A Durable Power of Attorney, or DPA, is a legal document that lets you handpick a trusted person to manage your financial and legal life if you're ever unable to. Think of it as choosing a co-pilot for your financial journey—someone you trust to take the controls if you can no longer fly the plane yourself.

What makes it durable is the key: this authority holds up even if you become incapacitated. That feature ensures a smooth, seamless transition of responsibility right when your family needs it most. At The Law Office of Bryan Fagan, we help our neighbors in Atascocita and Humble use this tool to protect their loved ones and gain peace of mind.

Why Planning Ahead with a DPA Protects Your Family

Life has a way of throwing curveballs. A sudden illness, a serious accident, or simply the challenges that come with aging can leave any of us unable to handle our own affairs. For families here in Atascocita, Humble, and northeast Harris County, a Durable Power of Attorney is one of the most fundamental estate planning tools you can have. It directly answers the question: who will take care of things if I can’t?

This isn’t just about making things easier; it’s about maintaining your dignity and control. Without a DPA in place, your loved ones would likely face a difficult journey to the Harris County courthouse to ask a judge to appoint a guardian for you. This guardianship process is often public, expensive, and incredibly stressful. A DPA keeps these deeply personal matters private and within your family, empowering the person you chose to act on your behalf.

What Can a DPA Agent Do?

When you create a DPA, you give your chosen agent (sometimes called an "attorney-in-fact") specific powers. You decide how broad or limited these powers are. The whole point is to make sure your financial life can continue running smoothly, no matter what.

Common responsibilities you can grant your agent include:

- Managing Bank Accounts: They can step in to pay your bills, make deposits, and handle everyday banking from your accounts.

- Handling Real Estate: They can manage your property, whether that means paying the mortgage on your Humble home or collecting rent from an investment property in Atascocita.

- Filing Taxes: Your agent can work with your accountant to prepare and file your state and federal tax returns on time.

- Accessing Benefits: They can apply for crucial government benefits you're entitled to, like Social Security, Medicare, or VA benefits.

A Durable Power of Attorney is your voice when you can no longer speak for yourself. It ensures your financial responsibilities are met, your assets are protected, and your wishes are honored by someone you have personally chosen.

For a clearer picture, here’s a quick summary of what a DPA does for our local community.

Key Features of a Durable Power of Attorney in Texas

| Feature | Description for Atascocita & Humble Residents |

|---|---|

| Durability | The agent's authority continues even if you become incapacitated, avoiding court intervention. |

| Agent's Role | The person you choose acts as your "fiduciary," legally required to act in your best interests. |

| Powers Granted | You can customize the powers, from managing all finances to specific tasks like selling a property. |

| Activation | Can be effective immediately upon signing or "spring" into effect upon a doctor's certification of your incapacity. |

| Revocability | As long as you are mentally competent, you can change or revoke the document at any time. |

This table provides a snapshot, but the real power of a DPA lies in the peace of mind it brings, knowing your affairs are in trusted hands.

A Growing Need for Proactive Planning

Families around the world are realizing how critical it is to plan for incapacity. In the UK, for instance, registrations for their equivalent document hit a record 1,161,958 in 2023—a staggering 37% jump in just one year. This isn't just a statistic; it shows a global shift in awareness as populations get older. Read more about these global trends and what they mean for family planning.

Here in Texas, our laws are designed to be helpful—a Power of Attorney is automatically considered durable unless you state otherwise. But the need for one is more urgent than ever, especially with dementia cases on the rise.

Getting a handle on legal tools like the DPA is a vital part of being a compassionate guide to supporting your aging parents through life's many transitions. By putting a thoughtful plan in place now, you give an incredible gift of peace of mind to yourself and the people you love. To discuss how a DPA can be tailored for your family's unique situation, contact the Law Office of Bryan Fagan for a free consultation at our Atascocita office.

Understanding the Different Types of POAs in Texas

When you start planning for the future, the term "Power of Attorney" pops up everywhere. But it's not a single, one-size-fits-all document. In Texas, there are several kinds, each built for a very specific job. Knowing the differences is the first real step toward creating a plan that genuinely protects you and your loved ones here in Harris County.

Think of it like picking the right tool from a toolbox. You wouldn't use a hammer to turn a screw. In the same way, the POA you need depends entirely on what you're trying to accomplish. Let's break down the main types so you can see which one actually fits your situation.

Medical vs. Financial Power of Attorney

The most basic distinction comes down to the kind of decisions your chosen agent can make. These two documents cover separate, but equally critical, areas of your life. A complete estate plan really needs both.

- Financial Power of Attorney: This is the document we've been focusing on. It gives your agent the authority to handle your property, money, and other financial matters. That can mean anything from paying the mortgage on your Atascocita home to managing investments or filing your taxes.

- Medical Power of Attorney: This document is strictly for healthcare. It lets you name an agent to make medical decisions for you, but only if you're unable to make them yourself. This person will be the one talking to your doctors, making sure you get care that lines up with your personal wishes.

It's absolutely critical to understand that one does not cover the other. A Financial POA gives your agent zero say in your medical care, and a Medical POA gives them no access to your bank accounts. Most people in Humble and Atascocita need both to be fully covered.

The Critical Difference Durability Makes

Beyond the financial and medical split, the next key question is when the document works and for how long. This is where that little word, "durable," becomes a very big deal.

A Non-Durable Power of Attorney is usually for a specific, temporary task. For example, if you were traveling and needed someone to sign closing papers on a house sale in Humble, you could grant a non-durable POA just for that one transaction. The agent's authority ends the moment the job is done or if you become incapacitated.

In contrast, a Durable Power of Attorney is built for the long haul. Its power endures—it stays in effect even if you become mentally or physically unable to handle things yourself. This is its entire purpose: to create a seamless transfer of authority right when you're most vulnerable, avoiding the need for a stressful and public court-ordered guardianship.

Under Texas law, the standard statutory power of attorney is durable by default unless the document specifically states it is not.

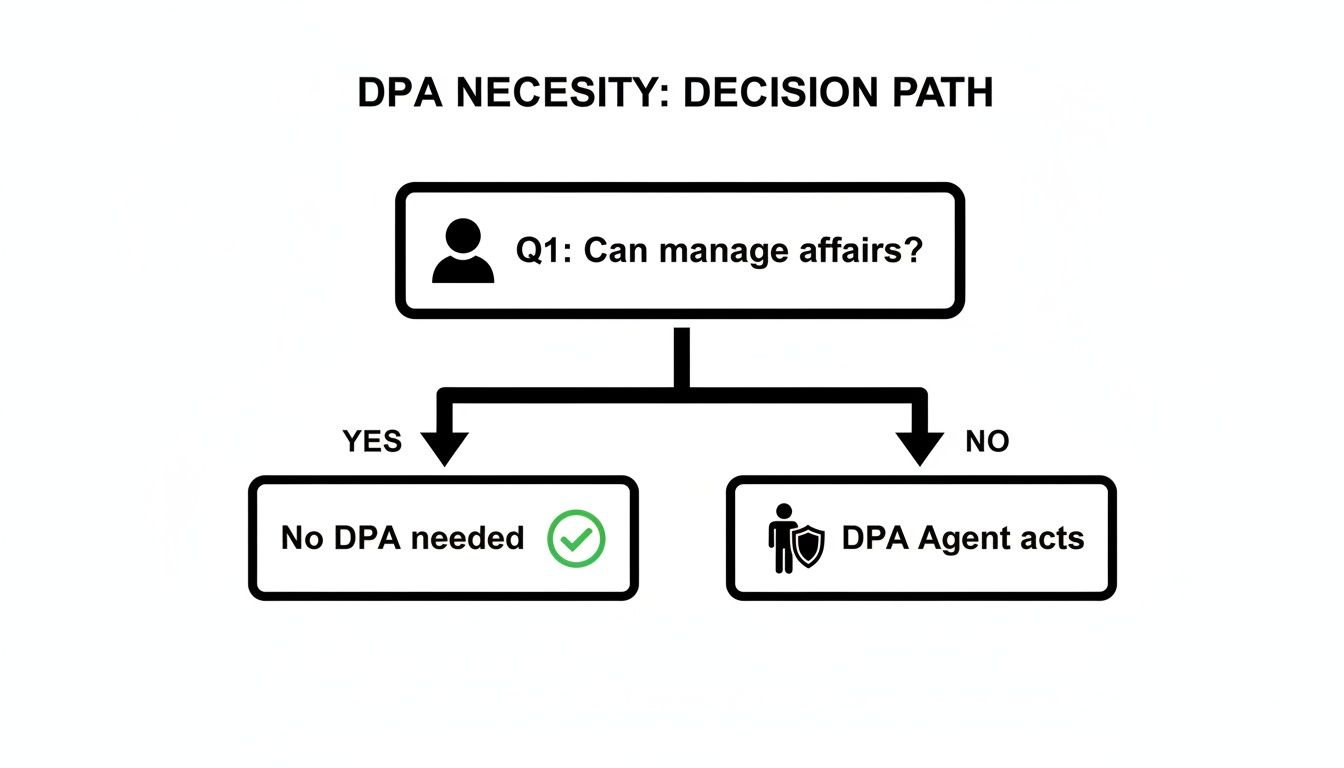

This flowchart pinpoints the exact moment a DPA becomes essential—when a person can no longer manage their own affairs. It shows how the agent’s role is activated by incapacity, serving as a vital shield for your financial well-being.

To help clear things up, here’s a quick comparison of the common POAs available to Atascocita residents.

Comparing Powers of Attorney Available in Texas

| Type of POA | When It's Effective | Common Use Case in Harris County |

|---|---|---|

| Durable Power of Attorney | Immediately upon signing, and continues through incapacity. | A spouse appoints their partner to manage finances for convenience now and for protection if they later develop Alzheimer's. |

| Springing Durable POA | Only upon the "springing" event, typically a doctor's certification of incapacity. | A parent names an adult child to take over only if they are officially deemed unable to manage their own affairs after a stroke. |

| Non-Durable (General) POA | Immediately upon signing, but terminates upon incapacity. | An individual traveling abroad for a month gives a trusted sibling the power to handle a specific real estate transaction in Humble. |

| Medical Power of Attorney | Only when you are certified as unable to make your own healthcare decisions. | Designating someone to communicate with doctors and make medical choices if you are unconscious after an accident. |

This table shows how each document is tailored for different life circumstances, from short-term needs to long-term care planning.

Springing vs. Immediate Power of Attorney

Finally, even with a Durable Power of Attorney, you get to decide exactly when it kicks in.

An Immediate DPA is effective the moment you sign it. This doesn't mean you instantly lose control of your finances. It just means your agent has the authority to act on your behalf right away if needed. Many couples find this practical, as it allows a spouse or trusted child to help with bills and banking without any extra steps.

A Springing DPA, on the other hand, only "springs" into effect after a specific event happens—almost always your legal incapacity. The document itself will spell out how incapacity is proven, usually requiring a written confirmation from one or more doctors. This gives an extra layer of protection to people who want to be certain their agent can only step in after it's medically necessary.

Picking the right combination of these documents is a deeply personal decision, based on your life, your family, and your peace of mind. The team at The Law Office of Bryan Fagan is here to help residents of Atascocita, Humble, and across northeast Harris County make these important choices with confidence. Schedule a free consultation with us today to talk about your specific needs and build a plan that works for you.

Why a DPA Is Your Best Defense Against Guardianship

One of the most compelling reasons to set up a Durable Power of Attorney is to shield your family from the ordeal of a court-imposed guardianship. If you become unable to manage your affairs and don’t have a DPA, your loved ones are forced to petition a Harris County court to get that authority.

It’s a process that’s public, emotionally taxing, and often incredibly expensive. It can quickly eat away at the very nest egg you worked so hard to build.

Imagine your family having to hire lawyers, show up for court dates, and argue before a judge that you are no longer capable of making your own decisions. This legal process, often called a guardianship or conservatorship, effectively hands control of your life over to the court system. A judge—a stranger—not your spouse or your child, gets the final say on who manages your finances and makes critical personal choices for you.

The Guardianship Process a DPA Helps You Avoid

Going through the guardianship process is nothing like the private, straightforward activation of a DPA. It’s a formal legal battle with many steps, each one adding more time, cost, and stress to an already difficult situation.

Without a DPA, here's what your family would likely be up against:

- Filing a Petition: It all starts with a formal application filed with the court right here in Harris County.

- Medical Evaluation: The court demands a doctor's report to legally certify your incapacity.

- Court-Appointed Attorney: A judge will appoint an attorney, known as an attorney ad litem, to represent your interests, adding another layer to the proceedings.

- Public Hearing: A formal hearing is held where a judge publicly determines your legal capacity and decides who to appoint as your guardian.

This whole ordeal strips your family of privacy and control, turning deeply personal family matters into public record. It's the polar opposite of a DPA, which keeps these decisions private and firmly in the hands of someone you trust.

A Durable Power of Attorney is a proactive choice that keeps control within your family circle. A guardianship is a reactive, court-ordered solution that takes that control away, often at a significant financial and emotional cost.

A Tale of Two Atascocita Neighbors

Let’s look at two neighbors, living just down the street from each other in Atascocita. The first, Carol, had met with an attorney to create a solid estate plan, which included a Durable Power of Attorney naming her son as her agent. When Carol had an unexpected stroke, her son was able to step in immediately. He used the DPA to pay her medical bills from her bank account, handle her mortgage payments, and make sure her life continued smoothly. The entire process was seamless, private, and stress-free for the family.

Her neighbor, Robert, wasn't so prepared. When he was diagnosed with advanced dementia, his family realized they had no legal authority to access his funds to pay for his care. They had no choice but to petition the court for guardianship. The family endured months of legal battles, spent thousands on court costs and attorney fees, and suffered the emotional toll of proving their father's condition in a public courtroom. By the time a guardian was finally appointed, their resources—and their spirits—were exhausted.

These kinds of delays can have devastating consequences. While not in the U.S., data from the UK shows how extreme bureaucratic holdups can get, with one case taking over 10 years to process. This highlights a universal problem: government processes can paralyze a family's ability to act when it matters most. Discover more insights about the challenges of legal processing times and how they impact families.

The difference between Carol’s and Robert’s experiences is night and day. Planning ahead with a DPA protects your dignity, your privacy, and your finances. It keeps your family out of the courthouse and allows them to focus on what’s truly important—caring for you. To get a better handle on the legal complexities your family can sidestep, you can read our guide on conservatorship in Texas.

If you want to ensure your family’s story is like Carol’s, the first step is speaking with an experienced local attorney. The Law Office of Bryan Fagan is here to help residents of Atascocita and Humble create a plan that delivers true peace of mind. Schedule your free consultation with us today.

How to Choose the Right Agent for Your DPA

When you create a Durable Power of Attorney, you’ll face one decision that towers above all the others: choosing your agent. This isn't just about picking someone you love or trust. You're handing over immense authority, and the person you choose needs the right mix of integrity, good judgment, and practical skills.

The person you name as your agent takes on a fiduciary duty. That's a formal, legal obligation to act only in your best interest. They have to manage your finances and property with the same diligence they’d use for their own, always putting your well-being first. It's a serious commitment that requires a clear head and an unwavering sense of responsibility.

Key Qualities to Look for in an Agent

Think of this less as a popularity contest and more as a job interview for a critical role. As you consider people in your life, from family in Humble to a trusted friend in the Atascocita area, look beyond your emotional connection and focus on their actual capabilities.

Here are the essential traits you should be looking for:

- Financial Responsibility: How do they handle their own money? You need someone who is organized, pays their bills, and has a good grasp of basic financial management.

- Clear Communication: Your agent will likely have to speak with bankers, accountants, or insurance agents for you. They need to be able to get their point across clearly and confidently.

- Assertiveness: Could this person stand up for your wishes, even if other family members disagreed? A good agent needs a backbone to navigate potential conflicts and make tough calls without caving to pressure.

- Local Availability: While not an absolute requirement, having an agent who lives nearby in Atascocita or the greater Harris County area is a huge plus. Many financial tasks, like visiting a safe deposit box or meeting with a local bank manager, simply have to be done in person.

The ideal agent is not just trustworthy, but also dependable and capable under pressure. They are someone who will honor your legacy by managing it with diligence, respect, and a steady hand.

Questions to Ask Yourself Before Making a Choice

To help you narrow down your options, sit with these questions for a bit. Answering them honestly can point you toward the right person and help you sidestep future problems.

- Do they share my financial values? If you're a conservative saver, appointing a risk-taker might not be the best fit for managing your retirement accounts.

- Can they handle pressure from relatives? Family dynamics can get messy. Will your agent be able to say "no" to a sibling or child asking for a "loan" from your funds?

- Are they organized enough for the job? This role demands meticulous record-keeping. Every transaction needs to be documented to protect both you and them.

- Do they have the time and willingness to serve? Being an agent can be a major time commitment. It’s essential to have a frank conversation with your potential agent to make sure they are genuinely willing and able to take this on.

The Importance of Naming Alternate Agents

Life is unpredictable. What happens if your first-choice agent gets sick, moves across the country, or even passes away before you do? If you don't have a backup, your DPA could become useless right when you need it most.

This is why a properly drafted DPA should always name at least one, and preferably two, alternate agents. Think of them as your fail-safe. These successor agents are ready to step in if your primary choice can't, ensuring there's no gap in the management of your affairs. It provides an incredible layer of security and peace of mind.

Choosing an agent is a decision that requires deep thought and honest conversation. The attorneys at The Law Office of Bryan Fagan are here to provide supportive, practical advice to help Atascocita residents make a confident choice. Schedule a free consultation with our team to discuss your options and build a plan that truly protects your future.

Meeting Texas Legal Requirements for Your DPA

For a Durable Power of Attorney to be a reliable shield for you and your family, it has to be legally solid. Texas law is very clear about what turns a piece of paper into a powerful legal tool, and getting these details right is the only way to ensure your wishes are honored without a hitch.

These requirements aren't overly complicated, but they are strict. A document that misses even one step could be rejected by a bank in Humble or a hospital in Atascocita, leaving your family without the authority they need at the worst possible moment.

The Essential Signing Formalities

To create a valid DPA in Texas, you have to follow a specific, required process. Think of it as a legal checklist that guarantees your document will work when it’s needed most.

The core requirements are simple but absolute:

- It must be in writing. An oral agreement just won’t cut it. The entire document, outlining every power you grant, has to be written down.

- You, the principal, must sign it. Your signature is what breathes life into the document and confirms it’s what you want.

- It must be acknowledged before a notary public. This is critical. You have to sign the document in front of a notary, who will verify your identity and place their official seal on it.

That final step—the notarization—is what tells the world, and any institution you can think of, that this document is official and can be legally relied upon.

The Risk of Generic Online Forms

It's tempting to grab a generic, one-size-fits-all form online to save a little time or money. But while they seem convenient, these templates are often a ticking time bomb. A form designed for another state or one that’s outdated and doesn't reflect recent changes in Texas law can be a recipe for disaster.

For example, Texas law now presumes a power of attorney is durable unless it specifically states otherwise. This is a huge help for Texas residents, but it's a legal nuance a generic form might completely miss. Research actually shows that when people are given simple, clear information, they are far more likely to put these vital documents in place. For a broader look, you can learn about the power of attorney laws across all 50 states.

A poorly drafted DPA isn’t just a wasted effort—it’s a risk to your family’s security. When a bank or hospital rejects your document, the only option left is often the costly and public guardianship process you were trying to avoid.

Working with a local attorney who knows the ins and outs of Texas law is the only way to be certain every detail is handled correctly. An attorney can navigate the specific language required by the Texas Estates Code and, more importantly, customize the document to fit your unique family and financial situation. This is where an experienced Atascocita estate planning attorney provides immense value, transforming a simple form into an ironclad protection plan.

At The Law Office of Bryan Fagan, we help our neighbors in Atascocita, Humble, and across northeast Harris County create legally sound Durable Powers of Attorney every day. We make sure your document not only meets every Texas requirement but is also perfectly tailored to protect what matters most to you. Schedule a free, no-obligation consultation with us to get started.

Customizing the Powers and Limits in Your Document

A Durable Power of Attorney isn't a one-size-fits-all form you just download and sign. Think of it more like a set of keys—you decide exactly which doors your agent can open. Texas law gives you complete control to hand over a master key or just a single key for a very specific purpose.

You can give your agent sweeping authority to manage all of your financial affairs, which is often a practical choice for a spouse or a trusted child. On the other hand, you can narrow their powers down to a few specific tasks. The choice is entirely yours.

Granting Broad vs. Specific Powers

So, what kind of authority can you actually grant? The scope is incredibly flexible, covering everything from minor daily tasks to significant life decisions.

Here are a few common powers people grant their agents:

- Manage Bank Accounts: This lets your agent pay your monthly bills, deposit checks, and handle other routine banking.

- Handle Real Estate Transactions: Your agent can be empowered to manage, rent out, or even sell your property, like your family home in Humble.

- Oversee Business Operations: If you own a local business in Atascocita, your agent can make payroll, pay suppliers, and keep things running smoothly.

- File Taxes and Manage Government Benefits: They can handle your tax filings and manage benefits you receive, like Social Security or Medicare.

Getting these details right is a lot like drafting contracts. Every word matters, and clarity is key to making sure your instructions are followed perfectly.

Setting Important Limitations

Just as you can grant powers, you can also put up guardrails. Limitations are your safety net, ensuring your agent acts precisely as you intend while protecting your assets. It's all about finding the right balance.

A well-drafted DPOA balances authority with protection. By customizing limits, you empower your agent to help you while safeguarding your most important assets and honoring your specific wishes.

Here are a few real-world examples of how Harris County residents might set specific limits:

- A business owner in Humble might give their agent full control over their personal finances but explicitly forbid them from selling or liquidating their company.

- A parent could require two of their adult children (serving as co-agents) to agree in writing before any piece of real estate is sold.

- Someone might place a cap on gifts, allowing the agent to give birthday presents to family but stopping them from making large cash gifts that could drain the estate.

These customizations give your agent the flexibility they need without giving them a blank check. This document is a critical piece of your overall estate plan, working alongside other directives. To understand the full picture, you can learn more by reading our guide about what is a living will in Texas.

At The Law Office of Bryan Fagan, we can help you build a Durable Power of Attorney that truly reflects your wishes. Reach out to our Atascocita office today for a free consultation to discuss your specific situation.

Common Questions About Durable Powers of Attorney

Even after you get the basics down, you’ll probably still have some real-world questions about how a Durable Power of Attorney actually works. It's one thing to understand the concept, but it's another to feel completely confident about putting it into practice for your own Atascocita or Humble family.

Let’s walk through some of the most common questions we hear from clients. Getting these answers straight can clear up any lingering doubts.

When Does a Durable Power of Attorney Become Effective?

This is a big one, and the good news is, you're in the driver's seat. You get to decide exactly when your agent can start acting on your behalf. There are two main ways to set it up:

- Effective Immediately: Your DPA can be active the moment the ink is dry. This is often the most practical option. It allows your chosen agent to step in and help with bills or banking right away if you need them to, without having to jump through any legal hoops later on.

- "Springing" DPA: The alternative is what we call a "springing" DPA. This document only springs into effect after a specific trigger event happens—almost always, this means a doctor has to certify in writing that you’ve become incapacitated.

While many of our Atascocita clients lean towards an immediate DPA for its simplicity, a springing DPA offers an added layer of control that gives some people extra peace of mind. It really comes down to your personal comfort level.

Can I Change or Revoke My DPA?

Absolutely. You are never locked in. As long as you have the mental capacity to make your own decisions, you retain the complete right to change your agent, adjust their powers, or tear up the whole document and start over. Your estate plan should always reflect your current wishes.

The power to create a DPA is matched by the power to revoke it. You remain in control of your legal documents as long as you have the capacity to make these decisions.

To make it official, you’ll need to create a formal written revocation. It's not enough to just tell your agent—you have to provide a copy of this written notice to them and, just as importantly, to any financial institutions like your bank in Humble that have the old DPA on file. This is where working with an attorney can prevent any mix-ups.

What Happens Without a DPA in Texas?

This is the question that truly highlights why this document is so critical. If you become incapacitated in Texas and you don't have a DPA, your family can't just step in and start paying your mortgage or accessing your accounts.

Instead, they'll be forced into a public, expensive, and often heart-wrenching court process in Harris County to have a guardian appointed for you. A judge—a stranger—will decide who manages your life and finances. It might not be the person you would have wanted.

A DPA keeps those decisions private, in your family's hands, and out of a courtroom. It’s a simple tool that saves your loved ones from an incredible amount of stress and expense down the road.

Planning for your future is one of the greatest gifts you can give your family. At The Law Office of Bryan Fagan – Atascocita TX Lawyers, we are here to help you create a Durable Power of Attorney that provides security and peace of mind. Schedule a free, no-obligation consultation with us today at https://www.atascocitaattorneys.com.