When a loved one passes away in Texas, their will goes through a formal court process called probate. This is how a court legally recognizes a will, makes sure the deceased person's debts are settled, and formally transfers their assets to the people named as beneficiaries.

Think of it as the official roadmap for honoring your loved one’s final wishes. The process also gives a person, known as the executor, the legal authority to manage the estate. For our neighbors in Atascocita, Humble, and northeast Harris County, understanding this process can bring clarity during a difficult time.

Your First Steps After a Loved One Passes in Atascocita

Losing a family member is incredibly difficult. On top of the grief, families here in Atascocita and Humble are often suddenly faced with a mountain of financial and legal tasks that can feel completely overwhelming. The word you'll hear almost immediately is "probate."

Simply put, probate is the court's way of supervising the whole process. It's a structured procedure designed to make sure everything is handled by the book—from paying off final medical bills to ensuring the house and other property end up with the right people. This process ensures your loved one's wishes are respected and legally fulfilled.

Understanding the Initial Requirements

One of the first questions we hear from local families is, "Do we really have to probate this will?" Most of the time, the answer is yes. It's almost always necessary if the estate includes assets like real estate in Harris County or bank accounts held only in the deceased person's name. Without probate, there's no legal way to transfer the deed to a house or get access to those funds.

Here is a step-by-step guide to your immediate priorities in those first few days and weeks:

- Locate the Original Will: This is non-negotiable. The court needs the original signed document, not a photocopy, to even start the process.

- Get a Death Certificate: You'll need multiple copies of this official document for everything from closing bank accounts to filing court paperwork.

- Start a List of Assets and Debts: Begin gathering statements and information on what your loved one owned (assets) and what they owed (debts). The executor will need this inventory.

Obtaining the death certificate is one of the most critical first steps. For a deeper dive into understanding the Texas Death Certificate and its role in legal proceedings like probate, this guide can be very helpful.

Why You Shouldn't Delay

It’s easy to let things slide when you're grieving, but Texas law has a strict deadline. The Texas Estates Code gives you four years from the date of death to file a will for probate.

If you miss that deadline, you create a massive legal headache. The court can refuse to recognize the will, which means the estate might have to be divided based on state law, not on what your loved one actually wanted. This can lead to family disputes and outcomes no one intended, causing further pain for families in our community.

At The Law Office of Bryan Fagan, we're here to provide the compassionate support and straightforward guidance your family deserves. Schedule a free consultation at our Atascocita office to talk through your next steps and find a clear path forward.

The Harris County Probate Process: A Step-by-Step Guide

Once you have the original will and the death certificate in hand, you're ready to start the formal legal process of probating a will in Texas. It can feel like a maze of legal requirements, but it’s really just a series of defined, manageable steps. For our friends and neighbors here in northeast Harris County, from Kingwood down to Humble, understanding how this works locally can make a difficult time feel a bit more under control.

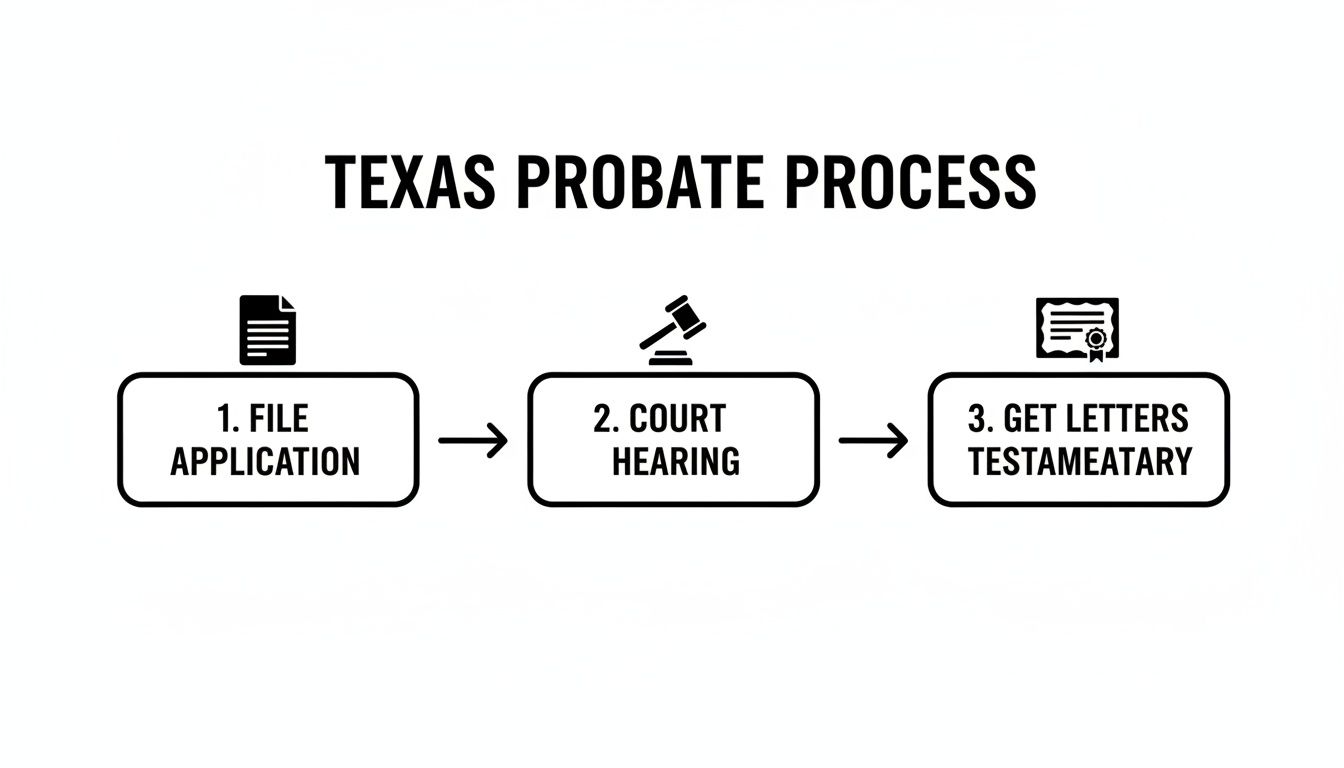

The journey begins by preparing and filing a document called an Application to Probate Will and for Issuance of Letters Testamentary. This is the formal petition that gets the ball rolling. Your attorney will file this for you with the correct court—which for us means one of the dedicated Harris County Probate Courts downtown. This application lays out all the essential facts for the judge: information about your loved one, the date they passed, who the beneficiaries are, and a general overview of the estate's assets.

Filing the Application and Getting on the Court's Docket

Filing the application officially starts the clock. Right away, Texas law requires a public notice, known as a posting, to be placed at the courthouse. This notice has to stay up for at least ten days before any hearing can happen. Think of it as a public announcement that a will has been submitted, giving anyone with a potential interest a chance to step forward.

While you're waiting for that ten-day period to pass, you'll be getting ready for the first court hearing. This is usually a quick, straightforward proceeding, but it's absolutely critical. You'll need to have two key documents with you:

- The Original Will: The court needs the actual, signed document. Copies won't cut it.

- The Death Certificate: This is the official proof of the decedent's passing.

Let's imagine a family from Atascocita is handling their mother's estate. Her will names the eldest son as the executor. He, through his attorney, would file the application, wait for the posting period to end, and then show up for the hearing. At the hearing, he'll be sworn in and asked a few simple questions to confirm his mother's identity, verify that the document is her true last will, and state that he is qualified to serve as executor. This step-by-step guidance helps clients understand what to expect.

Our Approach: We understand that a court hearing can be intimidating. Our role is to prepare you, stand beside you, and ensure this step is as smooth and stress-free as possible. The judge's job is simply to confirm the will is legitimate and formally appoint the executor. This hearing is what officially empowers you to act for the estate.

Getting Your "Letters Testamentary" (Your Official Authority)

If the judge agrees that everything is in order, they will sign an Order Admitting Will to Probate. This is the court order that makes the will legally valid. Shortly after, the court clerk issues what are called Letters Testamentary.

This document is an executor's golden ticket. It's the official certificate that gives you the legal authority to manage the estate’s affairs.

With Letters Testamentary, you can now:

- Access the deceased’s bank accounts.

- Talk to financial institutions and government agencies.

- Sell property, like a house in Humble, if the will directs it.

- Pay the estate's final debts and bills.

You will need to show certified copies of your Letters Testamentary to pretty much every institution you deal with. It's the proof that the court has put you in charge.

Notifying Heirs and Creditors: Your First Big Tasks

As soon as you’re officially the executor, your duties begin. One of the very first is to give formal notice to all beneficiaries named in the will. Texas law is specific here: this notice must be sent by certified mail within 60 days of the will being probated. This makes sure everyone is in the loop and knows what's happening.

At the same time, you have to deal with potential creditors. You'll do this by publishing a notice in a local newspaper—one that serves the Atascocita or greater Harris County area. This publication puts any person or business owed money on notice that they have a limited time to present their claim. This step is non-negotiable; it’s how you identify all the outstanding debts so they can be settled before any assets are passed on to the heirs.

If you’re wondering how all these deadlines and steps fit together, we've put together a resource that explains how long probate takes in Texas.

Handling these notifications correctly protects you and the estate. It creates a clear legal record that you've done your job, which is key to a smooth process. For families in our community, getting these steps right provides peace of mind and a clear path forward in honoring a loved one’s final wishes.

Independent vs Dependent Administration in Texas

When you're faced with probating a will in Texas, one of the first and most important forks in the road is deciding on the type of administration for the estate. This isn't just legal jargon; the choice you make here will directly affect the time, cost, and level of court involvement required to settle your loved one's affairs. For most families we work with in Atascocita and Humble, getting this right from the start is the key to a much smoother, less stressful probate journey.

The Go-To Option: Independent Administration

There's a reason Texas law leans heavily toward independent administration—it's used in roughly 80% of all probate cases. It's popular because it's practical. This approach allows the executor to manage the estate with very little court supervision.

Once the court appoints you as the independent executor, you're empowered to pay debts, sell property, and distribute assets to the heirs without having to run back to the judge for permission at every turn. It streamlines everything, saving the estate significant time and money.

Independent administration is usually on the table if the will specifically requests it (most well-drafted Texas wills do) or if all the beneficiaries are on the same page and agree to it. It’s built on a foundation of trust that the executor will act responsibly.

Imagine a straightforward situation: a family in Kingwood whose mother’s will clearly names her oldest son as the independent executor. The will is solid, and all the siblings get along. In a case like this, the son can efficiently handle everything—paying the last of the utility bills, listing the family home with a realtor, and eventually dividing the inheritance as the will directs—all without the hassle and expense of constant court hearings.

The probate process, whether independent or dependent, always kicks off with a few foundational steps.

This initial phase gets the ball rolling and officially appoints the executor, no matter which administrative path you take.

When Court Oversight is Unavoidable: Dependent Administration

While independent administration is the ideal, it's not a one-size-fits-all solution. Sometimes, a dependent administration is necessary. This route is the complete opposite in terms of court involvement. The executor (often called an "administrator" in this scenario) must get a judge's green light for nearly every single action.

This means filing formal motions and attending court hearings just to pay routine bills, sell a car, or make an initial distribution to an heir. It’s a painstaking process, but this high level of judicial oversight is there for a reason: to protect the estate when things are complicated or contentious.

So, when does this more restrictive path make sense?

- When there are major family disputes. If beneficiaries are at odds or simply don't trust the person nominated as executor, court supervision ensures every move is transparent and above board.

- When the estate is drowning in debt. Navigating a mountain of creditor claims is tricky. Having a judge approve the payment plan protects the administrator from personal liability.

- When an heir is a minor or incapacitated. The court steps in to act as another layer of protection, making sure their inheritance is properly managed and safeguarded.

- When the will itself is being challenged. If there are legitimate questions about the will's validity, a judge's guidance is absolutely essential to steer the process correctly.

Think of an estate in Humble where the kids are fighting over what to do with the family business. A dependent administration would move that argument into a formal, structured setting where a judge hears both sides and makes the final call, preventing one sibling from making a rash decision that hurts the others.

Our Local Perspective: At the end of the day, our goal is to honor your loved one's final wishes as efficiently as possible. While dependent administration absolutely means more legal hoops and higher costs, it plays a crucial role in preventing financial mismanagement and protecting vulnerable family members when conflict is brewing.

The right choice hinges entirely on your family’s unique situation—the clarity of the will, the complexity of the assets, and, most importantly, the relationships between the beneficiaries. Understanding these two paths is the first step toward having a productive conversation about the best way forward.

At The Law Office of Bryan Fagan, we guide Atascocita families through these crucial decisions every day. If you’re not sure which type of administration is right for your loved one's estate, we invite you to schedule a free consultation at our local office to talk through your specific circumstances.

The Executor’s Responsibilities for Estate Assets and Debts

Once the Harris County Probate Court hands you the Letters Testamentary, your role as executor officially begins. It's a significant shift—you're no longer just the person named in the will; you're now the active manager of the estate. This comes with a serious legal responsibility called a fiduciary duty, which means you must always act in the best interests of the estate and its beneficiaries.

It sounds intimidating, but for most families in Atascocita and the surrounding communities, the key is a clear, organized approach. Your first job is to marshal and protect all the estate's assets. This isn't just about making a list. You need to actively secure everything.

This could mean opening a new checking account in the estate's name and transferring all the cash from the deceased's various bank accounts. It might involve changing the locks on a property in Humble or making sure a car is safely stored and insured. Think of yourself as the temporary guardian of these assets, tasked with preventing any loss or damage while the probate process unfolds.

Creating the Estate's Financial Snapshot

Within 90 days of your appointment, you have a critical deadline. You must file a document with the court called the Inventory, Appraisement, and List of Claims. This is the financial cornerstone of the entire probate process.

Essentially, it's a detailed, sworn statement that lists all the estate's property, assigns a fair market value to each item as of the date of death, and identifies any money owed to the estate (these are the "claims"). This inventory creates a transparent financial picture for the judge and all the beneficiaries, leaving no room for questions or confusion about what the estate actually holds.

To put together a solid inventory, you'll need to:

- Dig up financial documents: Track down recent bank statements, brokerage reports, life insurance policies, retirement account info, and property deeds.

- Get professional appraisals: For significant assets like real estate, valuable art, or classic cars, you'll likely need to hire a professional appraiser to get an accurate, defensible market value.

- List all claims: Did your loved one lend money to a friend? That's an asset of the estate and must be listed as a claim the estate holds against someone else.

Managing and Paying Estate Debts

While you're gathering assets, you also have to tackle the other side of the balance sheet: the debts. As the executor, you're responsible for paying all of the deceased's legitimate debts before any assets can be passed on to the heirs.

After you've published the official notice to creditors, claims will start coming in. Texas law is very specific about the order in which you must pay these debts. Funeral expenses and the costs of a last illness get top priority, followed by the costs of administering the estate (like court fees and attorney fees), then secured debts like mortgages, and finally, unsecured debts like credit card bills.

A Practical Tip for Executors: Never, ever use your personal funds to pay estate debts. Open a dedicated bank account for the estate and use that money exclusively. Mixing your personal money with the estate's money is called co-mingling, and it can create a legal nightmare and even put you at risk of personal liability.

Keeping meticulous records of every transaction is your best defense against any future challenges. It might seem like a lot, but staying organized is the key to settling your loved one's final affairs honorably and efficiently.

Estimated Costs and Timelines for Texas Probate

Many families are understandably concerned about how long probate will take and what it will cost. The truth is, it varies greatly depending on the complexity and whether anyone contests the will. Here's a table to give you a general idea of what to expect for probate cases in Texas.

| Probate Type | Estimated Cost Range | Estimated Timeline |

|---|---|---|

| Uncontested Probate | $3,000 – $7,000 | 4 to 8 months |

| Contested Probate | $10,000 – $50,000+ | 1 year to multiple years |

These figures are just estimates and can be influenced by factors like the size of the estate, the types of assets involved, and the level of cooperation among beneficiaries. However, for a straightforward, uncontested case where everyone is on the same page, the process can move along quite smoothly. For more details, you can explore information about probate costs and timelines in Texas.

Exploring Alternatives to Full Probate for Smaller Estates

The full, formal process of probating a will in Texas isn't a one-size-fits-all solution. In fact, it’s often not necessary. For many families in Atascocita and Humble dealing with smaller, more straightforward estates, Texas law provides some incredibly useful shortcuts.

These alternatives are designed to transfer property quickly and cost-effectively, saving your family precious time and money during an already difficult period. Instead of getting bogged down in a full court proceeding, you might be able to use a much simpler process to settle your loved one's final affairs.

The Small Estate Affidavit

One of the most common and valuable tools we use for smaller estates is the Small Estate Affidavit (SEA). This is a sworn legal document that allows you to collect and distribute a person's assets when they died without a will (intestate), completely bypassing a formal probate administration.

But there’s a catch—the eligibility rules are very strict. To even consider a Small Estate Affidavit, the situation must meet these exact criteria:

- The value of the estate’s assets—excluding the homestead and other exempt property—cannot exceed $75,000.

- The person must have passed away without leaving a valid will.

- The estate’s assets must be worth more than its total debts.

- All legal heirs must agree to and be willing to sign the affidavit.

If the estate checks all these boxes, an SEA can be a lifesaver. You can present it to a bank, for instance, to release funds from a checking account. Imagine a parent in Humble passes away leaving only a small savings account and a paid-off car; an SEA is often the perfect solution for the heirs to gain access to those assets without ever stepping into a courtroom.

Muniment of Title: A Uniquely Texas Option

Texas offers another fantastic alternative called a Muniment of Title. You won't find this option outside our state. This process is for situations where the deceased person did leave a valid will, but the estate has no outstanding debts, except for any liens on real estate (like a home mortgage).

Think of it as having the court officially recognize the will as the legal document that transfers ownership. The court’s order acts as the new link in the property’s chain of title, moving assets directly to the beneficiaries named in the will. No executor is ever appointed.

A Muniment of Title is one of the fastest and least expensive ways to probate a will. Because no executor is appointed, you skip many of the administrative steps, like filing an inventory or notifying creditors, that make full probate a longer process.

For example, we often see this with Atascocita couples who owned their home outright and had a simple will leaving everything to their children. If they have no credit card debt or other significant bills, their children can use a Muniment of Title to transfer the house into their names quickly and with minimal fuss.

This path is a great fit for families with clear, uncontested wills and simple financial situations. Learning about these options is a key part of smart estate planning, which you can read more about in our guide on how to avoid probate in Texas.

Choosing the right path forward depends entirely on your family’s unique circumstances. At The Law Office of Bryan Fagan, we can help you determine if one of these efficient alternatives is right for you. Schedule a free consultation at our Atascocita office to discuss the most compassionate and practical way forward.

When to Call a Probate Attorney in the Atascocita Area

Let’s be honest: while it's technically possible to handle some very simple estates without a lawyer, trying to navigate the probate system alone while grieving is a recipe for stress. Many families in Atascocita and Humble think going the DIY route will save money, but it often ends up causing costly errors, missed deadlines, and serious family friction.

Knowing when to bring in a professional is key to settling an estate smoothly and honoring your loved one’s wishes. A good probate attorney does more than just file papers; they provide a clear, objective roadmap and shoulder the legal burdens so you can focus on your family.

Red Flags: When You Absolutely Need a Lawyer

Some situations are simply too complex or high-stakes to handle on your own. If you encounter any of these scenarios, your first call should be to an experienced probate lawyer.

- Family Disputes on the Horizon: Are beneficiaries already arguing? Is someone threatening to contest the will? An attorney can act as a neutral guide, ensuring the process stays on track and preventing disagreements from escalating into a full-blown court battle.

- Complicated Assets: If the estate includes a family business, commercial properties, mineral rights, or extensive investment portfolios, you need an expert. These assets require specialized valuation and management to avoid losing value during the probate process.

- The Estate is Insolvent (or Close to It): When there are more debts than assets, things get complicated fast. An attorney is essential for properly notifying creditors, prioritizing payments according to Texas law, and protecting the executor from personal liability.

- A Questionable Will: Was the will poorly drafted? Is it vague, ambiguous, or missing key signatures? A lawyer is needed to argue the deceased's true intentions before the court and get a clear ruling on how to proceed.

The real value of an attorney isn't just in handling the legal filings. It's in shouldering the procedural burdens so you and your family have the space to grieve without the added stress of court deadlines and complex financial duties.

Choosing the right legal partner is a critical decision. For more tips on what to look for, check out our guide on how to choose the right estate planning attorney for your family’s unique situation.

Here at The Law Office of Bryan Fagan, we've helped countless families across northeast Harris County through this difficult process. We understand what you're going through, and we're here to offer the compassionate, knowledgeable support you need. To get clarity on your next steps, we invite you to schedule a free, no-obligation consultation at our Atascocita office.

Common Questions We Hear About Texas Probate

When a loved one passes, their family is often left with a lot of questions about what to do next. Dealing with the legal side of things, especially probate, can feel overwhelming. Let's walk through some of the most common questions we get from our clients here in the Atascocita community as they start this process.

How Long Does Probate Usually Take in Harris County?

For a straightforward case—think a clear will, no family disputes, and an independent executor—you're typically looking at about 6 to 9 months from start to finish in Harris County. That timeframe covers everything from the initial court filing and required notices to the final distribution of assets.

But that's the best-case scenario. The timeline can easily get stretched out. If we have to track down a missing heir, if family members start arguing, or if the estate involves complex assets like a business that needs to be valued, things slow down considerably. And if the court requires a dependent administration? You can almost always expect it to take over a year.

What if My Loved One Didn't Have a Will?

When someone dies in Texas without a will, the law says they died "intestate." This doesn't mean the state gets everything, but it does mean a rigid legal formula in the Texas Estates Code kicks in to decide who gets what. Usually, assets are divided between the surviving spouse and children, but the exact split depends on the family structure and the type of property.

The process is also more complicated. Instead of just proving a will is valid, the court has to legally identify the heirs through a formal proceeding called a determination of heirship. Only after a judge signs an order officially naming the heirs can an administrator be appointed to manage the estate. It’s almost always a longer and more expensive road than when a will is in place.

Does Everything They Owned Have to Go Through Probate?

No, and this is a huge point of relief for many families. The probate process only touches assets that were in the deceased's name alone. Many assets are designed to skip probate entirely.

These are what we call non-probate assets, and they pass directly to the people named as beneficiaries.

- Life insurance payouts

- Retirement accounts like 401(k)s and IRAs

- Bank accounts designated as "payable-on-death" (POD)

- Any property held inside a living trust

It doesn't matter what the will says about these particular assets; they go straight to the beneficiary listed on the account or policy. For a deeper dive into the legal mechanics of settling an estate, you can find helpful background information by reading about What Is Probate and How It Works.

We know that sorting through the details of probate is tough, but you're not on your own. The compassionate team at The Law Office of Bryan Fagan – Atascocita TX Lawyers is here to give your family the clear, practical guidance you deserve. Call us to schedule a free, no-pressure consultation at our Atascocita office and let's figure out the best path forward together.