | Termination |

|---|---|---|

| What It Is | The start of the closing process. | The final end of the business's legal existence. |

| Timing | The first step after an event triggers the end. | The very last step after all affairs are settled. |

| Business Activity | Limited to actions needed to wind up affairs. | All business activities have completely ceased. |

| Legal Status | The partnership still legally exists but for a limited purpose. | The partnership no longer legally exists. |

As you can see, dissolution kicks things off, while termination is the finish line you cross only after everything is properly handled.

Navigating this path can feel overwhelming, but you don't have to do it alone. If you're considering a dissolution of a partnership agreement in the Atascocita or Humble area, our team is here to help. Contact The Law Office of Bryan Fagan today for a free consultation to discuss your situation and learn how we can support you.

What Kicks Off the End of a Partnership in Texas?

A business partnership in Texas doesn’t just stop existing overnight. The whole process has to be set in motion by a specific, legally recognized event. For business owners here in Atascocita, Humble, and across northeast Harris County, knowing what these triggers are is your first line of defense in managing a smooth exit.

Sometimes, these events are planned for. Other times, they catch you completely by surprise, throwing a wrench into everything.

Think of it a bit like a marriage ending. Some partnerships conclude on good terms because a shared goal was met, while others fall apart due to more challenging circumstances. The crucial part is recognizing the event for what it is: a legal trigger for the dissolution of a partnership agreement. Once you do that, you can take the right steps forward.

When Partners Agree to End Things (Voluntary Dissolution)

The simplest dissolutions are the ones where the partners decide to call it quits on their own terms. These are typically planned out and, with a good partnership agreement in place, can be managed with minimal friction.

Here are the most common voluntary triggers under Texas law:

- The Job is Done: The partnership was formed for a specific project or goal, and that goal has been achieved.

- A Mutual Decision: All the partners sit down and agree it’s time to move on and close the doors. This is the ideal, most peaceful scenario.

- Time's Up: The original partnership agreement had a built-in expiration date, and that day has finally come.

An Example from right here in Humble, TX: Let's say two local chefs team up to cater a series of big events at the Humble Civic Center. Their agreement is clear: the partnership exists only for this series. Once the last plate is cleared and the final invoice is paid, their business purpose is fulfilled. That completion automatically triggers a voluntary dissolution, and they can wind things down just as they planned.

When It’s Out of Your Hands (Involuntary Dissolution)

On the flip side, some events force a dissolution whether the partners want it or not. These situations are often unexpected, emotionally draining, and legally messy. This is where getting compassionate, professional guidance becomes absolutely essential.

Texas law lays out several events that can automatically force a partnership to dissolve. These often include:

- A Partner Walks Away: In what's called a "partnership at will" (meaning there's no set end date), any partner can decide to leave at any time. Their departure automatically triggers the dissolution process.

- Death of a Partner: The death of a partner is a terrible loss for the family and the business, but it also has immediate and serious legal effects on the company.

- A Partner's Bankruptcy: If one partner files for personal bankruptcy, it can legally trigger the partnership's dissolution to sort out creditor claims.

- A Judge Steps In: A court can order a partnership to dissolve if one partner is acting illegally, the business is consistently losing money, or it's just no longer practical for the partners to work together.

When one of these involuntary events happens, the road ahead is almost never straightforward. Tempers can flare, and partners might have completely different ideas about what to do next. This is a critical point where having a level-headed, experienced local attorney from The Law Office of Bryan Fagan can stop a bad situation from spiraling into an expensive court fight, protecting your family's financial future.

Whether the trigger was a mutual agreement over coffee in Atascocita or a sudden, tragic event, it will dictate how the entire "winding up" process unfolds. The very first step is to identify exactly what triggered your situation. From there, you can navigate the rules under the Texas Business Organizations Code and start building a clear plan.

If your business is up against one of these triggering events, you don't have to navigate it on your own. Schedule a free, confidential consultation with our Atascocita office today. We're here to listen and give you the steady legal support you need to protect what you've built.

Your Step-By-Step Guide to Winding Up the Business

Once you and your partners have made the tough call to dissolve the business, the next phase kicks in: "winding up." This isn't just a bit of legal jargon; it’s the hands-on, practical process of closing your company's doors for good. For business owners here in Atascocita and Humble, having a clear checklist is the best way to tackle this stage without missing a beat.

Think of it like getting a house ready to sell. You wouldn't just stick a sign in the yard and hope for the best. You'd clean everything out, make repairs, and square up the final utility bills. Winding up a business demands that same level of care to protect every partner and meet all your legal duties.

The following steps offer a clear roadmap for navigating the dissolution of a partnership agreement in a structured, manageable way.

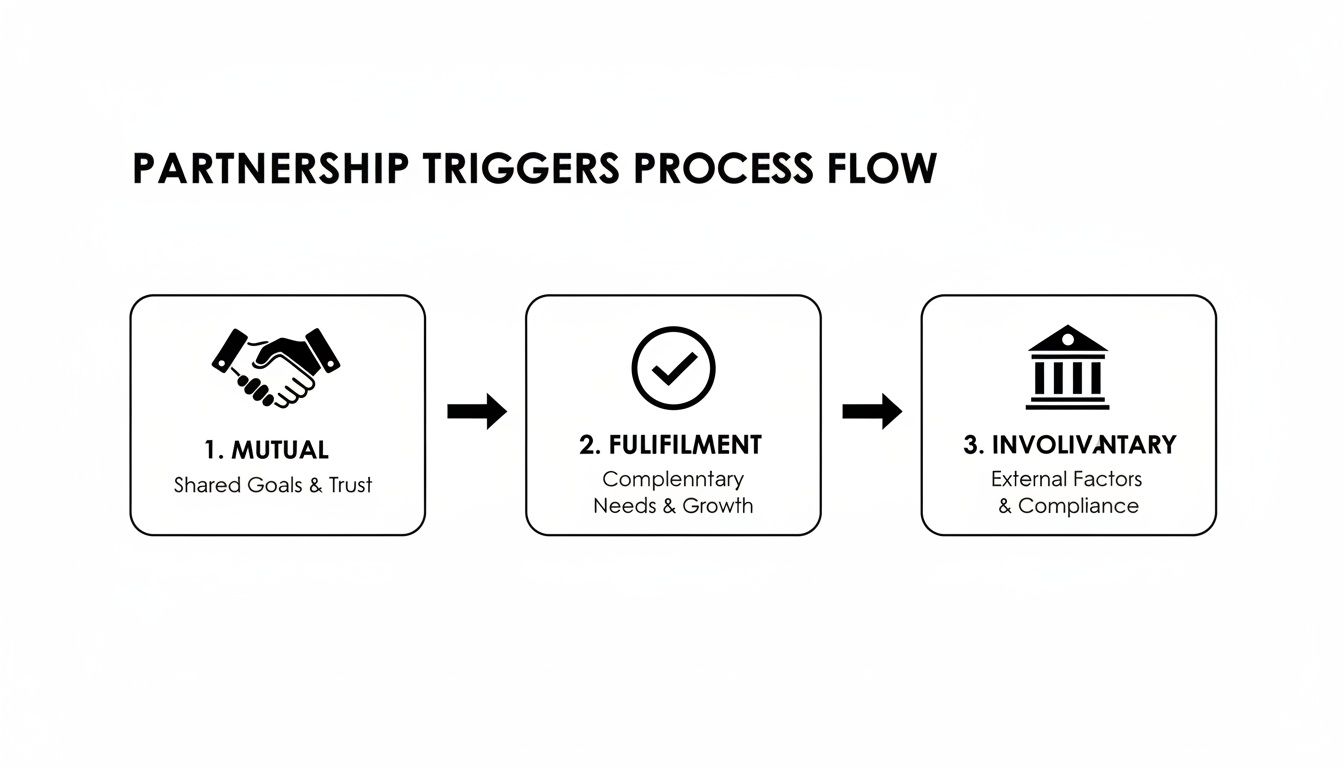

This process flow diagram shows the common events that can trigger a partnership dissolution, whether through mutual agreement, the completion of a business goal, or an involuntary legal action.

As you can see, a dissolution can be a planned event or a complete surprise. That’s why having a solid process matters, no matter what set things in motion.

Step 1: Put Everyone on Notice

First things first: you need to communicate. This means sending out formal, written notice of the dissolution to a few key groups. This isn't just good manners—it’s a crucial legal step that can shield you and your personal assets from liability down the road.

- Partners: Even if you all agreed verbally, send a formal written notice to every partner. This creates a paper trail and an official record of the decision.

- Creditors: Get in touch with everyone the business owes money to—suppliers, your landlord, and any lenders. This is absolutely critical for cutting off partner liability for any new debts that might be racked up after the dissolution date.

- Clients and Customers: Let your customers know the business is closing, especially if you have ongoing projects or open accounts with them. A professional heads-up helps protect your personal and professional reputation in our local community.

Step 2: Take Stock of Everything You Own

You can't settle the books if you don't have a crystal-clear picture of what the business actually owns. The next move is to conduct a full inventory and appraisal of all partnership assets.

This goes way beyond counting desks and computers. You need to list everything from the cash in your bank accounts and outstanding invoices (accounts receivable) to physical property like company vehicles, specialized equipment, and real estate. For major assets, like a commercial building in Atascocita, getting a professional valuation is smart. It ensures fairness and heads off arguments later.

Step 3: Finish What You Started

A partnership that's dissolving can't go out chasing new business, but it does have a duty to complete existing work whenever possible. This step is all about fulfilling your commitments to your current clients.

Wrapping up active contracts and projects brings in final revenue that you can use to pay down debts. If a project simply can't be finished, you’ll need to carefully negotiate a termination with the client to avoid a potential breach of contract lawsuit.

Handling the winding up process correctly is about more than just checking boxes; it’s about protecting your personal financial future. A misstep here could expose you to personal liability for business debts. At The Law Office of Bryan Fagan, we guide our clients through each step, ensuring every detail is handled according to Texas law.

Step 4: Settle Your Debts

Paying off what you owe is arguably the most important part of winding up. The Texas Business Organizations Code is very specific about the pecking order for who gets paid, and you have to follow it to the letter.

Here’s how the law prioritizes payments:

- Outside Creditors: All non-partner creditors—banks, suppliers, landlords—are at the front of the line. They must be paid first.

- Partner Creditors: If any partners personally loaned money to the business, they’re next up to be repaid.

- Partner Capital: Once all debts are cleared, partners get their initial capital contributions back.

Step 5: Distribute What Is Left

Only after every last debt and liability has been paid can the partners divide up any remaining assets or profits. Your partnership agreement should dictate exactly how this split happens.

If your agreement is silent on this point, Texas law defaults to an equal distribution among the partners. This is a classic trigger for disputes, which just goes to show why having a clear agreement—and legal guidance—is so important from the start.

Step 6: Make It Official with the State

The very last step is filing the final tax returns and official paperwork to close the book on your business. This involves submitting a final partnership tax return to the IRS and, crucially, a Statement of Termination with the Texas Secretary of State.

Filing this document is what officially ends the partnership's legal existence. It’s the finish line. It signals that the winding up process is complete and the business is truly terminated. If your business has a storefront on Will Clayton Parkway or another local commercial strip, making sure these public records are accurate is vital.

Winding up a business is a detail-oriented marathon, not a sprint. If you're facing a partnership dissolution in Harris County, you don't have to navigate it alone. Schedule a free consultation with The Law Office of Bryan Fagan in Atascocita to get the clear, supportive legal guidance you deserve.

Untangling Finances: How to Handle Debts and Assets During a Dissolution

Let's be honest—the financial side of a partnership split is almost always the most painful part. Untangling years of shared finances feels a lot like dividing property in a divorce. It’s personal, complicated, and can get heated very quickly. For business partners here in Atascocita and Humble, this is where the legal paperwork gets real.

This is the moment when tough questions surface: Who gets what? And, more importantly, who owes what? Your best defense against nasty disputes and long-term financial fallout is a calm, methodical approach. Thankfully, Texas law gives us a clear roadmap for this process.

The Legal Pecking Order for Paying Off Debts

When you're closing up shop, you can't just pay bills randomly. The Texas Business Organizations Code sets up a strict hierarchy for settling all financial obligations. This structure is designed to be fair to everyone involved, from your vendors right down to the partners themselves.

Here’s the legally required order you must follow:

- Outside Creditors Are Paid First: Before any partner sees a single penny, all external debts have to be settled. This includes bank loans, money you owe suppliers, back rent to your landlord, and any other money owed to non-partner individuals or companies.

- Debts Owed to Partners Come Next: Once your outside creditors are taken care of, the business must then repay any loans made by the partners. So, if you personally fronted the business $10,000 for startup costs, this is when you get that money back.

- Return of Partner Capital Contributions: After all loans are settled, partners are entitled to get back their initial capital contributions. This is the money or property they originally put into the business to get it off the ground.

- Distribution of Profits: If there’s anything left after all those other obligations are met, it’s considered profit. This final amount is then divided among the partners based on the profit-sharing terms in your partnership agreement.

A Critical Concern: Understanding Personal Liability

For anyone in a general partnership, the concept of personal liability is a huge deal. Unlike a corporation, a general partnership doesn't create a legal "shield" between the business's debts and your personal assets. This means if the business can't pay its bills, creditors can legally come after your personal bank accounts, your car, and even your home.

This is exactly why handling the dissolution process by the book is so incredibly important. One misstep could leave you personally exposed to financial risk for years.

Imagine your Humble-based retail shop has a commercial lease and owes money to a few local suppliers. If the business assets aren't enough to cover these debts during the dissolution, the landlord and suppliers could sue you personally to collect the rest. That’s the harsh reality of personal liability.

Protecting your personal assets should be your top priority. An experienced attorney can make sure all the proper notifications are sent and that the winding-up process is handled in a way that minimizes your individual risk.

Dividing the Partnership's Remaining Assets

Once every last debt is paid, the final step is to divide what's left. Your partnership agreement should be your roadmap here, as a well-written one will spell out exactly how to handle this.

But what about shared physical property? This is where local context really matters.

- A Shared Commercial Lease: What happens to your office space in Atascocita? Your options might include one partner taking over the lease, trying to negotiate an early termination with the landlord, or subletting the space to another business.

- Specialized Equipment: If you run a local landscaping company, who gets the commercial-grade mowers and the work truck? You could sell the equipment and split the cash, or one partner could buy out the other's share based on a fair market appraisal.

- Client Lists and Intellectual Property: Don’t forget about intangible assets. Things like customer lists and brand names have real value and must be accounted for and divided fairly.

If you or another partner contributed a personal loan to the business, having the right documentation is absolutely essential. You can discover more about the differences between a promissory note and a loan contract to see how these agreements are structured. Having that paperwork in order is crucial when it's time to get repaid during the dissolution.

Navigating the financial maze of a partnership dissolution requires a steady hand and a solid understanding of Texas law. If you're facing this process, don't leave your financial future to chance. Contact The Law Office of Bryan Fagan for a free consultation at our Atascocita office. We are here to help you secure a fair outcome and protect what you’ve worked so hard to build.

The Importance of a Strong Partnership Agreement

The easiest way to ensure a smooth business breakup is to plan for one from the very beginning. For any business owner in Atascocita or Humble, your partnership agreement is the single most important document you have. It protects your investment, your hard work, and even your relationships. Without one, you're at the mercy of the default rules in the Texas Business Organizations Code, which almost certainly won't match what you and your partners actually intended.

Think of a comprehensive agreement as a prenuptial agreement for your business. It's a roadmap you and your partners create together while everyone is optimistic and on the same page. This foresight lets you control the dissolution of a partnership agreement on your own terms, rather than having generic state laws dictate the outcome.

Key Clauses Your Agreement Must Have

A well-crafted partnership agreement sees potential friction points coming and lays out clear solutions before they ever blow up into full-blown disputes. When you're drafting or reviewing your agreement, make absolutely sure it includes these essential clauses.

- Specific Dissolution Triggers: Spell out exactly what events will automatically trigger the dissolution process. This could be a partner's retirement, disability, death, or even a simple mutual decision to close up shop.

- A Defined Method for Asset Valuation: How will you figure out what the business and its assets are worth when it's time to divide everything? Specify a clear formula or require an independent, third-party appraisal. This simple step can prevent huge arguments down the line.

- Clear Buyout Provisions: Outline the precise process for one partner to buy out another's share. Be sure to include payment terms—like a lump sum versus payments over time—to avoid draining the business's cash flow.

- Non-Compete and Non-Solicitation Clauses: These are critical for protecting the business you've built. They can prevent a departing partner from immediately opening a competing shop next door or poaching your best clients and employees.

A Proactive Approach Saves Time and Money

It might feel strange—even a little pessimistic—to plan for the end of a business relationship when you’re just getting started. But it's one of the smartest things you can do. The hard truth is that many partnerships don't last forever. Research shows most partnerships dissolve within 10 years, and a staggering 55% fail by the five-year mark, a timeline that eerily mirrors first marriage statistics. For business owners right here, Harris County court records show over 1,200 partnership disputes filed every year, with messy dissolutions often taking 18 months to resolve—as long as a complex divorce. You can see how these trends compare to personal relationship statistics on lhudspethfamilylaw.com.

This proactive approach is your shield against costly, emotionally draining legal battles. By agreeing on the rules of separation upfront, you and your partners in Harris County can preserve not only your financial investments but also the goodwill you've built over the years.

Leaving these terms undefined is an invitation for ambiguity and conflict, which often leads to expensive litigation. Remember, your partnership agreement is a legally binding contract. If a partner violates the terms, you might have a legal challenge on your hands. It's vital to understand how to sue for breach of contract in these situations.

Taking the time to draft a thorough agreement now is a direct investment in your business’s future stability and your own peace of mind. If you need help drafting a new partnership agreement or reviewing an existing one, our team at The Law Office of Bryan Fagan is here to help. Schedule a free consultation at our Atascocita office to ensure your business is protected from day one.

Resolving Disputes and Avoiding Costly Litigation

Even the most rock-solid partnership agreement can't always prevent friction when it's time to part ways. For business owners here in Atascocita and Humble, the end of a business venture can bring serious disagreements to the surface. Often, these disputes circle back to the same hot-button issues: what the business assets are really worth, who gets stuck with the remaining debts, or even claims that one partner wasn't acting in good faith.

When things get heated, it’s natural to feel like a lawsuit is the only way to protect what’s yours. But let me be clear: litigation should be the absolute last option on the table. A court battle is a public, incredibly expensive, and emotionally draining ordeal. It can easily drag out for months, sometimes years, torching the very funds and energy you need to start your next chapter.

The good news? There are much smarter, more constructive ways to handle these conflicts.

Exploring Alternatives to a Courtroom Battle

For local business owners, alternative dispute resolution (ADR) provides a private, more controlled, and far less hostile environment to work through disagreements. These methods are specifically designed to help you find common ground, preserving both your bank account and your sanity.

The two most effective paths are:

- Mediation: Think of this as a structured, productive conversation. You and your partner sit down with a neutral professional—the mediator—who doesn't take sides or make decisions. Their job is to guide the discussion, defuse tension, and help both of you arrive at a solution you can both live with. You stay in the driver's seat.

- Arbitration: This is a step up in formality but still worlds away from a courtroom. An arbitrator (or a small panel) acts like a private judge. You each present your case and evidence, and the arbitrator issues a final, binding decision. It’s significantly faster and less rigid than court but still delivers a conclusive end to the dispute.

Why Choosing the Right Path Matters

In many ways, dissolving a business partnership is a lot like a divorce. Here in Harris County, the process of untangling shared finances and assets can feel eerily similar. The upside is that, just like in family law, negotiated settlements work.

Statistics show that dissolutions handled through mediation have a 75% success rate when started early, helping partners sidestep litigation costs that can easily spiral into the $50,000 to $100,000 range.

Choosing mediation or arbitration isn't just about saving money. It's about choosing a more dignified, efficient way to move on. It lets you close this chapter of your professional life on your own terms, without the bitterness and scorched earth of a courtroom fight.

Sometimes, a dispute arises because a partner hasn't held up their end of the bargain. Knowing your rights in these situations is critical. You can learn more about what this means in our detailed guide on breach of contract in Texas.

The single most important step you can take is to get sound legal advice before a small disagreement becomes an expensive, all-out war. An experienced Atascocita attorney can help you understand your options, explore ADR, and ensure your interests are protected every step of the way. If you're facing a conflict in your partnership dissolution, contact The Law Office of Bryan Fagan for a consultation.

Common Questions About Partnership Dissolution in Texas

When a business partnership starts to unravel, it’s completely normal to feel a flood of uncertainty and have a ton of questions. Here in our Atascocita office, we’ve sat down with many local business owners who are facing this exact challenge. Let's walk through some of the most common concerns we hear.

What Happens If We Don't Have a Written Partnership Agreement?

This is a big one. If you’ve been operating on a handshake and a verbal understanding, you’re not alone. But when it's time to dissolve, the lack of a written agreement means the Texas Business Organizations Code (BOC) steps in and calls all the shots.

Essentially, state law becomes your partnership agreement. The BOC dictates the entire process, from how assets are split to who pays which debts. This default, one-size-fits-all approach rarely aligns with what the partners originally intended, often leading to costly and frustrating disputes. This is a critical time to speak with an attorney to understand what the law says your rights and obligations actually are.

Am I Still Liable for Partnership Debts After I Leave?

In short, yes—your liability doesn't just vanish the day you walk away. You can absolutely be held responsible for debts the business took on while you were a partner.

What’s more, you might even be on the hook for certain debts created after you’ve left if creditors weren't properly notified of your departure. Protecting your personal assets means navigating a specific legal process to formally cut ties and limit this lingering risk. An experienced attorney can make sure you give the right notice to the right people.

Can One Partner Force the Dissolution of the Partnership?

Often, the answer is yes. In what's known as a "partnership at will"—meaning there's no defined end date or specific goal—any partner can decide to withdraw at any time. Under Texas law, that single act can trigger the dissolution and begin the "winding up" phase.

However, there's a catch. If your partner’s decision to leave violates a specific term in your partnership agreement (if you have one), they could be held liable for any damages their sudden exit causes the business. It all comes down to the specific legal framework of your partnership, which is why a professional review is so important.

Ending a business partnership is a major legal and financial event. You need a trusted local advocate to protect your interests. At The Law Office of Bryan Fagan – Atascocita TX Lawyers, we provide the clear, compassionate guidance you deserve. Schedule your free consultation with us today at https://www.atascocitaattorneys.com.